by Bruce Wells | Feb 29, 2024 | Petroleum Companies

Although successful oil wells had been drilled as early as 1901, oil fever arrived in Montana with the October 1915 discovery of the Elk Basin oilfield in Carbon County.

More discoveries came at the Cat Creek oilfield in 1920 and in the Kevin-Sunburst oilfield of 1922, both of which motivated businessmen in Miles City to form the Montana Bell Oil & Gas Company. They filed to do business in the state on March 8, 1924, but their timing was terrible.

Montana’s first oil well was drilled in 1901 in the Kintla Lake area that’s now part of Glacier National Park. Photo courtesy Daily Inter Lake, Kalispell, Montana.

In the last few months of 1924 alone, a financial crisis described by Montana’s superintendent of banks as a “veritable nightmare” closed 191 banks.

Bankrupt in Montana

Between 1921 and 1926, no state had more bankruptcies than Montana. Newspapers reported in 1924 reported “the tremulous activity” of Montana Belle Oil that “may be expected in this country within the year, unless present plans halted.”

Nonetheless, Montana Belle Oil & Gas was able to secure a mineral lease from Adolph F. Loesch west of Miles City in April 1926. The company selected a drilling site for its first well in typically foreboding southeast Montana (see Public Land Survey System, Northeast Quarter of Section 28, Township 8 North, Range 45 East).

Drilling the wildcat well during hard financial times and in a remote location slowed progress. Legal issues also troubled the company, according to reports in the Billings Gazette.

“With the settlement of differences arising without recourse to the courts, the officers of the Montana Belle Oil & Gas company are preparing to proceed,” the newspaper noted in January 1928.

“Drilling in the Montana Belle Oil and Gas company well, located about twelve miles west of this city is proceeding 24 hours a day,” the reporter added.

Using dated cable-tool drilling technology, the company reached a depth of 1,035 feet. The Billings Gazette reported the company’s objective was a depth of 1,750 feet, “in accordance with the report of the geologist who has made a survey and examination of the earth strata, and at which it is expected that results will follow. Gas is also in evidence in the hole.”

Investors and stockholders were encouraged that the well was “showing some light oil though not in commercial quantities.” The drilling continued into deeper formations. On October 24, 1929 — “Black Thursday” — the U.S. stock market crashed, launching the Great Depression.

In December 1929, five years after incorporating, Montana Belle Oil and Gas Company’s only oil well shut down for the winter. It reportedly had reach the impressive depth of 4,562 feet, but drilling never resumed. Montana Belle Oil and Gas Company failed in 1930, as did Miles City’s oil refinery and many other oilfield businesses.

The first Montana oil well was drilled in 1901 in the Kintla Lake area, later part of Glacier National Park. More about the state’s petroleum history can be found in the 2011 article “Montana’s first oil well was drilled at Kintla Lake in 1901.”

_______________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? Become an AOGHS annual supporting member and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2024Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Montana Belle Oil & Gas Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/montana-belle-oil-amp-gas-company. Last Updated: February 29, 2024. Original Published Date: April 13, 2022.

by Bruce Wells | Feb 1, 2024 | Petroleum Companies

An experienced independent oil producer, W.D. Richardson orchestrated the merger of his own company, Lake Park Refining (incorporated 1918), with Dunn Petroleum and Davenport Petroleum to form Meridian Petroleum Company in September 1920.

Merger terms dictated one share of Dunn Petroleum for two shares Meridian Petroleum; one share of Lake Park Refining for two shares Meridian Petroleum; and one share of Davenport Petroleum Co. for 20 shares Meridian Petroleum.

The combined organization held assets valued at about $13 million, including refineries in Oklahoma: Okmulgee (3,500 barrel), Ponca City (2,500 barrel), and Hominy (1,500 barrel). There also were producing wells in Oklahoma, Kansas and Texas, as well as “promising acreage” in Wyoming.

