by Bruce Wells | Jan 22, 2025 | Petroleum Companies

Rise and fall of a California oil exploration company.

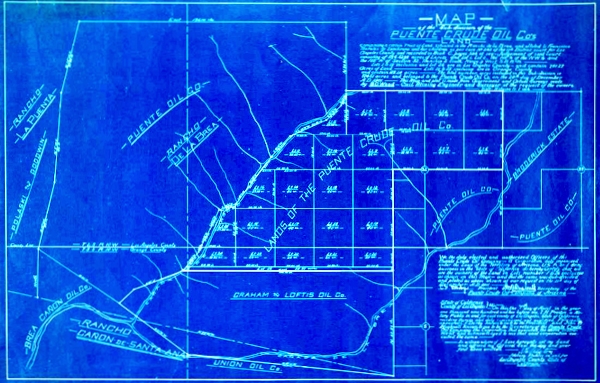

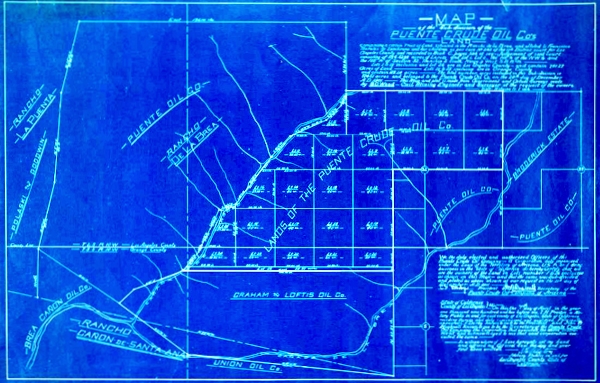

A new “black gold” rush in California took off in 1886 after William Rowland and partner William Lacy completed several producing oil wells at Rancho La Puente. Their company, Rowland & Lacy (later called the Puente Crude Oil Company), helped reveal the Puente oilfield.

The exploration venture — and a more successful one with a similar name, the Puente Oil Company — were among those seeking oil in southern California at the turn of the century. By 1912, many inexperienced companies had drilled more than 100 wells in the Fullerton area southeast of the Los Angeles field. Two expensive “dry holes” were completed by the Puente Crude Oil Company.

Puente Crude Oil Company was one of many small early 20th-century ventures hoping to find oil in southern California’s prolific oilfields at Brea Canyon and Fullerton.

Initially capitalized with $500,000, Puente Crude Oil offered stock to the public at 10 cents a share in 1900, but its two unsuccessful wells in the Puente field’s eastern extension brought the company to a quick financial crisis.

One well was lost to a “crooked hole” and the other found only traces of oil and natural gas as enthusiastic advertisements continued to solicit investment. Some ads referred to the widely known Sunset oilfield, discovered in 1892 in Kern County to the north.

By May 1901 company stock was offered at two cents per share to relieve indebtedness and enable further drilling on the company’s 870 acres in Rodeo Canyon. One year later, San Bernardino newspapers reported the company in trouble.

“This history of misadventure has not been pleasing to the stockholders of the Puente Crude Oil Company,” noted one article. “An auditing committee was appointed for the purpose of examining the books and accounts of the company,” it added.

Further reports in 1902 noted the company had issued no statements, “financial or otherwise,” for a year. Puente Crude Oil Company is absent from records thereafter.

South of Los Angeles, in Orange County, the Brea Museum and Heritage Center tells the story of the Olinda Oil Well No. 1 well of 1898 – one of many important California petroleum discoveries. Visit the Olinda Oil Museum and Trail at 4025 Santa Fe Road in Brea.

Much of Puente Oil’s former oil-producing land would later be managed by the Puente Hills Landfill Native Habitat Preservation Authority. In 2022, the Port of Los Angeles handled more than 220 million metric tons — 20 percent of all incoming cargo for the United States.

The stories of exploration and production (E&P) companies joining U.S. petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything?

_______________________

Recommended Reading: Los Angeles, California, Images of America (2001). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

(2001). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Please become an AOGHS annual supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2025 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Puente Crude Oil Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/puente-crude-oil-company. Last Updated: January 30, 2025. Original Published Date: July 2, 2013.

by Bruce Wells | Jan 14, 2025 | Petroleum Companies

Wildly optimistic promotions during WWI and some drilling, but no gushers.

