by Bruce Wells | Sep 22, 2024 | Petroleum Companies

Learning hard lessons about wasteful overproduction and depleted reservoir pressures.

The discovery of oil along a small creek in Titusville, Pennsylvania, in August 1859 launched the American petroleum industry. Drilled just 69.5 feet deep at Oil Creek by former railroad conductor Edwin L. Drake, the well produced oil that could be refined into an inexpensive lamp fuel, kerosene.

Drake, who pioneered drilling technology, borrowed a local kitchen water pump to fill the first oil barrels. Early oil production from his and other northwestern Pennsylvania wells brought new refineries to Oil City and Pittsburgh on the Allegheny River.

Four acres close to the Sherman well sold for $220,000 as venture oil capitalists, entrepreneurs, and speculators tried their luck in the newly created petroleum industry.

Demand for kerosene quickly outpaced the inexpensive but volatile lamp fuel camphene. Kerosene also replaced expensive whale oil. A typical four-year whaling voyage returned with 40,000 gallons; New oilfields produced 10 million gallons of kerosene in 1860 alone.

Edwin Drake’s well, drilled for the first U.S. oil company established by George Bissell, brought the country’s first drilling boom as entrepreneurs rushed in. Farmers who leased their land were among the first to benefit.

“Oil Creek was soon taken up and within a relatively short time, the entire valley as far back as into the hillsides, had been leased or purchased,” author Paul Gibbons noted.

With the science of petroleum geology yet to debut, early oil explorers searched near oil seeps and the “rich territory was limited to flats along the streams,” Gibbons added. Natural gas discoveries would later arrive to the benefit of Pittsburgh industries.

Sherman Well of 1861

J.T. Foster’s farm on Pioneer Run hillside off Oil Creek was in “the dry diggings” where few were willing to gamble. Nonetheless, newly minted oil operators gathered investors to try to find oil. Capital was hard to come by.

On the 200-acre Foster farm, one struggling and almost cashless outfit had to trade a one-sixteenth interest for $80 and an old shotgun to continue drilling on its Sherman well.

Drilling along Oil Creek continued undiminished, but in September 1861 on the Funk farm, the Empire well began flowing a river of oil under its own pressure. They called it a “fountain well.” Some said it initially produced 2,000 barrels of oil a day. Other successful wells followed.

Back on the Foster farm lease, the Sherman well (saved earlier for $80 and a shotgun) in March 1862 was completed as the “best single strike of the year,” despite being “above all the other flowing wells” according to the Hornellsville Tribune. Leases became highly prized and, as historian Terence Daintith observed, “subleasing was also a money machine.”

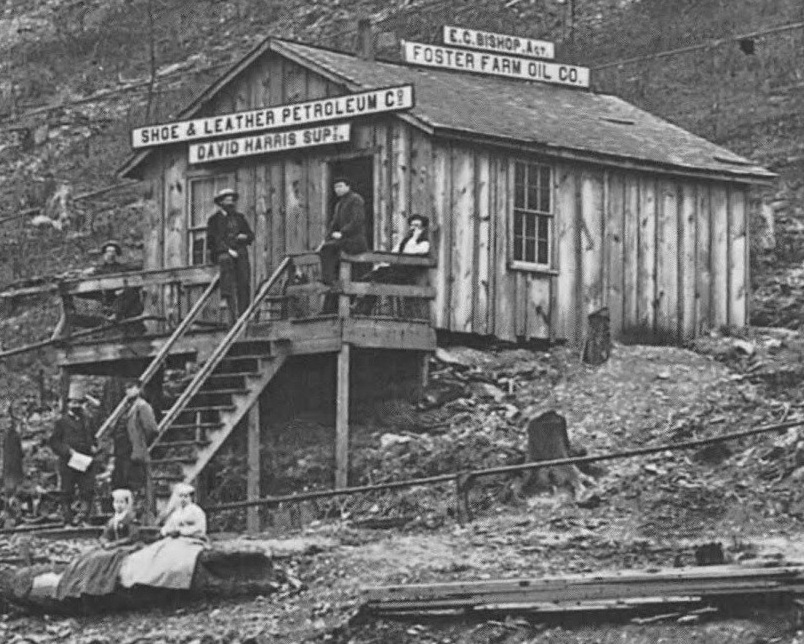

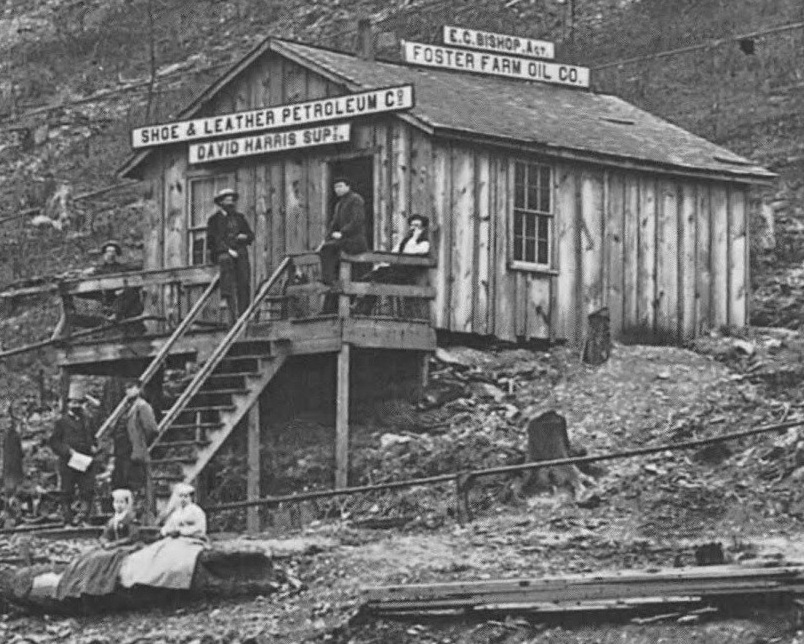

Oilfield offices of the Shoe & Leather Petroleum company, David Harris Supply Company, and the Foster Farm Oil Company, which drilled an 1866 well that produced 300 barrels of oil.

The Venango Citizen reported, “Territory along the river above and below Franklin has been changing hands at high figures, and preparations are being made for active work.”

Just four acres close to the Sherman well sold for $220,000 as venture capitalists, entrepreneurs, and speculators tried their luck in the newly created petroleum industry. The Foster Farm Oil Company and the Shoe & Leather Petroleum Company were among many corporations formed to exploit exploration opportunities.