The combined organization held assets valued at about $13 million, including refineries in Oklahoma: Okmulgee (3,500 barrel), Ponca City (2,500 barrel), and Hominy (1,500 barrel). There also were producing wells in Oklahoma, Kansas and Texas, as well as “promising acreage” in Wyoming.

With offices in Kansas City, Missouri, Delaware-chartered Meridian Petroleum was capitalized at $25 million. By the end of 1920, the new company reported a net profit of $1,076,828. At the company’s annual meeting in April 1921, at least 3,000 Meridian Petroleum stockholders re-elected W.D. Richardson and the company’s officers.

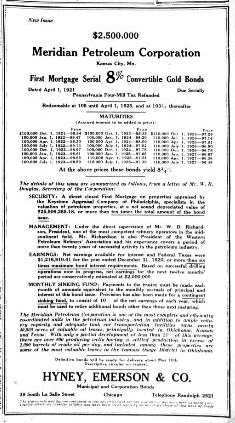

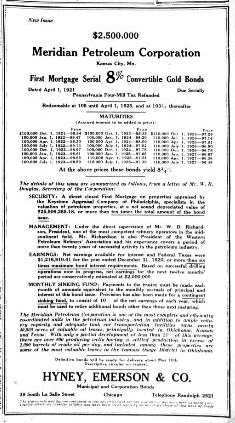

“Rarely have stockholders made so plain their confidence in the management of an oil company,” noted The Oil & Gas News reported. At the same meeting, stockholders approved the issue of $2.5 million dollars in “first mortgage bonds to be used in retiring present outstanding indebtedness and to give the company additional working capital.”

Trade publications carried advertisements for Meridian Petroleum products such as “No. 1100 Straight Run Auto Oil” and “No. 22-600 S. R. Cylinder Stock (Light Green).” These and other lubricants were promoted with the Meridian motto, “The Line that Circles the World.”

But all was not well. The Oklahoma refineries depended upon crude oil deliveries, which were declining. Throughout 1921, only one of Meridian’s Petroleum’s three refineries operated at all, and it at half capacity.

The first official Oklahoma oil well was completed in 1897 at Bartlesville. Photo by Bruce Wells.

Oil production from Meridian Petroleum’s own leases proved insufficient, although in July 1921, Oildom reported a hopeful development.

“The company’s big well in the Hominy district of Osage county, Oklahoma, which came in at 10,000 barrels and ceased flowing after several days, due to a caved hole, was put in commission again and was reported making 3,000 barrels natural (flow),” the publication noted.

A report in the American Investor valued the company’s stock at about 13 cents a share on the New York Curb Market in December 1921, down from a high of 22 cents a share for the year and far less than the original offering at $2 per share.

On April 1, 1922, Meridian Petroleum defaulted on a $100,000 debt and in June, U.S. District Court appointed a receiver as the $2.5 million mortgage approved by stockholders a year earlier went into foreclosure. The company also carried unsecured debt of $600,000 and never paid a dividend.

Despite predictions of a reorganization, by 1927 Meridian Petroleum was gone for good. W.D. Richardson quickly went on to form the Richardson Refining Company, capitalized at $250,000 in November 1922.

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The Library of Congress offers further research help at Business History: A Resource Guide.

_______________________

Recommended Reading: The Prize: The Epic Quest for Oil, Money & Power (1991). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Become an AOGHS annual supporting member and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2024 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Meridian Petroleum Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/meridian-petroleum-company. Last Updated: February 14, 2024. Original Published Date: January 29, 2016.

by Bruce Wells | Nov 19, 2023 | Petroleum Companies

In the early 1950s, Alaska Oil & Gas Development Company marketed 300,000 shares of stock for $1 each.

Decades before Alaska became a state, many petroleum exploration companies drilled expensive dry holes in the remote U.S. territory. The Alaska Oil & Gas Development Company was among them.

Although drillers completed the first Alaska Territory commercial oil well in 1902, significant oilfield production did not arrive until 1957, two years before statehood.