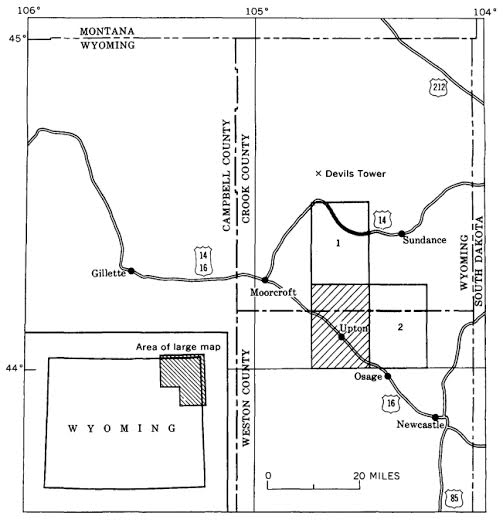

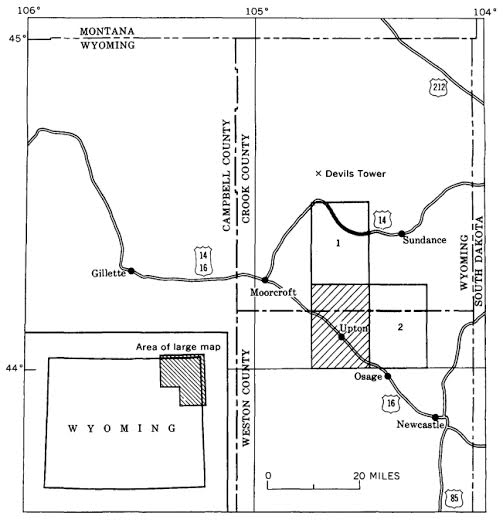

“Oil Excitement at Rocky Ford Field Near Sundance,” proclaimed a front page of the Moorcroft (Wyoming) Democrat on September 14, 1917, describing a “big drill” of the Wyoming-Dakota Company.

“Rocky Ford, the seat of the oil activities in Crook county is about the busiest place around,” the newspaper continued. “Cars come and go, people congregate and the steady churning of the two big rigs continues perpetually.”

Not finished with its excited reporting, the Moorcroft Democrat noted: “Excitement has reached the zenith of tension, and with each gush of the precious fluid, oil stock climbs another notch. The big drill of the Wyoming-Dakota Co. has been pulled from their deep hole until spring. The drill reached 600 feet and was in oil.”

The Rapid City, South Dakota, oil exploration company — reported to have one producing well and three more drilling — was capitalized $500,000 with a nominal par value of 25 cents per share. All the leases were in Crook County and included 3,200 acres in Lime Butte field; 10,000 acres in Rocky Ford field; and 4,000 acres in Poison Creek field.

Since Wyoming would not pass its first “Blue Sky” to prevent fraudulent promotions until 1919, Wyoming-Dakota Oil’s newspaper ads often rivaled patent medicine exaggerations. For example, one ad noted “geologists claim this showing indicates alone 500,000 barrels to the acre.”

Since Wyoming would not pass its first “Blue Sky” to prevent fraudulent promotions until 1919, Wyoming-Dakota Oil’s newspaper ads often rivaled patent medicine exaggerations. For example, one ad noted “geologists claim this showing indicates alone 500,000 barrels to the acre.”

Wyoming-Dakota Oil further enticed investors with, “Your Chance Has Come if you want to make money in Oil.” In Sioux Falls, South Dakota, the Sells Investment Company offered Wyoming-Dakota Oil Company stock reportedly after “a careful selection of conservative issues from among the thousand prospects, offering same to you before higher prices prevail or its present substantial position has been discounted by professional traders. A good clean cut speculation of this character may mean a fortune. Watch this company for sensational developments.”

The United States had entered World War I in April 1917; by November newspapers reported Francis Peabody, chairman of the Coal Committee of the Council of National Defense, was telling the U.S. Senate Public Lands Committee that the country was not producing enough oil to win the war.

“He said if nothing were done to develop new wells the reserve supply would he exhausted in twelve months and production would be 50,000,000 barrels less than requirements,” one newspaper noted. Wyoming-Dakota Oil Company executives took advantage of the opportunity.

“The (war) situation outlined leads us to suggest that you investigate Wyoming-Dakota Oil. ‘We are doing our bit’ by drilling night and day. Ours is an investment worth while. The allotment of Treasury stock at 25 cents is almost sold out and the Directors will advance the price of stock to 50 cents a share (100 per cent on your present investment) on December 15th, 1917.”

