The story of Nova Petroleum Corporation begins in the petroleum boom days of the early 1980s and ends decades later in the healthcare industry.

In October 1973, OPEC declared what it called “oil diplomacy,” prohibiting any nation that had supported Israel in the Yom Kippur War from buying oil.

The embargo marked the end of cheap gasoline. The price of oil, which had ranged between $22 per barrel and $25 per barrel since the 1950s, skyrocketed to $51 a barrel by February 1974. America’s energy crisis caused New York Stock Exchange share values to drop by $97 billion. A devastating recession followed.

As the nation recovered, the Iranian revolution and Iran-Iraq war led to another energy crisis. With American importing about 27 percent of its oil, the U.S. price per barrel approached $100 by January 1980. Crude oil prices would average around $75 per barrel for the next five years.

America’s desperate need for oil launched drilling booms in most of the 33 producing states. Competition was intense as many new exploration and production companies sought financing for leases and equipment. Drilling costs soared as advancements in drilling technologies allowed wells to reach producing formations many miles deep.

The petroleum industry’s historic production surge would come to an abrupt end by 1986 when oil prices collapsed. Hundreds of companies were wiped out when the price fell to $28 per barrel in April.

Nova Petroleum Corporation

At the height of the early ’80s drilling frenzy, oil fever once again seized Americans. Companies like Nova Petroleum actively sought investors to finance exploratory wells. The company drilled several wells in North Dakota, but all were expensive dry holes.

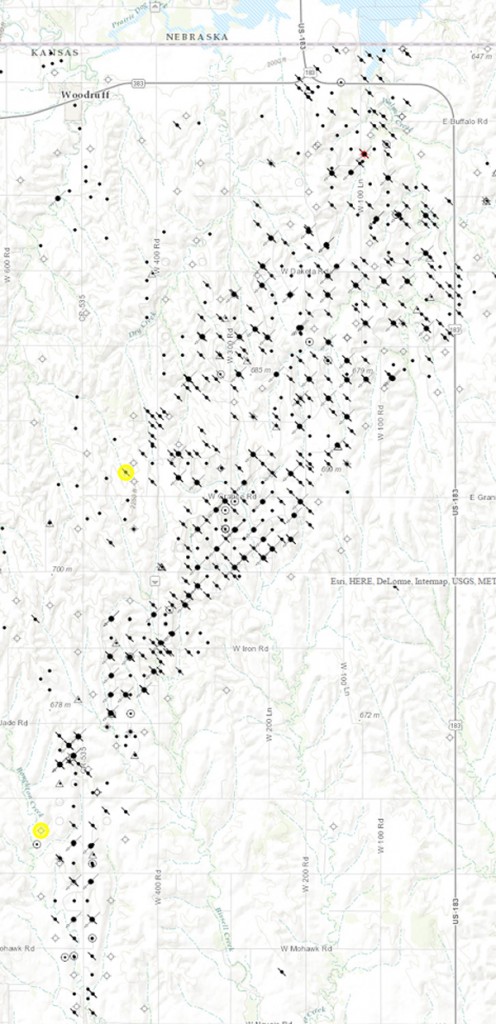

Undeterred, Nova Petroleum persevered. In June 1983 the company drilled its first Kansas well south of Woodward, at the Nebraska border. Although near the Huffstutter oilfield, the well found no oil or natural gas. A second attempt the following year farther south also proved a dry hole.

Nova Petroleum’s two Kansas wells missed finding producing zones in the Huffstutter oilfield. Ma courtesy the Kansas Geological Survey.

Despite the setbacks, potential investors as far away as California showed interest in the company. One reader of the San Bernardino County Sun sought the paper’s advice about investing in Nova Petroleum. The response was sobering given recent news about many drilling ventures.

“I assume that like so many others, you are buying into the speculative new-issue market in natural resource companies,” the newspaper noted. “To the more conservative, this market has been overdone and owes its surprising strength to excessive enthusiasm over prospects for new oil and gas finds.”

The editorial warned of many companies forming in Colorado (above the highly productive but deep and expensive to drill Overthrust Belt).

“One expert in oil and gas was asked to evaluate the several ‘energy’ stocks on your list; he said he had never heard of any of them,” the paper reported.

Meanwhile, the cost of Nova Petroleum’s failed efforts was substantial. While the company survived, its business model evolved just as collapsing oil prices forced industry consolidations – and many bankruptcies.

Nova Petroleum Corporation merged with Power Resources Corporation (a minerals and uranium mining venture) to form Nova Natural Resources Corporation. By 1995 it had reincorporated under Colorado law, changing its domicile from Delaware to Colorado.

A 2000 Nova Natural Resources filing with the Securities and Exchange Commission reported:

“In recent years, the Company focused its activities on marketing and selling kaolin clay from its Minnesota kaolin mine, exploring for paper-grade kaolin on leases elsewhere in Minnesota, seeking partners for exploration and development of gold on its properties in Alaska and Colorado and seeking partners for exploratory drilling on two oil and gas prospects in Wyoming.”

But within two years Nova Natural Resources Corporation had reorganized itself to become a provider of healthcare services, including addiction and mental health. Nova Natural Resources then changed its name to GreeneStone Healthcare Corporation with its stock trading on the Over the Counter Market. As of June 30, 2008, there were 3,071,764 shares of common stock outstanding and the company no longer appeared to be in the mining, oil, or natural gas business.

Per Securities and Exchange Commission (June 30, 2015), GreeneStone Healthcare Corporation:

The Company has a working capital deficiency of $2,972,976 and accumulated deficit of $19,914,883. Management believes that current available resources will not be sufficient to fund the Company’s planned expenditures, including past due payroll and sales tax payments, as well as estimated penalties and interest, over the next 12 months.

Accordingly, the Company will be dependent upon the raising of additional capital through placement of common shares, and, or debt financing in order to implement its business plan.” At that time GreeneStone Healthcare traded in the range of three to fourteen cents per share with a total of 47,738,855 issued and outstanding common shares as of June 30, 2015. Its symbol was (and remains) “GRST.”

___________________________________________________________________________________

The stories of other attempts to join petroleum exploration booms (and avoid busts) can be found in an updated series of research at Is my Old Oil Stock worth Anything?

___________________________________________________________________________________