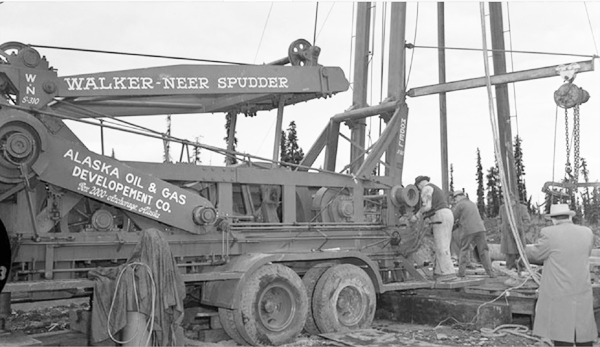

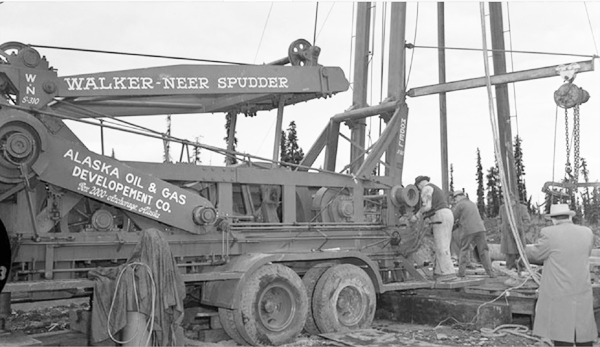

Before switching to a rotary rig in 1954, the Alaska Oil & Gas Development Company drilled its Eureka No. 1 using this Walker-Neer Manufacturing Company cable-tool “spudder.” Photo courtesy the Anchorage Museum.

The July 1957 discovery well by Richfield Oil Corporation — later known as ARCO — successfully drilled near the Swanson River on the Kenai Peninsula. The first well, which produced 900 barrels of oil a day from 11,215 feet, revealed a giant oilfield.

Many Alaskans already had been wildcatting for black gold.

Among those searching for petroleum riches, Alaska Oil & Gas Development accepted the financial challenges of exploring unproven territory. William A. O’Neill and a former oilfield roughneck incorporated the company on October 31, 1952.

“Bill O’Neill, a local mining engineer and University of Alaska regent, and partner C.F. ‘Tiny’ Shield, a giant of a man, believed they could find oil in the Copper River Basin,” explained Jack Roderick in his 1997 book, Crude Dreams: A Personal History of Oil & Politics in Alaska.

“Before coming to Alaska in the early 1920s, Shield had been a cable-rig ‘tool pusher’ in Montana, Texas and California,” he added.

Within a year, Alaska Oil & Gas Development began drilling near “mud volcanoes” — sulfuric residues bubbling up from the valley floor — and near mud cliffs embedded with giant marine fossils, Roderick reported.

The Eureka No. 1 well with its Walker-Neer cable-tool rig at its remote site just off Glenn Highway about 125 miles northeast of Anchorage. Photo courtesy the Anchorage Museum.