Foster Farm Oil Company

Foster Farm Oil Company incorporated in February 1865. Based in Philadelphia and capitalized at $1.5 million, the company offered 150,000 shares to the public. “The Foster Farm is owned by a company of ten gentlemen, and is known as the Foster Farm Oil Company,” reported the The Titusville Morning Herald. E.C. Bishop (Elisa Chapman ) was principal owner as well as one time general agent, treasurer, and superintendent.

The new company secured acreage on the Foster farm that already had 12 wells pumping 100 barrels of oil a day. Foster leased acreage in small tracts to several new companies vying for closest proximity to known producers. Oil prices had always fluctuated wildly, but a standard 42-gallon barrel of crude oil sold in 1865 for about $6.50, including a Civil War excise tax of $1 per barrel.

Foster Farm Oil Company continued drilling and subleasing small tracts. In April 1866, it drilled a well producing 300 barrels of oil a day from 612 feet deep. Then a second well produced at 310 barrels, a third at 100, and another at 350 barrels of oil a day. In 1867, Foster Farm Oil Company sold 1,000 barrels of oil at $2.10 each.

All over the Pioneer Run hillside, wooden derricks with steam engines pumped away even as overproduction drained the oilfield. Margins disappeared and companies began to fail.

Foster Farm Oil Company’s fortunes faded, as did the value of its stock. In 1869, total U.S. oil production topped 4 million barrels and oversupply drove many out of business. After 10 years in the oil patch, Elisha C. Foster departed to enter the banking business in Connecticut.

By 1871, shares of Foster Farm Oil were being auctioned off along with other “Stocks, Loans, etc.” The following year, 5,000 shares of Foster Farm Oil Company were offered at 11 cents a share. Litigation began to overtake the failing company in 1873; it would continue long after the drilling boom had moved on, finally being settled by the Connecticut Superior Court in 1886.

Shoe & Leather Petroleum

Shoe & Leather Petroleum Company incorporated in New York City in March 1865 to join the Pennsylvania oil rush. The company initially capitalized at $400,000, later reduced to $160,000. “Until the spring of 1865, the Foster Farm, Pioneer Run and vicinity were considered dry territory. Through the exertions of Mr. David Harris of this city, the Shoe & Leather Petroleum was formed,” reported the Titusville Morning Herald.

The company leased six acres on the Foster farm, then subleased them into 11 smaller tracts – the kind sought by smaller, speculative operations. “Substantial leaseholders could milk their leases by subleasing small lots for large premiums and high royalties,” historian Daintith later noted. “Far more money could be made this way than by actual production.”

By 1867, Shoe & Leather Petroleum had five producing wells, on five different tracts, with five different operators, yielding about 350 barrels of oil a day. But frantic production at Pioneer Run and Oil Creek, compelled land owners above oil reserves to drill, “regardless of price or market demand, in order to prevent his neighbor from draining his reserves.”

This traditional “law of capture” rendered an oily landscape thick with derricks, according to local accounts.

Overproduction and waste depleted reservoir pressures. Wells were pumped dry. Triumph Hill, and Pithole and other examples reinforced the precedent of oil discovery leading to drilling boom, and then to inevitable bust. By 1902, United States Investor reported Shoe Leather & Petroleum Company had “disappeared” and concluded, “The supposition is that the company has gone out of existence.”

In 1904, Smythe’s Directory of Obsolete American Securities and Corporations described Shoe & Leather Petroleum, “Extinct. Stock worthless.”

The stories of exploration and production companies can be found updated in Is my Old Oil Stock worth Anything?

_______________________

Recommended Reading: Cherry Run Valley: Plumer, Pithole, and Oil City, Pennsylvania (2000); Myth, Legend, Reality: Edwin Laurentine Drake and the Early Oil Industry

(2000); Myth, Legend, Reality: Edwin Laurentine Drake and the Early Oil Industry (2009). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(2009). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society preserves U.S. petroleum history. Please become an AOGHS annual supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2024 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Early Wells of Oil Creek.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/stocks/early-wells-of-oil-creek. Last Updated: November 1, 2024. Original Published Date: December 22, 2018.

by Bruce Wells | Sep 13, 2024 | Petroleum Companies

Utah company sought oil from Gilsonite deposits in 1917.

Although attempts to extract commercial amounts of oil from Utah’s abundant shale formations failed, the effort of Ute Oil Company in the Uinta Basin was far ahead of its time.

A survey party in 1861 described the Uinta Basin in eastern Utah as, “One vast contiguity of waste and measurably valueless, except for nomadic purposes, hunting grounds for Indians, and to hold the world together.”

After reading the survey report, Brigham Young, who had founded Salt Lake City in 1847, scrapped his plans to send a group of Mormon settlers to the area.

Gilsonite is a coal-like natural asphalt found in the Uintah Basin in northeastern Utah.

Young thought the arid region better suited for a Ute Indian reservation, according to historians at the Utah Humanities Council, and President Abraham Lincoln created the Uintah Reservation by executive order.

However, by the time Utah became the 45th state in 1896, the sparsely populated region bordering Colorado had begun revealing its mineral wealth, including gold, silver, lead, zinc, copper, and a soft coal-like substance.

Coalbed Methane

Coal and a coal-like hydrocarbon — Gilsonite — brought mineral exploration companies to eastern Utah soon after the turn of the century. Gilsonite, also known as North American Asphaltum, was unique to the region known for its thick shale deposits.

In the 1920s, companies extracted oil shale and Gilsonite from narrow mines.

By the early 20th century, aspiring entrepreneurs had arrived to exploit these new petroleum resources. Several new ventures would be among the earliest anywhere seeking to make money by squeezing oil from shale. The Uinta Basin has since become one of the largest coalbed methane producing areas in the United States.

By 2015, petroleum engineers estimated the vast desert plateau in Utah and Colorado contained between eight trillion cubic feet and 10 trillion cubic feet of gas reserves.

The Gilsonite Maneuver

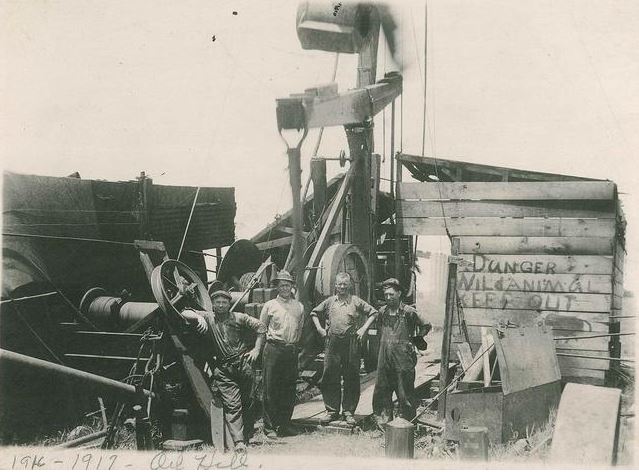

“The first attempt at oil shale exploitation took place in 1917 by the Ute Oil Company,” noted the Bureau of Land Management in a 2007 technical report about oil shale and tar sands areas in Colorado, Utah and Wyoming.

