by Bruce Wells | Jul 29, 2022 | Petroleum Companies

In October 1917, Wyoming Peerless Oil Company stock promotions first appeared in the pages of the Cheyenne State Leader, Laramie Republican and Wyoming Tribune newspapers.

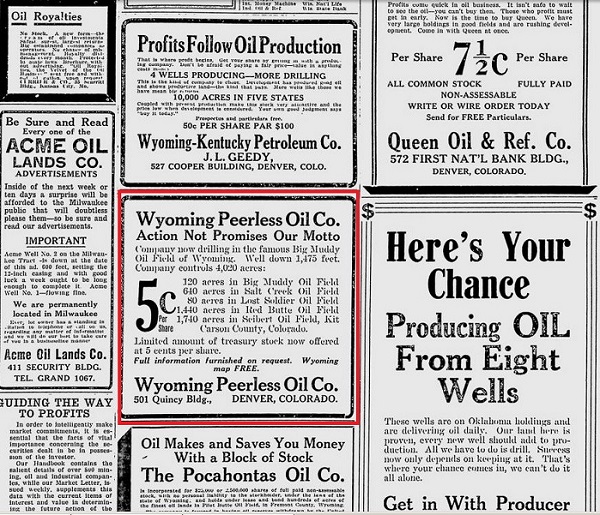

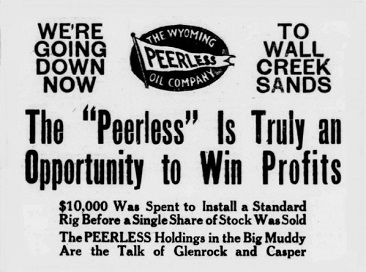

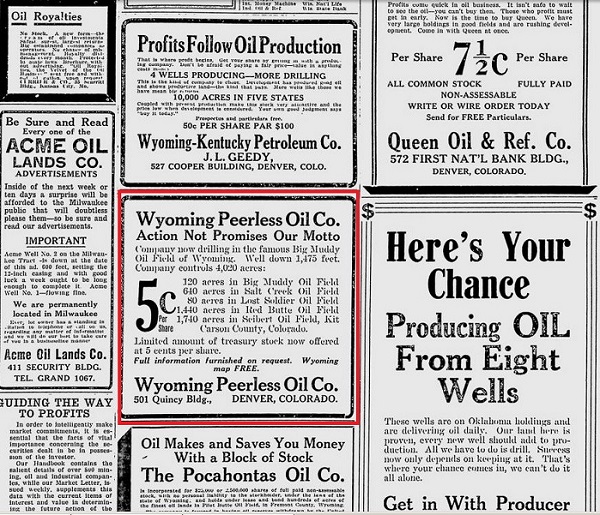

Oil investment ads in Milwaukee Journal on June 2, 1918.

Within a year the new exploration company’s advertisements appeared in newspapers as far away as Milwaukee, Wisconsin: “Action Not Promises Our Motto,” noted one placed in the June 2, 1918, Milwaukee Journal (above).

Many U.S. newspapers at the time included similar promotions as oilfield discoveries proliferated from California to Kansas.

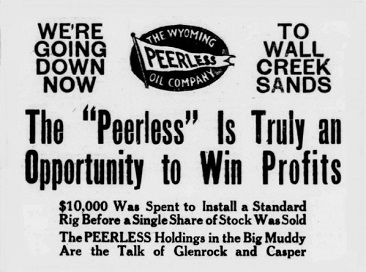

Peerless Oil Company promotions appeared in Wyoming newspapers.

Demand for gasoline was skyrocketing, both for Model T Fords and World War I, which the United States would soon join. Oil companies proliferated.

Some used questionable claims to keep investors unaware of how risky and expensive the business finding and producing oil truly was. Nine out of 10 exploratory well attempts proved to be dry holes – and drilling was expensive in such remote areas.

The Big Muddy

The Wyoming Peerless Oil Company set its sights on drilling a well six miles from the nearest producer in the Big Muddy oilfield east of Casper.

Peerless Oil stock was initially offered at three cents per share. “Don’t wait for our first well to come in. You might not be able to get this stock then for less than 25-cents or 50-cents per share.”