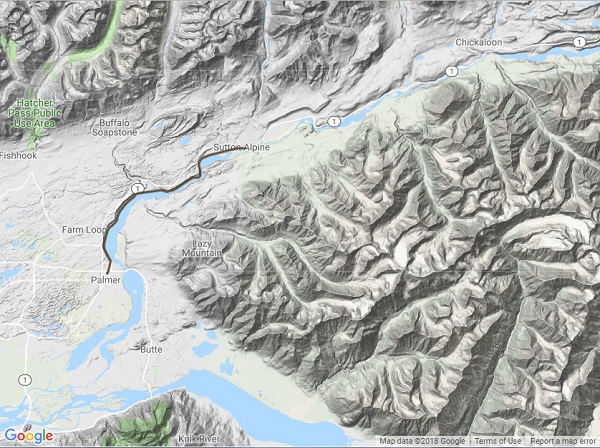

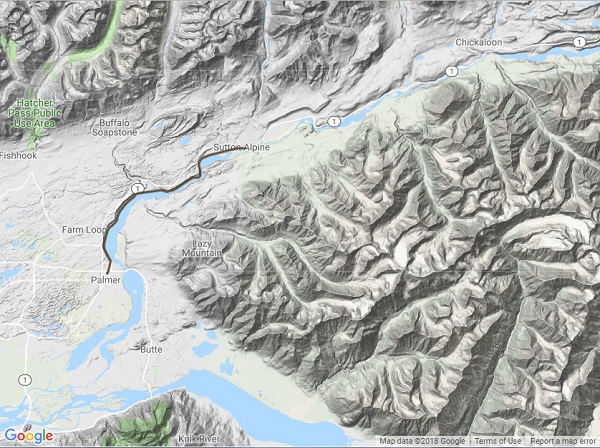

Far from any oil or natural gas producing well in North America, the well site — known as a rank wildcat — was at Eureka Roadhouse, about 125 miles northeast of Anchorage, just 200 feet off the Glenn Highway (part of Alaska Route 1).

Risky Business

Alaska Oil & Gas Development Company offered 300,000 shares of stock at $1 per share, advertising in newspapers:

The money realized from the sale of this stock is being used to purchase equipment and finance operations for oil exploration in the Eureka-Nelchina location. The location of the first exploratory drill hole has been chosen by our consulting geologist after a geological survey of the area.

The Walker-Neer cable-tool rig reached about 2,500 feet deep before drilling was temporarily suspended at the site. A Texas geologist suggested converting to a rotary rig for greater depth. Photo courtesy the Anchorage Museum.

Drilling at the Eureka Roadhouse site began on September 20, 1953, using cable-tool technology — a Walker-Neer Manufacturing Company rig often called a spudder.

“By early 1954, the Eureka No. 1 well had been drilled down more than half a mile, but the antiquated equipment, making each day’s going tougher, eventually forced O’Neill and Shield to shut down the operation,” noted Roderick.

The limitations of outdated cable-tool technology — and the onset of Alaska’s winter — delayed but did not deter the men. “Shield traveled to Texas, and while looking up some tool pusher buddies, contacted Fort Worth independent James H. Snowden,” Roderick explained.

Snowden sent a geologist to Alaska to investigate the well. “He reported that by converting the cable-tool rug to a rotary, the Eureka well could be deepened to 5,500 feet,” Roderick reported.

By the summer of 1954, having switched the Walker-Neer spudder for a rotary rig, the Eureka No. 1 well reached about a mile in depth — but found no indications of oil.

Alaska Oil & Gas Development Company spudded a well in the Matanuska Valley northeast of Anchorage in June 1953. Map courtesy USGS.

O’Neill and Shield tried again, drilling a second well near Houston, Alaska, on the Alaska Railroad line. It ended as a dry hole as well.

According to Roderick, Alaska Oil & Gas Development plugged and abandoned both wells by 1957. Another company also had tried to find oil in the Matanuska Valley, but failed before it could drill even one well (see Chickaloon Oil Company).

With its funds exhausted, the Alaska Oil & Gas Development Company failed to file a required report and was “involuntarily dissolved” by regulators.

In 1957, Richfield Oil Corporation made the first major discovery two years before Alaska statehood. The company struck the territory’s first commercial oil well at Swanson River on the Kenai Peninsula.

Discovery of the Prudhoe Bay field on Alaska’s North Slope in 1968 made the 49th state a world-class oil and natural gas producer. Prudhoe Bay, the largest oilfield in North America, in turn inspired the U.S. petroleum industry’s 1977 engineering marvel, the Trans-Alaska Pipeline.

The stories of many exploration companies trying to join petroleum booms (and avoid busts) can be found in an updated series of research in Is my Old Oil Stock worth Anything?