Established in 1916, Ute Oil Company was created to refine petroleum from a dense shale mined north of Watson, Utah. Oil shales had proven abundant there. So had Gilsonite found in deep vertical veins. The coal-like natural asphalt had many industrial uses.

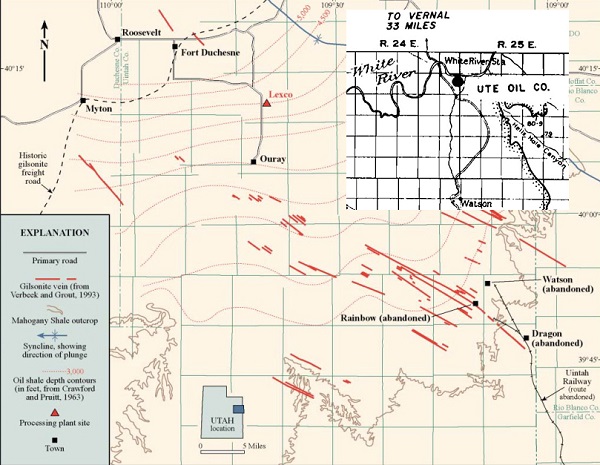

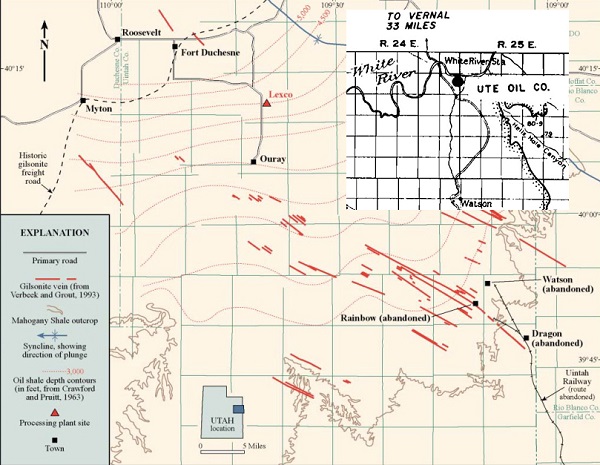

Although Ute Oil Company found Gilsonite and oil shales abundant in northeastern Utah, processing the hard shale proved too expensive as other conventional U.S. discoveries brought far lower oil prices. Color map courtesy Utah Geological Society.

Gilsonite had been vigorously promoted since 1886 by Samuel H. Gilson, its principal investigator, marketer and namesake. He formed a company to mine and market Gilsonite on a commercial scale.

Gilson, a former rider for the Pony Express between California and Missouri, believed his Gilsonite (or Uintahite) practical for use in everything from a waterproof coating for wooden pilings, as an insulation for wire cable, and as paint or a varnish. He even promoted the natural, resinous hydrocarbon as an additive for chewing gum.

Utah’s Gilsonite was selling for more than $12 a ton when in 1888, despite Bureau of Indian Affairs protests, Congress opened a 7,040 acre oil shale and Gilsonite-laden strip on the Uinta Ouray Reservation for placer mine claims.

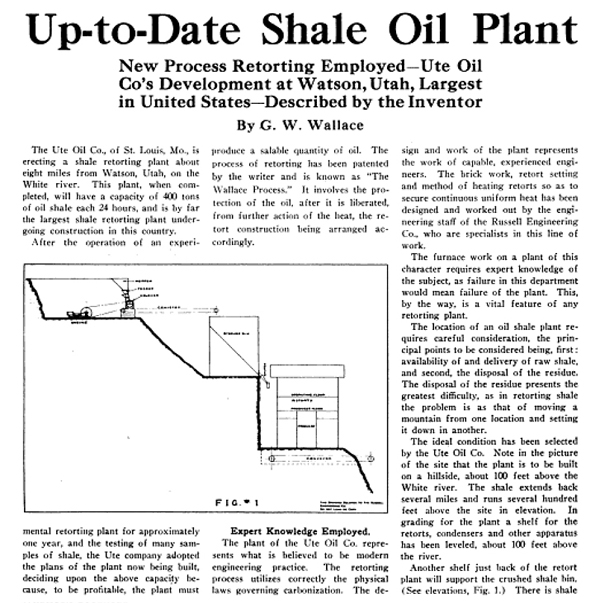

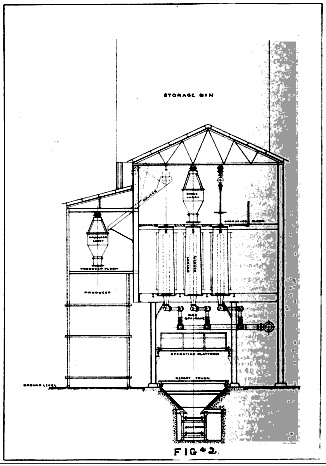

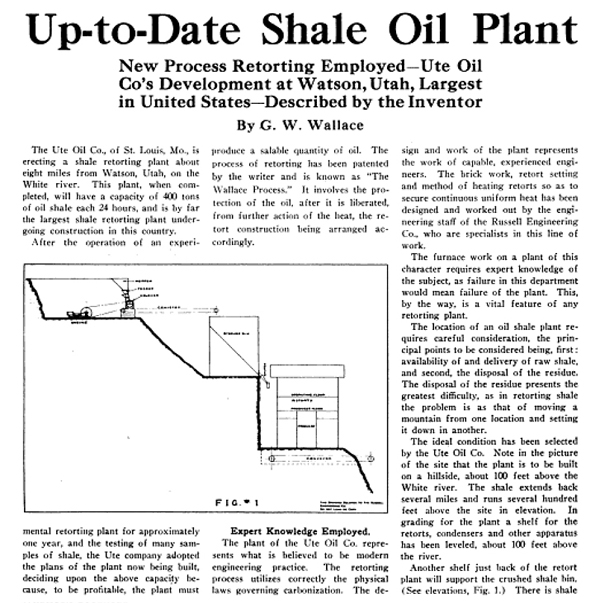

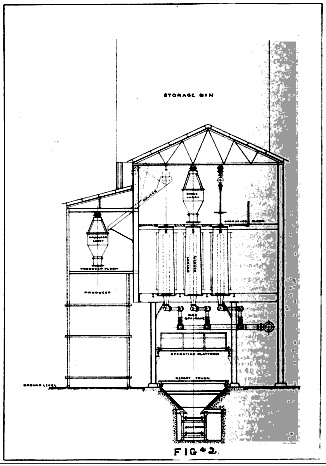

An October 1918 article in “Petroleum Age” magazine described a planned shale oil plant at Watson, Utah, that would be the largest in United States. The author is the plant’s designer, St. Louis engineer George W. Wallace, who will become superintendent of Ute Oil Company.