Wyoming Big Muddy Oilfield Marker

The Big Muddy oilfield, located about four miles west of Glenrock in Converse County, was discovered in 1916, a discovery that touched off widespread drilling and brought about one of Wyoming’s famous oil booms. Today, a marker on the south side of Hwy. 230 at the junction with County Road 33 describes the historic field:

Big Muddy oil field is a typical Wyoming oil producing structure. The field, discovered in 1916, has produced over 30 million barrels of high quality oil.

Strata here were arched upward at the time the Rocky Mountains originated over 60 million years ago, to form anticline, or dome. Because oil is lighter than water, it rose to the crest of the dome where it was trapped in pore spaces between sand grains. The Wall Creek sand lies at a depth of near 3,000 feet and the Dakota sand at about 4,000 feet. The first oil well in Wyoming was drilled in 1884. There are now about 100 oil fields in the state.

Seeking more investors, advertisements reported Wyoming Peerless Oil ‘s drilling progress on its Big Muddy exploratory well: Down 1,475 feet by June of 1918; down 1,675 feet by July and down to 3,315 feet by August of 1919.

Although rumors of a dry hole began to circulate, the company continued to solicit more investors to fund deeper drilling. But after reaching 4,050 feet without finding oil, company officer Charles Straub announced the well would be abandoned.

If more funds could be secured, Wyoming Peerless Oil would drill a second well, Straub added.

“Efforts have been made to extend the limits of the (Big Muddy) field in every direction, but these efforts have all been failures and the area of the field is plainly marked,” reported the Oil and Gas News reported (this would change in 1950 with a discovery to the east of the field).

Failed Well

By February 1920, stockholders from Denver had petitioned a court to put the Wyoming Peerless Oil Company into receivership, alleging mismanagement by Straub and other company officers. Straub responded with a $50,000 libel suit, reported by the Casper Daily Tribune on March 5, 1920.

The results are obscured, but Wyoming Peerless Oil never drilled a second well and the company disappeared from newspaper accounts.

The Big Muddy oilfield now has produced more than 300 million barrels of oil and wells are still pumping.

The first record of oil in Wyoming came in 1832. An expedition led by Captain B.L.E. Bonneville took the first wagons through South Pass. Fifty years later, prospector Mike Murphy, bought an oil lease on the site of Capt. Bonneville’s “great tar spring” southeast of Lander.

Learn more in First Wyoming Oil Wells.

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything?

_______________________

Recommended Reading: William F. Cody’s Wyoming Empire: The Buffalo Bill Nobody Knows (2007); The Salt Creek Oil Field: Natrona County, Wyo., 1912 (reprint, 2017); Kettles and Crackers – A History of Wyoming Oil Refineries

(reprint, 2017); Kettles and Crackers – A History of Wyoming Oil Refineries (2016). Your Amazon purchases benefit the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(2016). Your Amazon purchases benefit the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society preserves U.S. petroleum history. Become an AOGHS annual supporting member and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2023 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Wyoming Peerless Oil Company.” Authors: B.A. Wells and K.L Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/oil-almanac/buffalo-bill-oil-company. Last Updated: January 27, 2023. Original Published Date: July 29, 2013.

by Bruce Wells | Jun 15, 2022 | Petroleum Companies

Drilling booms attracted investors seeking “black gold” riches, real or imagined.

Exaggerated, questionable, and sometimes fraudulent claims by shady business ventures seeking investors grew in the years following World War I. As the Great Depression approached, many states passed “blue sky laws” to regulate securities sales and protect the public from fraud.

But it would take an act of Congress in 1934 to stop skilled swindlers from taking advantage of unwary investors seeking often fictional profits. Federal lawmakers established the Securities and Exchange Commission (SEC) to help rein in exaggerated claims found in newspaper advertisements, mail solicitations, and other stock promotions.

Since the U.S. petroleum industry’s earliest booms and busts in Pennsylvania following the Civil War, the need for dependable information and early financial centers — petroleum exchanges — led to a new profession — the oil scout.

As demand for refined kerosene for lamps grew, the search for new oilfields moved to mid-continent. Thousands of exploration and production companies were established. Most drilled dry holes. When wildcat wells (remote) revealed giant oil and natural fields in Texas and Oklahoma, a new generation of business financing hucksters took advantage.

