Back in the 1920s, assets of failed oil ventures were often auctioned from county court house steps. Pieces of defunct companies could be scavenged from abandoned leases, equipment and debts to start new companies with new investors. It was a convoluted business of extraordinary risk and many casualties.

In the span of about five years, American Producing & Refining Company begat the Kentucky Midland Pipe Line & Refining Company, which in turn begat the Oakline Pipe Line Company, which in turn was sold to the Ulf brothers, principal investors in the original American Producing & Refining Company. That company incorporated in August 1917, “to acquire and develop oil lands.”

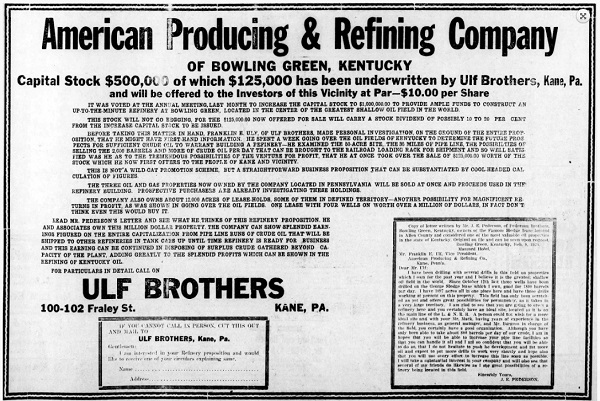

By 1919, American Producing & Refining was in Kentucky “running oil from the eastern part of Warren County” and announcing its intent to build a 5,000 barrel oil storage tank at Bowling Green. In May 1920, it sold more stock and increased its capital from $500,000 to $1 million. A Pennsylvania newspaper reported the company’s activity.

“What is probably the largest deal in Kentucky leases ever made in this section was closed today when the American Producing & Refining company, of Bradford, Pennsylvania, took over the leases held by Ulf Brothers,” reported The Kane Republican in January 1920.

In addition to the Ulf Brothers, the newspaper reported the company added leases from F.A. Aggers and the leases held by the Bluegrass Kentucky Oil Company and the Union Kentucky Oil Company. “The total acreage amounts to approximately 12,000 acres. With the present market of $3.10 per barrel for Kentucky crude, there is a strong demand for acreage, especially with production near it.”

In addition to the Ulf Brothers, the newspaper reported the company added leases from F.A. Aggers and the leases held by the Bluegrass Kentucky Oil Company and the Union Kentucky Oil Company. “The total acreage amounts to approximately 12,000 acres. With the present market of $3.10 per barrel for Kentucky crude, there is a strong demand for acreage, especially with production near it.”

The Ulf brothers were successful clothiers and independent oil producers from Tidioute, Pennsylvania, who would appear again in American Producing & Refining’s history. The Kane Republican also reported arrival of a representative of the company.

“Many of Kane’s men are largely interested in the company which will operate extensively in the Kentucky Field,” the newspaper noted. “The company has over 60 miles of pipe line which will bring the production for the refinery being constructed at Bowling Green.”

The company also planned construction of an additional 16,000 barrel capacity steel tank. But something must have gone awry. The March 30, 1921, National Petroleum News reported financial trouble.

“Following the petition of creditors for the American Producing & Refining Company for a receiver, the referee in bankruptcy has issued an order that a trustee be elected by the creditors on April 4,” the trade publication explained. “A schedule of the liabilities shows $177,051.77 and the assets are listed at $171,948.99. Close to $40,000 is due creditors for oil, the list of creditors numbering close to 1,000. The American has been operating an Independent pipe line in certain sections of the field and ran about 10,000 barrels in February.”

As bankruptcy proceedings advanced, American Producing & Refining pipelined 7,000 barrels of oil of Warren County’s 107,000 barrels of oil total in May 1921. In September the company sold 5,500 barrels of its oil at 80 cents a barrel to Standard Oil Company of Kentucky. “Some relief for the creditors of this company has been secured during the past two weeks through considerable sales of oil in storage,” noted National Petroleum News.

In June 1921, a federal court order directed Bowling Green Trust Company as trustee, to sell the bankrupt American Producing & Refining Company. It was purchased by a syndicate of investors from Chicago and Kentucky for $130,156. The buyers planned to form a new company and extend pipelines further into Warren and adjacent counties. They also intended to continue with plans to erect a refinery in Bowling Green.

The new company incorporated as Kentucky Midland Pipe Line & Refining Company in Delaware. Its property consisted of a completed pipeline from Bowling Green to the oilfields of Warren and Allen counties, Kentucky, with pumping stations and a site for a refinery at Bowling Green (incorporators were Arthur W. Britton, Samuel B. Howard and Robert K. Thistle, all of New York).

But Kentucky Midland Pipe Line & Refining Company was short-lived. “A successor to the American Producing & Refining company, known up to this time as the Kentucky Midland Pipe Line & Refining Company, was incorporated,” reported the National Petroleum News, adding that the venture was a $2 million Delaware corporation “with a Kentucky permit, under the name of the Oakline Pipe Line Company.”

Oakline Pipe Line Company began construction of a 5,000 barrel storage tank on their loading rack site in Bowling Green. It operated approximately 65 miles of lines in Warren and northwestern Allen counties. Pipelines transported oil from the shallow Plano field and from the Davenport field’s deep production north of Bowling Green. But within six months, Oakline Pipe Line Company was bankrupt.

The pipeline company was sold at public auction in Bowling Green on January 5, 1922, to the Ulf Brothers of Kane, Pennsylvania, for $160,000. These were the same Ulf brothers who just two years earlier had sold 12,000 acres to the American Producing and Refining Company in the “largest deal in Kentucky leases.”

The Kane Republican provided an epitaph: “Ulf Brothers and associates, who purchased the American Pine Line & Refining Company’s properties for a consideration of $160,000, intend to extend its lines in Warren county and will also make large extensions in Logan and Simpson counties. It is also understood that they will take over the refinery which was started by the Oakline people, and also lines built by them, and make further extension, to their lines. There will be a meeting of. the stockholders of the American Producing and Refining company in the Y.M.C.A., Friday evening, Feb. 24th at 7:30 o’clock. All stockholders are requested to be present.”

The Ulf brothers continued investing in the oil patch, extending their ventures into Texas with plans to form the Ranger-Duke Exploration Company, but the American Producing & Refining Company was gone. Learn about America’s early petroleum industry in Kentucky’s Great American Oil Well.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

___________________________________________________________________________________