Placer claims could be filed for mining a fixed amount of acreage by a person or group. These claims on Indian Reservations often led to lengthy litigation. The law required production of resources in order for the claimant to be granted a legitimate right to the land. Learn more about the Placer Act in First Wyoming Oil Well.

Ute Oil Company’s interest was in oil shale’s kerogen (naturally occurring organic matter) content. Oil shales like Gilsonite can yield petroleum when sufficiently “cooked.” The distillates boil off and are captured as in other refining operations.

In eastern Utah, Ute Oil Company made a 100 acre placer claim near Watson alongside the White River, about 100 feet up a hillside where promising oil shale deposits could be cheaply mined and then refined. Other companies had the same idea.

Shale Oil Boom

The boom towns of Watson, Dragon Junction and Rainbow were spawned amidst new Gilsonite mines. A narrow gauge (and short-lived) Uintah Railroad was built specifically to link them to the Rio Grande Western Railway 63 miles away.

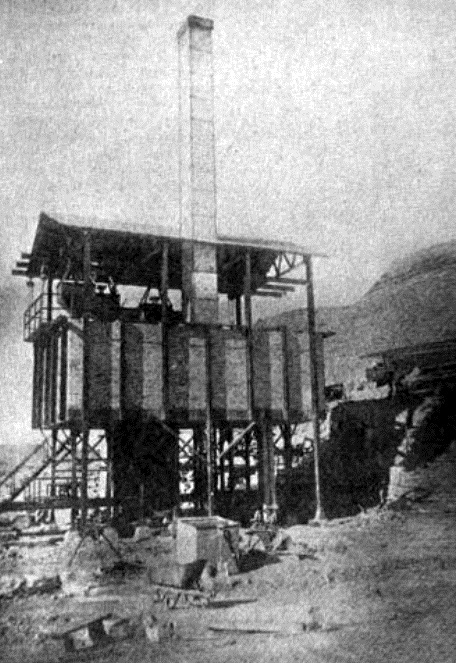

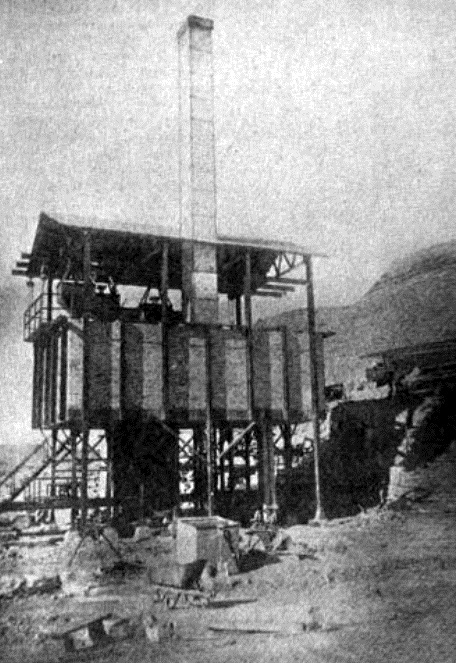

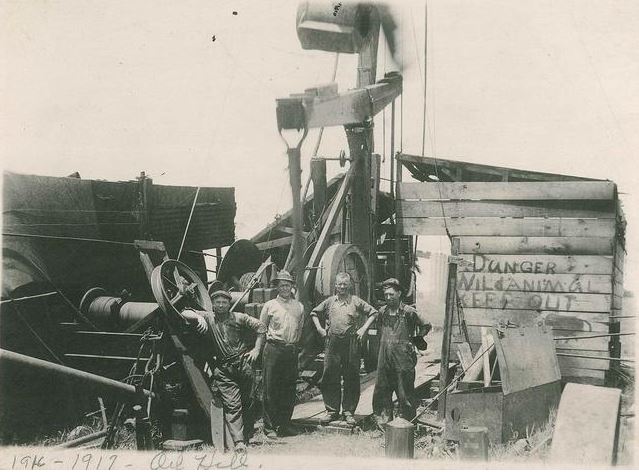

Oil shale production mining technologies of the 1920s were dangerous and expensive. Above is Ute Oil Company’s processing plant under construction.

By 1911, what was called the “crookedest railroad in the West” had overcome steep mountain grades and crossed 40 bridges to reach Watson and the Rainbow Gilsonite mine, above the White River. Crane Shale Oil, Utah Shale & Oil, and the Western Shale Oil Company all planned oil and gasoline reduction plants near Watson.

As the Bureau of Land Management (BLM) began tracking these early efforts to make money by extracting oil from shale, Ute Oil led the way as a petroleum industry pioneer for the oil shale boom that began in the mid-2000s.

Although the company would never complete its ambitious construction of a retorting plant for processing shale, it explored new technologies to maximize production. A 2007 BLM report explained how the company planned building its plant at Watson, today a Uintah County ghost town.

“Construction began on a tramway and processing plant ,” the report noted. “Processing was supposed to extract 90 percent of the oil contained in the pulverized oil shale to produce an average of 54 gallons of oil per ton of shale.”

It was difficult and dangerous to get the shale out of the isolated region.

By November 1919, construction of Ute Oil’s new refinery was nearing completion near the old White River stagecoach station. The company predicted yields of 51.5 gallons of oil and 3.6 gallons of gasoline per ton of processed oil shale when the 18 retorts went onstream. The new plant had a projected capacity of 400 tons daily.

Even using modern technology, the U.S. Geological Survey has reported typical shale yields are between 15 gallons and 25 gallons of oil per ton.