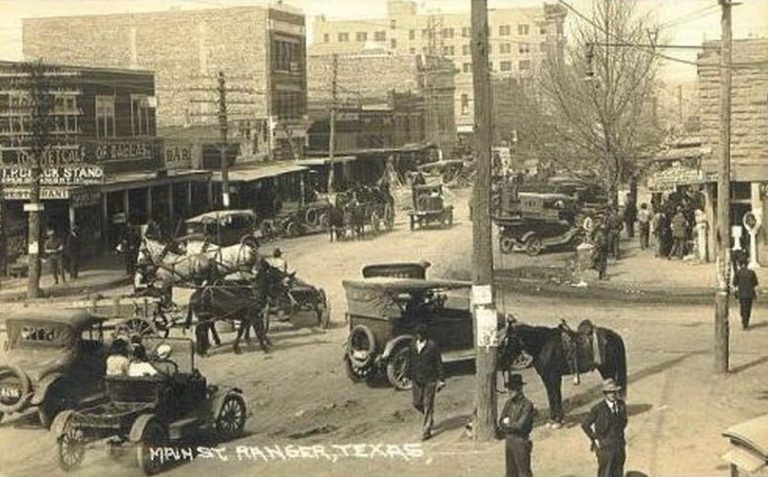

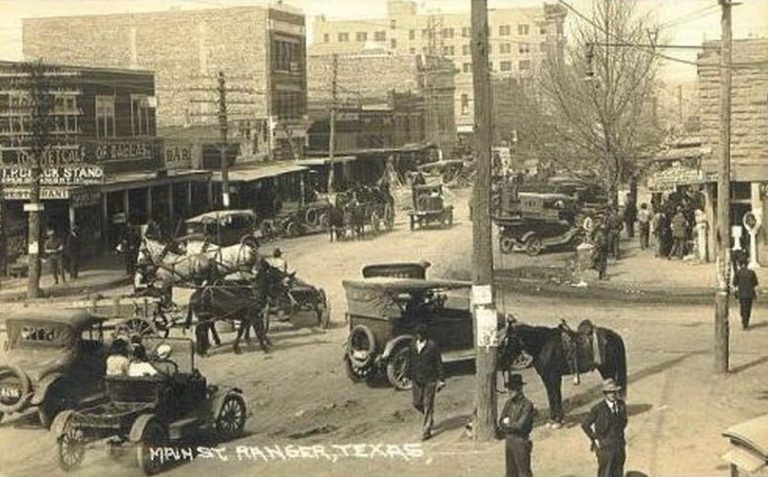

The J.H. McCleskey No. 1 discovery well of October 1917 created an mammoth oil boom at Ranger and across Eastland County, Texas. Photo courtesy Library of Congress.

Giant oilfield discoveries in North Texas made headlines, leading to the hundreds of new exploration companies (see Is my Old Oil Stock worth Anything?). Many began by seeking capital from local investors, often banks, doctors, and civic leaders.

Newspapers nationwide reported wells with geysers of oil at Electra (1911), Ranger (1917), and the “World’s Wonder Oilfield” of Boom Town Burkburnett (1918). Publicity about these oil booms rekindled enthusiasm for Texas petroleum riches not seen since the giant oilfield discovery at Spindletop Hill in 1901, the famous “Lucas Gusher.”

Sudden, unexpected “black gold” or “Texas tea” wealth brought prosperity to struggling farming communities. Thanks to the Ranger oilfield, Eastland County’s Merriman Baptist Church (and graveyard) was once declared the richest church in America.

Black Gold Dreams

Criminals specializing in financial deception joined the influx of drilling contractors, workers, equipment suppliers, lease brokers, and associated oilfield service companies. In part to combat fraud in North Texas, the American Association of Petroleum Geologists (AAPG), founded in 1917, American Petroleum Institute (API), founded in 1919, and other industry associations organized.

With so many oil boom-inspired companies forming so quickly, the rapid printing of eye-catching but boiler-plate stock certificates often occurred (see Oil Prospects Inc. for one of the most common certificate vignettes).

In a rush to find investors, quickly formed exploration companies ended up using the same oilfield scene for stock certificates. It might have saved time and money by choosing a printer’s common vignette.

Already iconic U.S. boom towns and busts (see the remarkable 1865 rise and fall of Pithole, Pennsylvania) would help launch major companies like Marathon and Texaco, as did the first California oil wells. New petroleum discoveries attracted experienced companies — and many more inexperienced exploration and production ventures that aggressively sought leases, equipment and men, and investors.