_______________________

Recommended Reading: Crude Dreams: A Personal History of Oil & Politics in Alaska (1997); Kenai Peninsula Borough, Alaska (2012); From the Rio Grande to the Arctic: The Story of the Richfield Oil Corporation

(2012); From the Rio Grande to the Arctic: The Story of the Richfield Oil Corporation (1972). Your Amazon purchases benefit the American Oil & Gas Historical Society; as an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(1972). Your Amazon purchases benefit the American Oil & Gas Historical Society; as an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Become an AOGHS annual supporting member and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2023 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “ Alaska Oil & Gas Development Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/alaska-oil-gas-development-company. Last Updated: November 22, 2023. Original Published Date: July 14, 2016.

by Bruce Wells | Sep 25, 2023 | Petroleum Companies

Although William S. Pratt entered the oil exploration business in Wyoming in 1915, he soon moved to Kansas and organized the Wichita Eagle Oil Company. It and many newly formed “wildcatting” companies would not succeed in risky Mid-Continent drilling and production (see Otter Creek Oil & Gas, formed by Wichita businessmen and the Cahege Oil & Gas Company, at Caney, where a Kansas gas well fire had made headlines.

A major oilfield discovery in North Texas — “Roaring Ranger” — in 1917 also attracted national attention. Pratt launched his Texas United Oil Company there in July 1919. By the last quarter of 1919, the Texas comptroller’s office reported Pratt’s company had produced more than 31,000 barrels of oil.

Promoting Texas United Oil

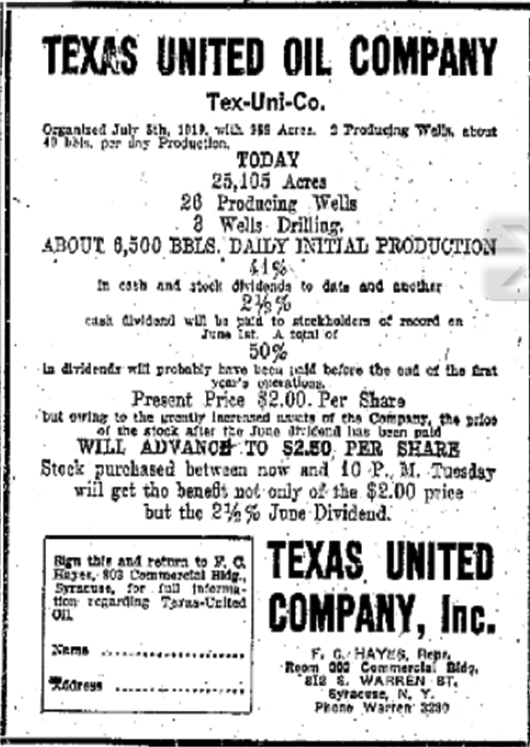

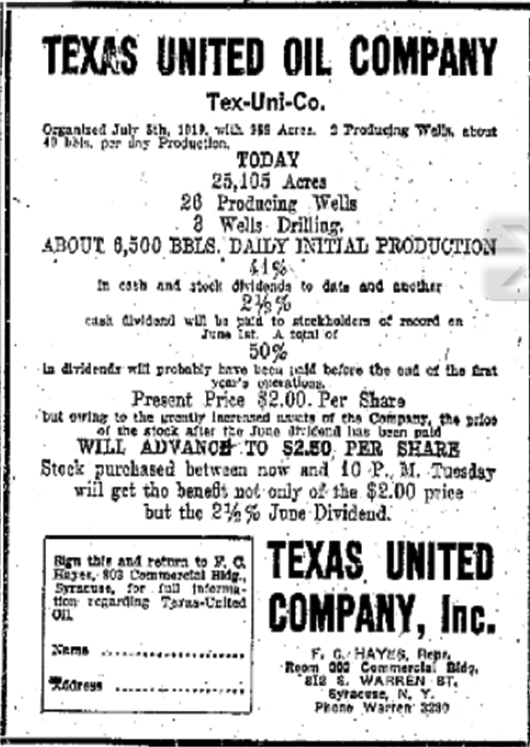

Texas United Oil Company solicited investment capital with a series of ads placed in newspapers nationwide, including in Spokane, Washington; El Paso, Texas; Troy, Syracuse, and Plattsburgh, New York; and Washington D.C.