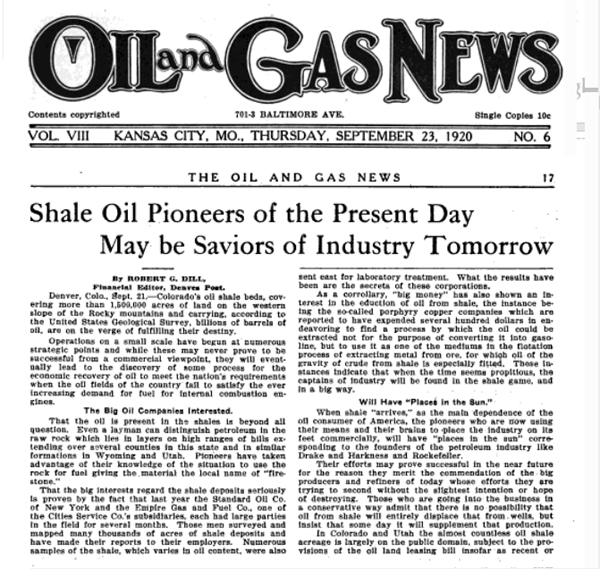

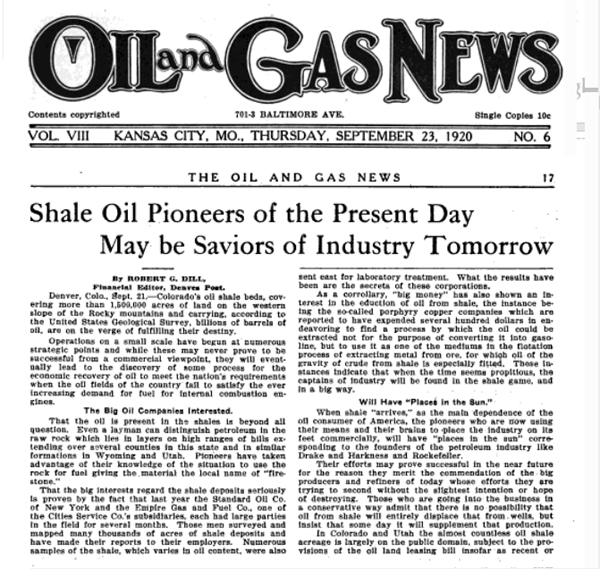

In 1920, industry trade publications continued to praise oil shale developments in Utah and Colorado, but noted that high processing costs for limited production were proving hard to overcome with the day’s technology — see Central Oil Shale Refining Company, a Chicago venture that sought to profit from shale during World War I.

Hard Shale Oil Lessons

The economic possibilities of shale oil intrigued investors and the “American Gas Engineering Journal” of January 3, 1920, crowed: “Twenty-Two Billion Barrels of Oil a Possibility of the Process – Estimates of Production Cost Show Possibility of Shale Oil Competing with Gasoline at Its Lowest Previous Level.”

A Geological Survey investigator proclaimed oil shales offered “more than eight times all of the oil available from the oilfields of the United States!”

Petroleum industry trade publications recognized that Gilsonite and products made from other oil shales like Asphaltite might supplement production from U.S. oilfields, but the business model was risky. Much hinged on a small margin — limited by extraction technologies and the price of crude oil.

“A few crumbling buildings” are all that reman of Watson, Utah, where the Ute Oil Company was the first company to attempt to profit from oil shale. Quote and 1998 photo courtesy Jeremy Carter, Ghosttowns.com.

“Crude shale oil, obtained by retorting oil shale, cannot find a general market until the price of well oil is above the cost of producing shale oil,” reported the October 1921 Mining and Oil Bulletin.

“This cost has been conservatively estimated at $1.85 a barrel, for mining and retorting,” the trade publication added. “When the price of well petroleum approaches or better — exceeds this figure — the production of crude shale oil will take on renewed activity.”

Ute Oil Company had optimistically projected its cost at only $1.02 per barrel. In 1918, the year after the company formed, oil sold for about $1.98 per barrel, but in 1920, it dropped to $1.73. It would get much worse. By 1931, oil prices had dropped to only about 65 cents per barrel.

Ute Oil company’s profit margin depended a high price for oil, but surging oil supplies from traditional oil wells in Texas and other states drove down the price.

By the 1920s, many industry publications were following attempts to develop oil shales in Utah and Colorado. In addition to the “Oil and Gas News” prediction above, the “American Gas Engineering Journal” envisioned production of 22 billion barrels of oil from shale.

End of Ute Oil

In addition to the financial and technological risks that Ute Oil faced, regulatory issues added to its misery. In 1920, Congress passed the Mineral Leasing Act, updating the archaic 1872 law and requiring for the first time that the federal government receive royalty payments from successful placer claims.

An ominous 1921 “Petroleum Times” article noted work had been delayed “by a controversy with the Government over title to the land.”

The litigation among private, state, federal and Indian tribal interests would last decades. The controversy came from renewed congressional interest in rectifying injustices that had historically deprived the Uinta Basin Indians since the reservation had been formed in 1861.

Ute Oil Company failed in 1923 before it could complete its uniquely designed retort for processing oil shale.

Although legal battles would continue, Ute Oil’s fate was sealed. Trade publications reported that the company undertook reorganization in 1923, but did not survive. The BLM would later note that “interest in oil shale production rebounded when oil prices peaked in the 1970s.”

In 1909, Earl Douglass, paleontologist for the Carnegie Museum in Pittsburgh, discovered dinosaur bones in the Utah desert. The site was soon designated the Dinosaur National Monument, and Douglass later became an eloquent spokesman for Utah’s petroleum industry.

J.L. “Mike” Dougan made the state’s first major oi discovery in 1948 after drilling unsuccessfully in Utah for more than 25 years (see First Utah Oil Wells).

In the Energy Policy Act of 2005, Congress declared U.S. oil shale and tar sands strategically important domestic energy resources that should be developed to reduce dependence on imported oil. Five years later, Utah produced more than 8.1 trillion cubic feet of natural gas valued at more than $1.7 billion.

Depending on quality and location of the resource, U.S. market price of Gilsonite in the early 2020s ranged from $600 to $1,000 a ton — compared to $10 to $12 per ton in the late 1800s.

_______________________

Recommended Reading: Utah Oil Shale: Science, Technology, and Policy Perspectives (2016); From the Ground Up: A History of Mining in Utah (2006); Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(2016); From the Ground Up: A History of Mining in Utah (2006); Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Please become an AOGHS supporter and help maintain this website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2024 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Ute Oil Company — Oil Shale Pioneer.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/stocks/oil-shale-pioneer. Last Updated: September 10, 2024. Original Published Date: April 6, 2016.

by Bruce Wells | Aug 27, 2024 | Petroleum Companies

Future CITGO discovered giant Mid-Continent oilfields.

Cities Service Company was established in September 1910 by Henry Latham Doherty as a public utility holding company in Bartlesville, Oklahoma, home of the first commercial Oklahoma oil well. Five years after its founding, Doherty’s company would make its own historic discoveries.