However, with little knowledge of the new science of petroleum geology and drilling technologies, few of newly formed companies would find oil. Most did not survive long in the highly competitive oilfields.

Crowding too many wells on leases and a lack of infrastructure for storing and transporting oil harmed the environment. Many companies learned from hard experience, but more went bankrupt without ever finding oil.

Competing exploration companies, lacking petroleum engineers and efficient production technologies, often overproduced geological formations. Unchecked drilling and oversupply in the oil market led prices to collapse as low as 15 cents per 42-gallon oil barrel in the giant East Texas oilfield of the 1930s.

Huckster of Hog Creek

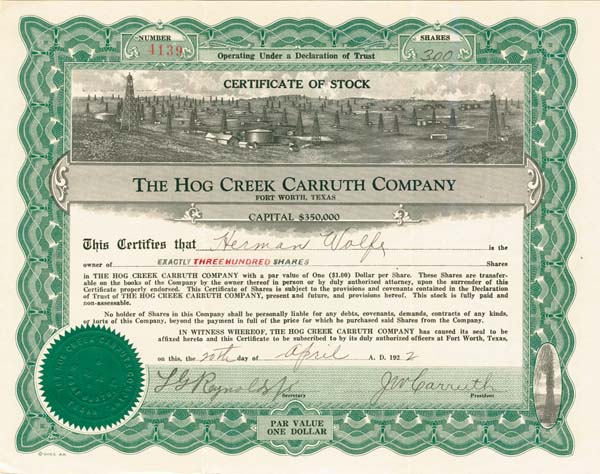

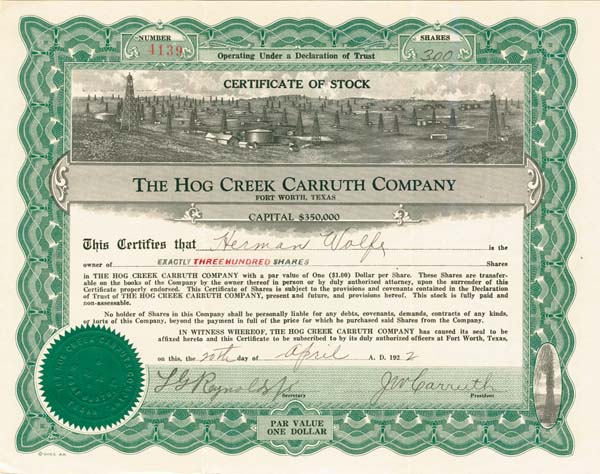

The lure black gold also attracted skilled confidence men who could create oil companies on paper. J.W. “Hog Creek” Carruth was among the most notorious.

Financial World in 1912 described “Hog Creek” Carruth as a con man who made a fortune selling worthless oil stocks. The magazine also cited the far better known infamous explorer Dr. Frederick Cook (learn more in Arctic Explorer turned Oil Promoter).

In September 1918 a discovery well near Desdemona blew in after reaching a depth of 2,960 feet, initially producing 2,000 barrels of oil a day. “Unlike Ranger, Desdemona was a small operator’s field. Production reached a peak of 7,375,825 barrels in 1919, and then dropped sharply, chiefly because of over drilling,” according to the Handbook of Texas Online.

“Hog Creek” Carruth proclaimed himself to be the discoverer of the Desdemona oilfield (he was not). He advertised expansively to sell worthless stocks inflated by his phony reputation.

Pilgrim Oil Company

Pilgrim Oil Company formed as a common law trust estate (unincorporated business managed by trustees) in Fort Worth, Texas, on December 20, 1920. The company’s trustees included George M. Richardson and Warren H. Hollister. and was capitalized at $1 million with 100,000 shares offered at par value of $10.

The petroleum company, another fraudulent enterprise of J.W. “Hog Creek” Carruth, would be his last.

J.W. “Hog Creek” Carruth falsely claimed to have discovered the Desdemona, oilfield, along Hogg Creek. Detail from circa 1919 panoramic photo courtesy Library of Congress.

The oilfield along Hog Creek had been discovered in 1918, just one year after the famous Ranger well. This new field at Desdemona (once called Hog Town) attracted the usual rush of new exploration companies, many with little or no drilling experience.

