Standard Oil curbed the excitement of unruly speculators trading oil and pipeline certificates.

In a sign of the growing power of John D. Rockefeller at the end of the 19th century, Standard Oil Company brought a decisive end to Pennsylvania’s highly speculative — and often confusing — trading markets at oil exchanges.

On January 23, 1895, the Standard Oil Company’s purchasing agency in Oil City, Pennsylvania, notified independent oil producers it would only buy their oil at a price “as high as the markets of the world will justify” and not necessarily “the price bid on the oil exchange for certificate oil.” The action would bring an end to the “paper oil” markets of brokers and buyers.

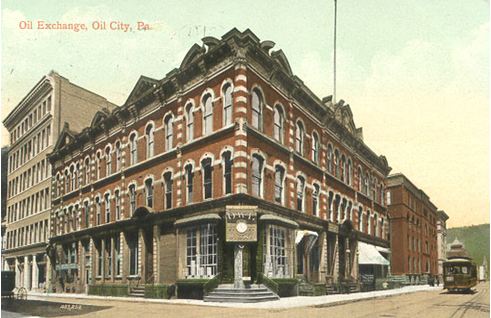

The Oil City, Pennsylvania, Oil Exchange in 1877 was the third largest financial exchange of any kind in America, behind New York and San Francisco.

Before the 1870s, oil buyers took on-site delivery in wooden barrels they provided. A rapidly growing pipeline infrastructure spawned “oil certificates” or “pipeline certificates.” These negotiable new instruments were based on the number of barrels in a pipeline issued for delivery in kind.

Since the certificates could be bought and sold, trading flourished in oil exchanges at Titusville, Petroleum Center, and Oil City. The oil region’s independent producers had met in 1866 and agreed upon how many gallons would constitute a standard barrel (learn more in History of the 42-Gallon Oil Barrel).

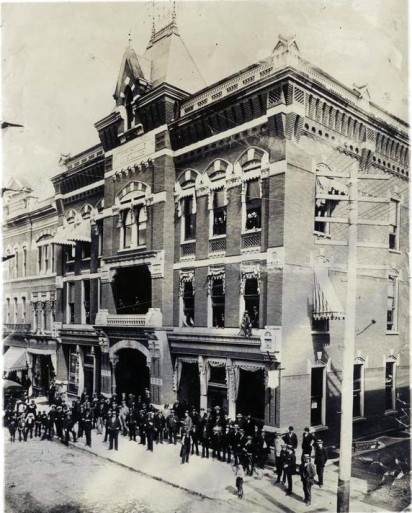

Prior to the Titusville Oil Exchange (above), established in 1871, producers gathered in any convenient place, such as a Titusville hotel or along Centre Street in nearby Oil City — known as the “Curbside Exchange.”

“The necessity of a suitable place in which to trade oil certificates was one that followed the improved method of transportation, and was in fact apparent from the early stages of oil commerce,” explained an Oil City Derrick souvenir book published in 1896.

During these early days of an industry seeking oil to refine into kerosene, paper certificates could represent as many as 40 million barrels of oil. But with Standard Oil buying 90 percent of production and setting its own price independent of oil certificates, the company’s edict effectively ended oil exchanges.

Marginalized by the Standard Oil pricing strategy, the independent exchanges closed one by one. The petroleum industry’s oldest exchange, established in 1871 in Titusville, dissolved in 1897.

“During the later years the excitement of speculation has been greatly eliminated from the oil business, and this has so reduced the business as to make it a shadow of its former greatness,” the Oil City Derrick concluded in 1896 about the Oil City exchange.

“Its members are scattered far and wide, but the glory of the days when fortunes were made and lost in hours and minutes, will ever be a memory with them and thousands of others,” the publication added. Learn more about the role of pipelines, oil exchanges and certificate speculators in Scouts — Oil Patch Detectives.

_______________________

Recommended Reading: Early Days of Oil: A Pictorial History of the Beginnings of the Industry in Pennsylvania (2000); Myth, Legend, Reality: Edwin Laurentine Drake and the Early Oil Industry

(2009); The Oil Scouts: Reminiscences of the Night Riders of the Hemlocks Hardcover

(1986). Your Amazon purchase benefits the American Oil & Gas Historical Society. As an Amazon Associate, AOGHS earns a commission from qualifying purchases.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Please become an AOGHS annual supporter and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2025 Bruce A. Wells.

Citation Information – Article Title: “End of Oil Exchanges.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/oil-almanac/end-of-oil-exchange. Last Updated: January 16, 2026. Original Published Date: November 9, 2015.