Doherty began by selectively purchasing natural gas producing properties in Kansas and Oklahoma. He acquired distributing companies and linked them to his natural gas supplies. Cities Service Company derived income from the subsidiary corporations’ stock dividends. One natural gas subsidiary drilled exploratory wells in central Kansas.

Occidental Petroleum acquired Cities Service Company in 1982. Stock certificates have only collectible value.

(more…)

by Bruce Wells | Aug 21, 2024 | Petroleum Companies

The “Snake Hollow Gusher” brought Pittsburgh a $35 million natural gas drilling boom — and bust.

“Rarely, a community sees its pulse quicken with a get-rich-quick beat, feels the boom fever strike, suffers the chill of disillusion when the ‘El Dorado’ fades out and then recovers,” noted the Pittsburgh Press in 1934, decades after the excitement began.

“But this is what happened at the McKeesport gas field, scene of the Pittsburgh district’s biggest boom and loudest crash,” the newspaper added. McKeesport Gas Company was among the many petroleum company casualties.

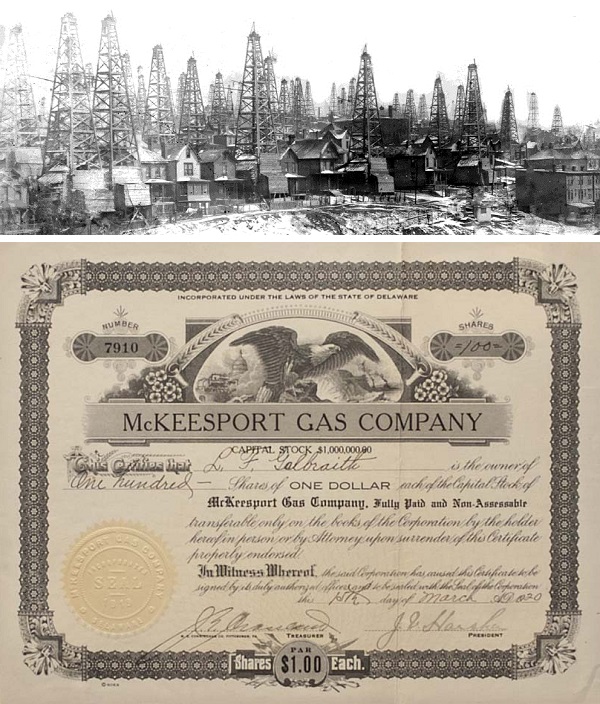

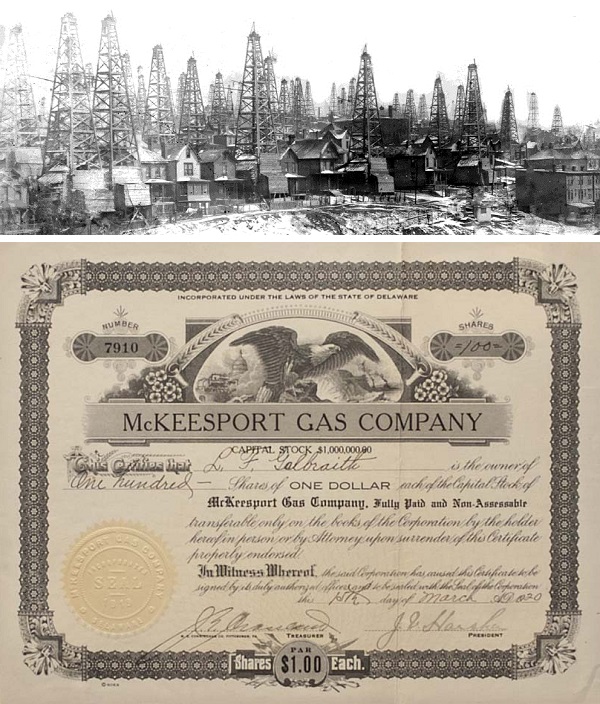

Pennsylvania’s natural gas fields attracted investors to many ambitious drilling ventures, including McKeesport Gas Company.

Following the first U.S. oil discovery at Titusville, Pennsylvania, in late August 1859, natural gas development began in western Pennsylvania.

With new oilfields came discoveries of large volumes of gas suited for illumination, heating, and manufacturing. Natural gas began to be widely used after two brothers drilled into a massive gas field gas field on November 3, 1878.

The Haymaker brothers’ discovery brought the new energy resource to Pittsburgh factories and steel mills. By the late 1880s, Pittsburgh skies cleared for the first time in decades as mills and factories burned natural gas instead of coal.

Learn more about the once famous 1878 Haymaker gas well in Natural Gas is King in Pittsburgh.

Biggest Boom

For investors in 1919, the region’s natural gas history seemed to be repeating itself. McKeesport Gas Company was one of about 300 petroleum companies that sprang up within six months of an August 30, 1919, discovery — a runaway natural gas well near McKeesport.

The “Snake Hollow Gusher” between the Monongahela and Youghiogheny rivers, blew in at more than 60 million cubic feet of natural gas a day. The headline-making gas well, drilled by S.J. Brendel and David Foster, prompted a frenzy that saw $35 million dollars invested during the boom’s seven-month lifespan.

McKeesport Gas Company incorporated on December 5, 1919, and two weeks later enticed investors with advertisements in the Pittsburgh Press and the Gazette Times newspapers. “Over 500 Acres of Leases in the Heart of the McKeesport Gas Fields,” proclaimed one newspaper ad, offering stock at $1.25 a share.

“Many residents signed leases for drilling on their land,” noted another local reporter. “They bought and sold gas company stock on street corners and in barbershops transformed into brokerage houses in anticipation of fortunes to be made.”

Then the natural gas reserves ran out.

Loudest Crash

By the beginning of 1921, McKeesport natural gas production was falling in about 180 producing wells — and more than 440 unsuccessful wells had been drilled. The field would be reported as, “the scene of the Pittsburgh district’s biggest boom and loudest crash.”

Of the estimated $35 million sunk into the nine square mile area of the boom, only about $3 million came out.

A detail from “McKeesport, Snake Hollow, Gas Belt,” a circa 1920 panoramic image by Hagerty & Griffey. Photo courtesy Library of Congress.

A circa 1920 panoramic photograph at the Library of Congress captured the drilling boom at the McKeesport, Snake Hollow, Gas Belt, by Hagerty & Griffey.