From December 1919 through 1920, company marketing efforts promised: For Quick Returns and Unlimited Profits Invest With the Texas United Oil Company…27 Wells Showing Initial Production of 8,700 Bbls. Daily.

But at least one investment magazine described the company as unlikely to prosper, and the assessment proved to be accurate.

By December 1920, Texas United Oil Company entered into receivership and did not emerge until April 27, 1921, reorganized and with a new president, Aldred S. Wright of Philadelphia.

Despite the reorganization, the company did not survive long. United States Investor reported in 1922 that Texas United Oil Company had very little value.

“It is of course not listed on any of the principal exchanges,” the magazine noted, adding that no dividends had been issued since 1920. “The company had about $1,300,000 stock outstanding and there was one public offering by people in Hartford, Connecticut, at $2 per share. Two cents per share is approximately the price now.”

“A Sure and Safe Investment ”

October 1, 1919 – The Texas United Oil Company of Dallas produces 31,541 barrels of oil valued at $10,789 between October 1 and December 31, 1919, according to the Texas comptroller.

December 21, 1919 – In one of its first newspaper appearances, President W. S. Pratt describes the company’s leases and production success in the Northwest Extension of the Burkburnett oilfield.

Pratt announces that the company’s trustees have resolved to increase capital to $5 million and he encourages potential investors to purchase stock at $2 per share to enable “development of our many properties and the purchase of additional production.” — ad in Spokesman-Review, Spokane, Washington

January 3, 1920 – The company is promoted in an open letter advertisement sent from Electra, Texas, “to our stockholders and others” from J. R. Lucore, shareowner, of Olean, New York. Lucore reports very positive on-scene observations of drilling and production in progress. His endorsement follows:

“The Texas United is a sure and safe investment for anyone to buy stock in. No one need be in the least afraid to invest as large as one see fit and his investment will be the safest and surest of any company operating in the State…I expect to arrive home in a few days and will enlarge my stock order to you in the Texas United Oil Company on my arrival.” — ad in Gloversville, N.Y., Morning Herald

January 31, 1920 – The company is reported as formed by a Declaration of Trust filed on July 2, 1919, with trustees L. W. Harrington, Herbert Bingham, H. C. Ralph and J. M. Davis. It receives a poor recommendation:

January 31, 1920 – The company is reported as formed by a Declaration of Trust filed on July 2, 1919, with trustees L. W. Harrington, Herbert Bingham, H. C. Ralph and J. M. Davis. It receives a poor recommendation:

“Our information as to the management is that it is not as economical as it might be, and that operating costs are likely to be altogether too high because of rather poor judgment in planning the work.” — article in United States Investor

“The King of the Oil Companies”

February 21, 1920 – The Texas United Oil Company of 1209 Half Main Street, Dallas, Texas, asserts that the United States Investor’s bad recommendation refers to another company of the same name whose headquarters is in Wichita and not Dallas. The company protests that “conclusions relative to the Wichita enterprise cannot fairly be applied.” Investigation planned. — article in United States Investor

February 25, 1920 – The company proclaims itself as “The King of the Oil Companies” and promises 30 percent dividends and $5 million in capital stock with 12 producing wells. — ad in Spokesman Review, Spokane, Washington

March 13, 1920 – Company promotion continues, citing “12 producing oil wells – over 3,000 barrels daily” and “30 percent dividends have been paid in 7 months” Shares are offered at $2. Agent is J. S. Miramon, Rensselaer Hotel, Troy “Salesmen wanted: Liberal commission. Phone for appointment.” — ad in Troy (N. Y.) Times

April 17, 1920 – J. S. Miramon, now of Barows Company, 141 Broadway, New York City, advertises “Wise Investors, Increase your income” with company’s “2 percent monthly dividends, with record of 39 percent in dividends past nine months.” — ad in El Paso (Texas) Herald

April 10, 1920 – Analysts confirm poor recommendation after consulting with the company, the New York City based owners of the company. “We cannot do otherwise than classify this as the ordinary type of oil gamble, a quite unproven enterprise, depending for its future upon the skill with which it is managed. — article in United States Investor

May 15, 1920 – Tex-Uni-Co. (trademark for Texas United Oil Company) advertises 18 producing wells, two ready to come in per April 30 telegram testimonial by Ralph P Reed, president National Investors Protective Corporation.