The Wyoming-Dakota Oil promotion continued: “By that time our newspaper announcement in the Eastern cities, pointing out the enormous acreage, present production and negotiations for additional valuable holdings will be made known to millions of seasoned investors in New York, Philadelphia, Chicago, Boston and Pittsburgh. We feel confident this will result in a demand for this stock that will send the present market price skyward. We trust you will see the wisdom of prompt action before all available stock at 25 cents per share has been purchased by other investors.”

In early 1918, Wyoming-Dakota Oil Company had drilled wells in the Upton-Thornton oilfield and was “holding out high hope of bringing in a gusher in few days.” In July, the Laramie Daily Boomerang reported the company had “two rigs going steadily in Crook County’s Rocky Ford field” — but no oil gushers

Growing investor pessimism was reflected in Wyoming-Dakota Oil Company’s stock prices, which fell in over-the-counter markets from 75 cents bid in June 1919 to 50 cents bid at the end of September. By March 1920, brokers offered 5,000 shares or any part thereof at 5 cents a share.

A final blow to the company was reported in the Laramie Republican of July 25, 1921: “Wyoming-Dakota…has completed pulling the casing from the well which it has been drilling north of town, after having struck a formation said to be granite, at a depth of 715 feet,”

The Laramie newspaper remained optimistic. “While this has a tendency to retard the activities of other interests, it is by no means stopping them entirely and it is to be hoped that another well will be started this summer.”

That did not happen. Reports on Wyoming-Dakota Oil Company disappeared for the next 24 years, until a court summons was published in the January 25, 1945, Sundance (Wyoming) Times. The summons said Wyoming-Dakota Oil — address or place of residence to plaintiff unknown — was being sued in the Sixth District Court of Wyoming.

The world war-inspired oil exploration company has since faded into history, and its stock certificates are valued only by scripophily collectors. For the true story behind a Texas oilfield that played a vital role in the “War to End All Wars,” see Roaring Ranger wins WWI.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Please become an AOGHS annual supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2025 Bruce A. Wells.

Citation Information: Article Title – “Wyoming-Dakota Company” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL https://aoghs.org/old-oil-stocks/wyoming-dakota-oil-company. Last Updated: March 31, 2025. Original Published Date: January 14, 2016.

by Bruce Wells | Jan 2, 2025 | Petroleum Companies

Three petroleum exploration companies risked everything on one well in their gamble to to find an Oregon oilfield.

The lure of petroleum wealth invited speculators practically since the first U.S. oil well of 1859 in Pennsylvania. Exploratory wells especially have remained a high-risk investment since almost nine out of ten of these “wildcat” wells fail to produce commercial amounts of oil.

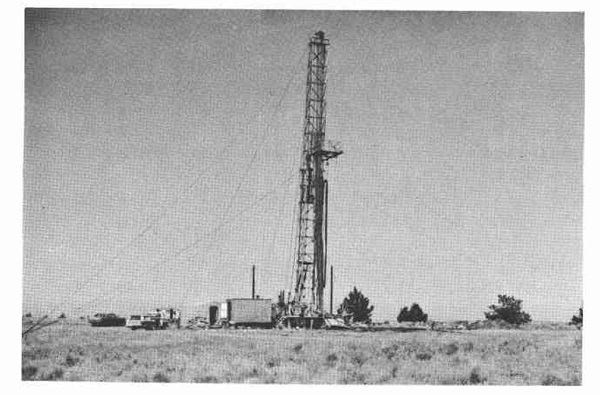

The Morrow No. 1 well, an ill-fated wildcat well first drilled in 1952 in Jefferson County, Oregon. Photo courtesy Oregon Department of Geology and Mineral Industries, “The Ore Bin,” Vol. 32, No.1, January 1970.

With under-capitalized operations turning to public sales of stock to raise money, many small ventures have been forced to bet everything on drilling a first successful well to have a chance at a second. Drilling a producing well can bring some wealth, but a “dry hole” brings bankruptcy.

And so it was in the 1950s on a remote hillside in Jefferson County, Oregon, where three companies searched for riches from the same well.

Northwestern Oils Inc.

The first of these three Oregon wildcatters, Northwestern Oils, incorporated in 1951 with $1 million capitalization in order to “carry on business of mining and drilling for oil.”

With offices in Reno, Nevada, in early 1952 Northwestern Oils began drilling a test well about eight miles southeast of Madras, Oregon. Using a cable-tool drilling rig (see Making Hole – Drilling Technology), drillers reached a depth of 3,300 feet on the Baycreek anticline before work was suspended because of “lost circulation troubles.”