McKeesport Gas Company likely drilled a few of the boom’s hundreds of dry holes and with funds exhausted, disappeared into petroleum history. Fifteen years later, McKeesport Mayor George H. Lysle explained to a Pittsburgh newspaper reporter how the town survived the “seven-month wonder” natural gas boom:

“Other boom towns,” he said, “were built merely on the strength of the wealth that was to pour from their wells or mines. But McKeesport and vicinity was established before the boom came.”

When the drilling ended, Lysle added, “people still had their jobs in the mills and stores, the permanent population remained, and the natural resources of the district, except for gas, were still as great as ever. We were still a great industrial community.”

Advances in the science of petroleum geology and improved production technologies have brought surer results than the Snake Hollow Gusher. As early as 2010, the region’s gas boom — the Marcellus Shale — extended across western Pennsylvania into other Appalachian Basin states.

Because of the region’s history, McKeesport Gas Company stock certificates are considered collectible; the stories of other exploration companies trying to join petroleum booms (and avoid busts) can be found in the updated research in Is my Old Oil Stock worth Anything?

_______________________

Recommended Reading: McKeesport – Images of America: Pennsylvania (2007); Western Pennsylvania’s Oil Heritage

(2007); Western Pennsylvania’s Oil Heritage (2008); The Extraction State, A History of Natural Gas in America (2021); Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(2008); The Extraction State, A History of Natural Gas in America (2021); Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Please become an AOGHS annual supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2024 Bruce A. Wells. All rights reserved.

Citation Information: Article Title: “McKeesport Gas Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/stocks/mckeesport-gas-company. Last Updated: August 23, 2024. Original Published Date: April 29, 2013.

by Bruce Wells | Aug 5, 2024 | Petroleum Companies, Petroleum History Almanac

Searching for petroleum wealth in risky Mid-Continent fields.

The Kansas petroleum industry began in 1892 with an oilfield at Neodesha. In 1915, an oilfield discovery at El Dorado near Wichita revealed the giant Mid-Continent field, but it took years for business sense to arrive, according to the editor of a 1910 History of Wichita and Sedgwick County, Kansas.

The new science of petroleum geology helped reveal the Mid-Continent’s giant El Dorado oilfield in 1915. Photo courtesy Kansas Oil Museum.

“Sedgwick county has run the gamut of the hot winds, the drought, the floods, the grasshoppers, the boom, the wild unreasoning era of speculation, the land grafters, the oil grafters, the sellers of bogus stocks, speculation, over-capitalization, and all of the attendant and kindred evils,” observed Editor-in-Chief Orsemus Bentley. (more…)

by Bruce Wells | Jul 3, 2024 | Petroleum Companies

Rise and quick fall of a small oil company.

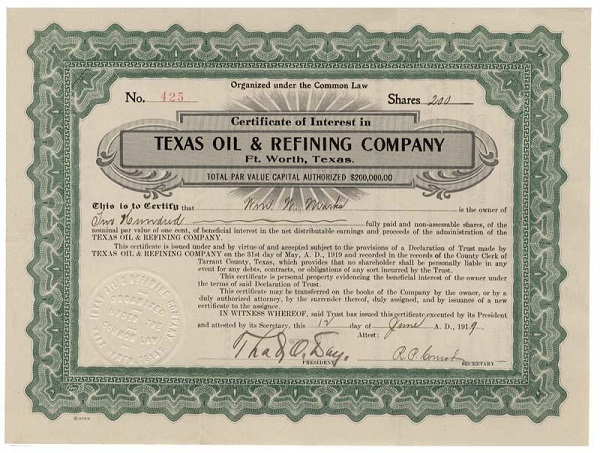

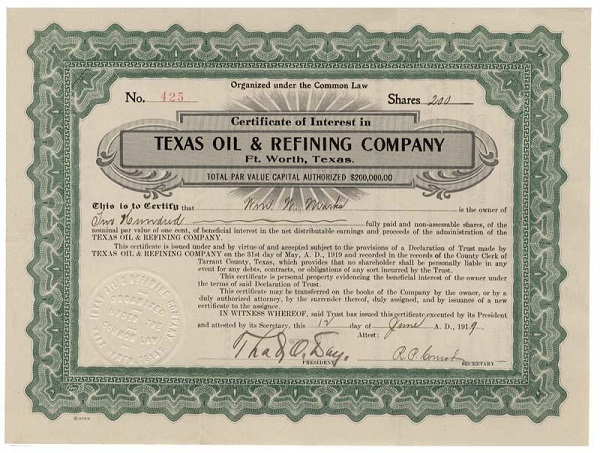

In October 1919, Texas Oil & Refining controlled leases in Comanche and Tillman counties of southern Oklahoma — an area of about 2,000 acres northwest of the Burkburnett oilfield (see Boom Town Burkburnett).

The Texas Oil & Refining Company (also called the Douglas-Texas Oil & Refining) was organized in Fort Worth in 1919. With capital of $200,000, it managed to acquire a small refinery in Port Arthur.