Among the Eastland County startups, a wily financial conman’s Hog Creek Carruth Oil Company profited by colorful stock sale advertisements to attract investors.

The skillfully exaggerated promotions of Carruth prompted one contemporary writer to admire the crook’s audacity. “Any reader who cannot get a thrill out of Carruth’s highly colored advertising literature is indeed phlegmatic,” the observer declared.

But harm to many small, unwary investors was real. Most of the stock sales’ dollars went into Carruth’s pockets instead of his companies. Even the failure of his oil companies became part of his schemes.

Hogg Oil + Hog Creek Carruth Oil

Carruth merged two of his insolvent petroleum companies — Hogg Oil Company and Hogg Creek Carruth Oil Company — to create the Pilgrim Oil Company. His latest venture attracted some skeptical attention from financial magazine editors. The Pilgrim Oil Company, “makes a business of gathering in defunct oil companies,” reported Financial World.

As part of his connived merger game plan, stockholders of the two bankrupt Carruth oil ventures had to buy an additional 25 percent of Pilgrim Oil Company shares (in cash) or lose their investments entirely. Carruth used this money to pay dividends, thereby luring more buyers into his petroleum company Ponzi scheme.

Financial World noted, “This is a promoter’s way of reloading old stockholders with additional $25 worth of stock for every $100 they hold in a defunct company.”

J.W. Carruth merged his fraudulent Hogg Creek Carruth Oil with his other fraudulent oil company to create Pilgrim Oil company, a Ponzi scheme using investors’ purchase money to pay dividends and lure more buyers.

In 1923, a federal court indicted J.W. “Hog Creek” Carruth for mail fraud. Also indicted were Pilgrim Oil Company trustees Richardson and Hollister. Eighty-nine other shady characters also were named in a sweeping indictment aimed at stock hucksters.

U.S. Penitentiary, Leavenworth

Federal prosecutors reviewed financial harm to innocent Pilgrim Oil Company shareholders, who pleaded to the court for justice.

“False, fraudulent, and untrue representations were made for the purpose of inducing plaintiffs to buy the said stock of the said two companies, and for the purpose of cheating, swindling, and defrauding plaintiffs out of their money, and did cheat, swindle, and defraud plaintiffs out of their said money,” the attorneys declared.

“That in 1922, and for a long time prior and subsequent thereto, defendant was engaged in handling and selling oil stock certificates and owned and controlled interests in various oil companies and concerns in this state,” the prosecutors added. Dozens of convictions followed.

Carruth earned a one-year sentence in Leavenworth, Kansas. He joined the federal penitentiary’s oil-scheme alumni Dr. Frederick Cook, the fraudulent Arctic explorer turned oil well promoter. Pilgrim Oil Company and the other Carruth company shareholders were left with stock certificates of no value, except perhaps as a family stories and heirlooms.

Convicted felon “Hog Creek” Carruth, who died in obscurity in 1932, should not be confused with former Texas Governor James S. “Big Jim” Hogg, who helped discover the important West Columbia oilfield in 1917 — learn more in Governor Hogg’s Texas Oil Wells.

More articles about U.S. exploration and production companies and links for further research can be found in Oil Stock Certificates.

_______________________

Recommended Reading (October 9): The Prize: The Epic Quest for Oil, Money & Power (2008); The Extraction State, A History of Natural Gas in America (2021); The Birth of the Oil Industry (1936); Trek of the Oil Finders: A History of Exploration for Petroleum (1975). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(2008); The Extraction State, A History of Natural Gas in America (2021); The Birth of the Oil Industry (1936); Trek of the Oil Finders: A History of Exploration for Petroleum (1975). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society preserves U.S. petroleum history. Join today as an annual AOGHS annual supporting member. Help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2021 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Exploiting North Texas Oil Fever.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/stocks/pilgrim-oil-company-exploiting-oil-fever. Last Updated: June 4, 2022. Original Published Date: September 9, 2021.

.

by Bruce Wells | Apr 20, 2022 | Petroleum Companies

Bandits and revolution in Mexico are not good for petroleum exploration.

National Oil Company of New Jersey (later the New National Oil Company of Delaware) originally formed in August 1910, as a holding company with multiple subsidiaries. The venture’s activities included shipping as well as oil exploration drilling operations in Texas, Louisiana — and during the Mexican Revolution.

Further, a subsidiary National Oil Company of Mexico (formerly Cie Exploradora Del Petroleo) held title to about 36,000 acres of oil-produing land as well as a tidewater terminal and other facilities on the Panuco River near Tampico, Mexico.

The leases on La Herradura and Los Chijoles came under attack during Mexico’s revolutionary period. On April 17, 1914, Constitutionalist forces raided, appropriated livestock and equipment, and forced the company to abandon a 30,000 barrel a day gusher that had yet to be capped. They returned 30 days later, but negotiations with Mexico over damages would last for decades. (more…)

by Bruce Wells | Jan 28, 2019 | Petroleum Companies

Alas, there is very little chance your newly found old oil stock certificate will lead to petroleum riches here at Old Oil Stocks in progress G. Few come close to Not a Millionaire from Old Oil Stock about a certificate that spawned lengthy litigation with the Coca-Cola Company.

The American Oil & Gas Historical Society, which depends on your support, does not have resources for extensive research. As AOGHS looks into forum queries as part of its energy education mission, investigations have revealed interesting stories like Mrs. Dysart’s Uraniu Well and Buffalo Bill’s Shoshone Oil Company; others have found questionable dealings during booms and “black gold” fever epidemics like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum for updates frequently added to the A-to-Z listing in Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Garfield Oil & Refining Company

The Oklahoma business records department can provide incorporation information on the Garfield Oil & Refining Company, which had properties near Nowata but does not appear to have prospered.

Gate City-Wyoming Oil & Gas Company

The Gate City-Wyoming Oil and Gas Company incorporated in Idaho July 10, 1917, with Pocatello, Idaho, physician Dr. O.B. Steeley as president. The company acquired leases in Wyoming’s Lost Soldier Dome (640 acres); Rattlesnake Dome (640 acres); Laramie Dome (160 acres); and Rock Springs Dome (640 acres). Curiously, the company’s officers and property were also recorded as the Gate City Oil & Gas Company. Dr. Steeley died suddenly in June 1920. The Idaho secretary of state may have further information, but the company’s last filing was in September 1923. Its charter was forfeited on December 1, 1924. Read about other Wyoming wildcatters in First Wyoming Oil Wells and Buffalo Bill’s Shone Oil Company.

Gatex Oil Company

Gatex Oil Company incorporated in Delaware March 1, 1920. The company undertook exploratory “wildcat” drilling in northeast Texas’ Hopkins and Bowie counties with plans to drill in Hunt County. But in Hopkins County, its Davis No. 1 well was abandoned after reaching 2,020 feet deep without finding oil. Similarly in Bowie County, its Perkins No. 1 well was shut down at 1,570 feet deep with no success. Wildcat drilling on unproven land has always been risky; early failures have often exhausted under-capitalized ventures. This seems to have been the case with Gatex Oil Company, which was dissolved on June 4, 1936. (more…)

by Bruce Wells | Jan 24, 2019 | Petroleum Companies

People seeking obscure financial information probably will not find riches here – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends on your donations, doesn’t have resources for extensive research.

But as AOGHS looks into forum queries as part of its energy education mission, investigations have revealed interesting stories like Mrs. Dysart’s Uranium Well and Buffalo Bill’s Shoshone Oil Company; others have found questionable dealings during booms and “black gold” fever epidemics like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Fairchild Petroleum

One company named Fairchild Petroleum was incorporated in 1921 capitalized at $120,000 in Paintsville, Kentucky, a few miles from the town of Oil Springs (also known as Medina) and home to the Big Sandy Oil & Refining Company. Although there was substantial interest in Johnson County’s petroleum prospects, there is little trace of Fairchild Petroleum activity in Kentucky.

More information may be available from the Kentucky secretary of state business services. This notwithstanding, in 1922 a Fairchild Petroleum Company drilled the No. 1 Boggs well in Brazoria County, Texas, and also drilled in Liberty County, near Nome. The No. 1 Boggs reportedly produced oil from a depth of 4,550 feet. The Texas Railroad Commission maintains records that may provide further insights. (more…)

(reprint, 2017); Kettles and Crackers – A History of Wyoming Oil Refineries

(2016). Your Amazon purchases benefit the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.