Circulation troubles continued with the Morrow No. 1 well – also known as the Morrow Ranch well – in Jefferson County (Section 18, Township 12 South, range 15 East). By March 1956, with no money and no additional drilling possible, Northwestern Oils’ assets were “seized for non-payment of delinquent internal revenue taxes due from the corporation” and auctioned off at the Jefferson County courthouse.

Central Oils Inc.

Central Oils (Seattle) also was formed in 1956. With plans to join the other rare Oregon wildcatters, the company registered with the Security and Exchange Commission on July 30, 1958. It sought to sell one million shares of stock to the public at 10 cents a share. Proceeds would finance leasing and drilling, just like Northwestern Oils.

Central Oils received a permit to deepen Northwestern Oils’ old Morrow Ranch well in 1966 and planned to continue drilling with a cable-tool rig. Nothing happened.

“Commencement of this venture has been delayed until the spring of 1967,” one newspaper reported. But Central Oils had run afoul of the SEC. Oregon regulators recorded the well abandoned as of September 12, 1967, and Central Oils “out of business; no assets.”

Robert F. Harrison

In May 1968, Robert F. Harrison and his associates took over the same well — this time with plans to deepen it to more than 5,000 feet. But two years later the drilling effort was still stuck at a depth of 3,300 feet. Desperate, Harrison tried to clear the borehole by applying technologies for Fishing in Petroleum Wells.

On February 2, 1971, an intra-office report noted that R.F. Harrison “will abandon as soon as weather permits,” never having exceeded the original Northwestern Oils total depth of 3,300 feet. It would be a dry hole.

Harrison finally plugged and abandoned the Morrow No. 1 well as of October 12, 1971. Oregon’s Department of Geology and Mineral Industries has identified the stubborn nonproducer as well number 36-031-00003. There has never been a successful oil well drilled in Oregon.

America’s first dry hole was drilled in 1859 by John Grandin of Pennsylvania – near and just a few days after the first commercial discovery. In 2014, U.S. oil wells produced more than 8.7 million barrels of oil every day, according to the Energy Information Administration.

The stories of many exploration companies trying to join petroleum booms (and avoid busts) can be found in an updated series of research in Is my Old Oil Stock worth Anything?

______________________

Recommended Reading: Oil on the Brain: Petroleum’s Long, Strange Trip to Your Tank (2008);The Greatest Gamblers: The Epic of American Oil Exploration

(2008);The Greatest Gamblers: The Epic of American Oil Exploration (1979).

(1979).

Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Become an annual AOGHS supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2025 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Oregon Wildcatters.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/oregon-wildcatters. Last Updated: February 26, 2025. Original Published Date: January 29, 2016.

by Bruce Wells | Dec 10, 2024 | Petroleum Companies

He was a controversial North Pole visitor whose fraudulent claims were part of failed oil company ventures, a mail fraud conviction, and jail time.

Arctic explorer Dr. Frederick Albert Cook in 1908 made the widely accepted claim to have reached the North Pole after an arduous journey. He became a celebrity after accounts of his feat appeared in newspapers. Cook’s near approach to the pole would be erased in less than a year when Admiral Robert E. Peary made a scientifically documented journey to achieve the milestone.

In 1909, a special commission at the University of Copenhagen investigated Cook’s conclusion that he had reached the pole before Peary. After examining Cook’s records, the commission on December 21, 1909, found no evidence Cook had reached the pole. The U.S. Congress formally recognized Peary’s claim in 1911.

Cook would spend years defending his claim, despite the lack of navigation evidence. Then he got into the oil business.

(more…)

by Bruce Wells | Dec 1, 2024 | Petroleum Companies

The gas that would not burn — and the professor who in 1905 extracted helium from a natural gas well.

Drilling for natural gas in May 1903, an exploratory well drilled by Gas, Oil and Developing Company found natural gas beneath William Greenwell’s farm near Dexter, Kansas. The discovery came as the company drilled into a geologic formation that produced “a howling gasser” that would not burn.

(more…)

by Bruce Wells | Nov 10, 2024 | Petroleum Companies

New York, Manhattan, Metropolitan, Municipal, Knickerbocker and Harlem gas companies merged in 1884.

The history of Con Edison includes stories of work crews from New York City’s many competing gas companies digging up lines of rivals — and literally battling for customers, giving rise to the term “gas house gangs.” (more…)

(2001). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.