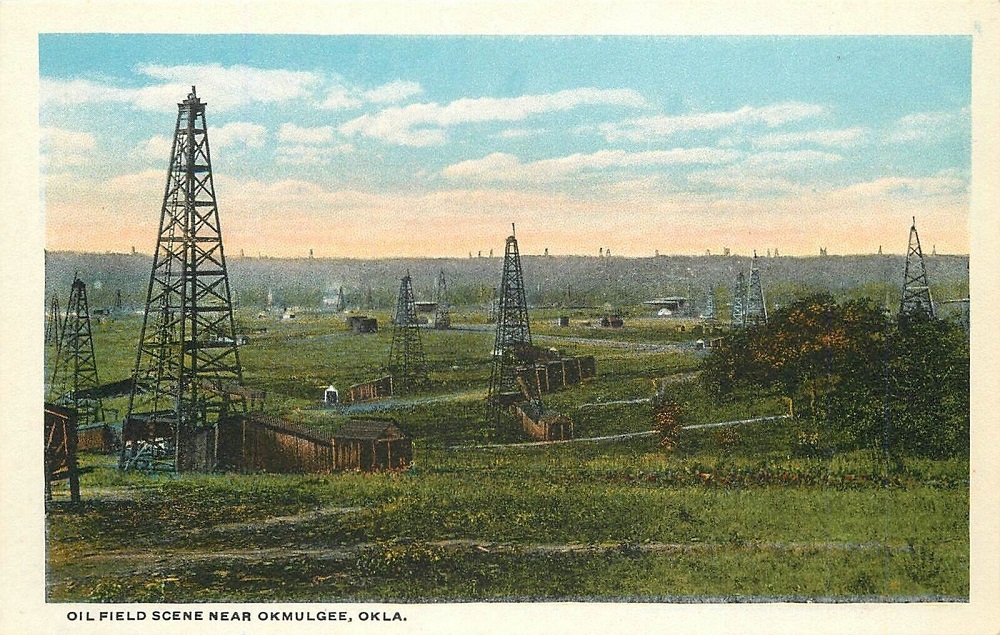

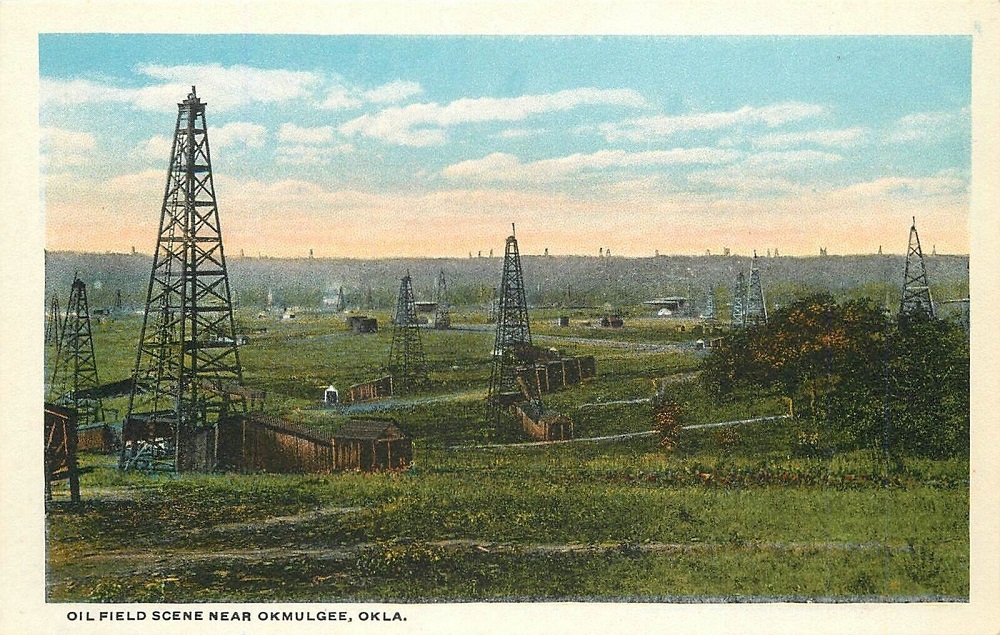

In Oklahoma, near where the Red Fork gusher and more recent oilfield discoveries made headlines, the company leased land south of Tulsa and drilled the No. 4 Henderson well near Okmulgee. The wildcat well as a 1,900-foot-deep “dry hole.”

About 35 miles north, the Glenn Pool oilfield (discovered in 1905 between Okmulgee and Tulsa) brought the first rush of exploration companies. An oilfield discovery closer to Okmulgee was drilled and completed in 1907, the same year of Oklahoma’s statehood.

The Texas Oil & Refining venture continued to explore for oil. By the end of 1919, the company had completed two shallow, producing oil wells on a 680-acre lease in the Beggs-Bixby oilfield at Okmulgee.

Exploring in South Texas in 1920, the company drilled a wildcat well in Gonzales County. The No. 1 Hassman well “spudded” a mile west of the town of Coast, but there is no other information.

Petroleum exploration and production proved beneficial for Okmulgee businesses, according to residents. The “back gold” wealth helped create the “Roaring 20s” throughout the state, which had been Indian Territory in 1897 when the first Oklahoma Oil well was drilled.

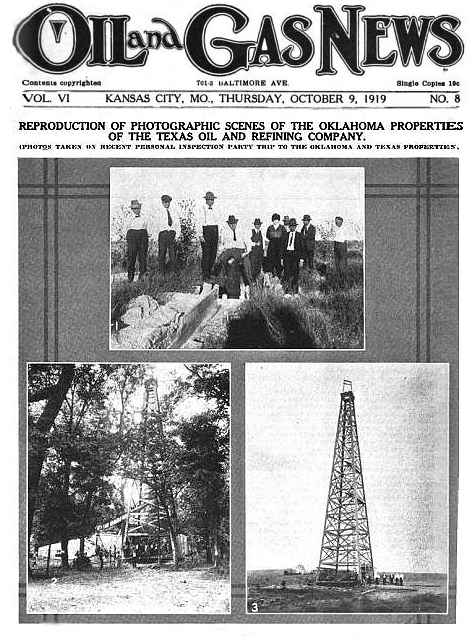

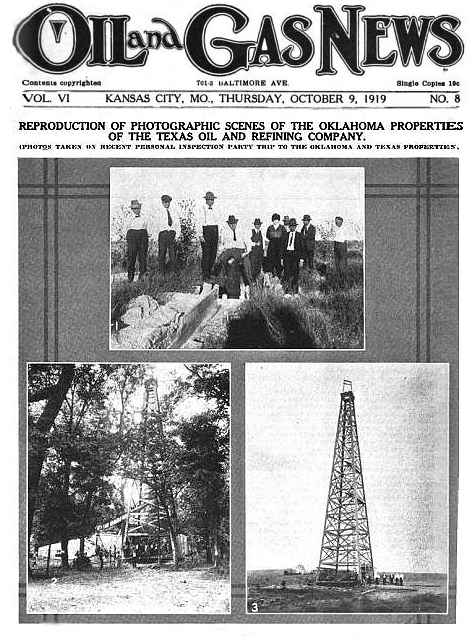

The October 9, 1919, issue of Oil & Gas News promoted the company’s efforts with photos and names of company sites, principals, and investors. The trade publication noted several dispersed activities and some apparent success, but then nothing else as the company faded away.

Texas Oil & Refining Company disappeared from financial records by 1921.

Especially in the 1920s and 1930s, bankruptcies were common among new, inexperienced exploration companies. Many in Oklahoma failed, despite drilling relatively shallow wells of about 1,500 feet deep, which considerably lowered drilling expenses (see more in the history of the Healdton field).

The high quality of the oil produced from these Oklahoma wells also made them attractive to investors. As production of the thick, sulfurous oil from the 1901 Spindletop field in Texas declined, this oil was “light and sweet” and easily refined into gasoline and kerosene, according to geologist Norman Hyne, PhD, at the University of Tulsa.

Learn more Oklahoma petroleum history in Making Tulsa the Oil Capital.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Please become an annual AOGHS supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2025 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Texas Oil & Refining Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/texas-oil-refining-company. Last Updated: March 20, 2025. Original Published Date: July 5, 2013.

(2000); Myth, Legend, Reality: Edwin Laurentine Drake and the Early Oil Industry

(2009). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.