“These dividends will make a total of 43 ½ percent in cash and stock dividends paid in less than one year.” A. E. Roberts and Co., Washington, D.C. — ad in The Federal Employee, Washington D.C.

May 30, 1920 – The company promotes its self (Tex-Uni-Co.) as having rapidly grown from its origins in July, 1919 with 389 acres and two 2 producing wells, yielding about 42 barrels a day of production grown until. — ad in Syracuse Herald, Syracuse, New York.-

“Quick Returns and Unlimited Profits”

Jun 2, 1920 – “For Quick Returns and Unlimited Profits Invest With The Texas United Oil Company” upstate New York advertisement proclaims “27 Wells Showing Initial Production of 8,700 BBls. Daily.” — ad in Daily Republican, Plattsburgh, New York

December 1920 – Company enters into receivership.

February 25, 1921 – Advertising continues for twelve producing wells 30 percent dividends.” — ad in Spokesman-Review, Spokane, Washington

April 16, 1921 – Value of the company plummets as it is reported to have “been the subject of much litigation of late…Texas United shares have declined to around five cents since their first appearance upon the market at $2 per share.” — article in United States Investor

April 27, 1921 – The company emerges from receivership reorganized and with a new president, Aldred S. Wright of Philadelphia.

November 11, 1922 – The company “is of little value …two cents per share is approximately the price now.” — article in United States Investor

More history ablur U.S. petroleum exploration and production companies joining petroleum booms (and avoiding busts) can be found in Is my Old Oil Stock worth Anything?

Among trusted financial publications — and available at many libraries — is the Directory of Active Stocks and Obsolete Securities published by Financial Information, Inc., Jersey City, New Jersey.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Become an AOGHS annual supporting member and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2023 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Texas United Oil Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/texas-united-oil-company. Last Updated: October 1, 2023. Original Published Date: January 5, 2013.

by Bruce Wells | Apr 1, 2023 | Petroleum Companies

High hopes for oil riches from someone’s family heirloom.

Despite years of mergers and acquisitions, the 1924 Palmer Union Oil Company stock certificate Tony Marohn bought at a garage sale did not make him a millionaire. As with most obsolete securities, no ownership in the company or its successors remained by the time it became part of Coca-Cola.

For many people like Marohn, discovering an old stock certificate brings hopes of wealth. This seems especially true if the certificate is one of the thousands of petroleum companies incorporated since the first, the Pennsylvania Rock Oil Company of New York, organized in 1855.

Unfortunately, as the research posted in Is My Oil Oil Stock worth Anything? shows, the highly competitive, boom-and-bust world of oil and natural gas exploration leaves many casualties. (more…)

The combined organization held assets valued at about $13 million, including refineries in Oklahoma: Okmulgee (3,500 barrel), Ponca City (2,500 barrel), and Hominy (1,500 barrel). There also were producing wells in Oklahoma, Kansas and Texas, as well as “promising acreage” in Wyoming.

The combined organization held assets valued at about $13 million, including refineries in Oklahoma: Okmulgee (3,500 barrel), Ponca City (2,500 barrel), and Hominy (1,500 barrel). There also were producing wells in Oklahoma, Kansas and Texas, as well as “promising acreage” in Wyoming.

January 31, 1920 – The company is reported as formed by a Declaration of Trust filed on July 2, 1919, with trustees L. W. Harrington, Herbert Bingham, H. C. Ralph and J. M. Davis. It receives a poor recommendation:

January 31, 1920 – The company is reported as formed by a Declaration of Trust filed on July 2, 1919, with trustees L. W. Harrington, Herbert Bingham, H. C. Ralph and J. M. Davis. It receives a poor recommendation: