In July 1953, Fidel Castro’s revolutionaries first challenged the government of Fulgencio Batista with organized guerrilla resistance and revolution. Three years later, United Cuban Oil incorporated with Ted Jones as president and offices in Los Angeles. The investment banking firm of S.D. Fuller & Company underwrote the venture, investing $534,694 to control 66 percent of United Cuban Oil stock.

In July 1953, Fidel Castro’s revolutionaries first challenged the government of Fulgencio Batista with organized guerrilla resistance and revolution. Three years later, United Cuban Oil incorporated with Ted Jones as president and offices in Los Angeles. The investment banking firm of S.D. Fuller & Company underwrote the venture, investing $534,694 to control 66 percent of United Cuban Oil stock.

The new petroleum company’s objective was “to consolidate production, development and exploration of oil and gas on concession rights (38 leases) in Cuba.” Jones had existing but independent ventures working on the north coast of the island, including Companie de Fomento Petrolero.

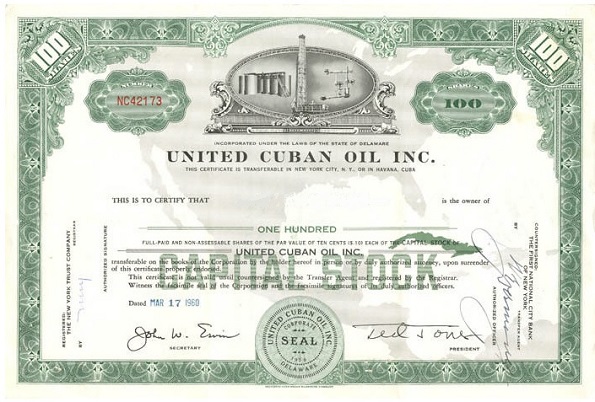

United Cuban Oil filed with the U.S. Securities and Exchange Commission to register 2,573,625 common stocks and an initial public offering of 2,000,000 shares at $1.25 a share. The company exchanged 573,625 shares of stock one-for-one to absorb Jones’ Companie de Fomento Petrolero and make it a subsidiary.

Jones’ holdings in Cuba also became subsidiaries: Empresas Petroleras Jones de Cuba and Compania Perforadora Jones de Cuba. A group headed by James J. McBride bought 1,200,000 shares to be held in escrow for three years.

On June 13, 1957, United Cuban Oil announced plans to drill in California. The selected site was on the 111 acre Muller ranch, about three miles west of La Honda. Drilling of the Muller No. 1 well began on June 29. Interviewed by the Santa Cruz Sentinel, company president Jones took the opportunity to promote United Cuban Oil’s prospects with its six producing wells in Cuba.

Six weeks later, Jones, “reportedly stated that oil was struck at 2,610 feet in 45 feet of oil sand. Officials would only say that it was producing a ‘couple of hundred barrels.’” Regardless of production, by the end of August 1957, United Cuban Oil had plugged and abandoned the Muller well after water intrusion and a failed re-drilling effort.

In Texas, United Cuban Oil completed its No. 1A Coker well in Coleman County, five miles northeast of Novice. But the wildcat well turned out to be just a brief producer. It too was abandoned. At the time, United Cuban Oil was selling for about 56 cents a share on the American Stock Exchange, but for any business operating in Cuba, everything changed on January 1, 1959. Fidel Castro seized power, dictator Fulgencio Batista fled the island, and the Cold War became more dangerous.

Back in the United States, United Cuban Oil was reorganized by three wealthy entrepreneurs from El Paso, Texas. In May 1959, they merged Balcones Corporation, Dell City Gas Company, and United Cuban Oil to form a new company while retaining the United Cuban Oil name and Ted Jones as president. The company planned to move its headquarters to El Paso.

Although United Cuban Oil’s underwriters, S.D. Fuller & Company, offered analysis of prospects to potential investors in the Commercial and Financial Chronicle, few were willing to gamble on Cuba’s uncertain future. By November 1959, the Law 635 of the Batista government effectively stripped United Cuban Oil of its Cuban operations.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.