With World War I raging in Europe (America still on the sidelines), a series of discoveries in North Texas and Oklahoma brought oil fever to the East Coast. Despite allegations of fraud and ongoing litigation, an insurance company president took advantage of excited (if unwary) oil patch investors.

Organized in 1911, “to eliminate the irresponsible brokers and valueless stocks from the outside market,” the New York Curb did not move indoors until 1921 – and later became the American Stock Exchange.

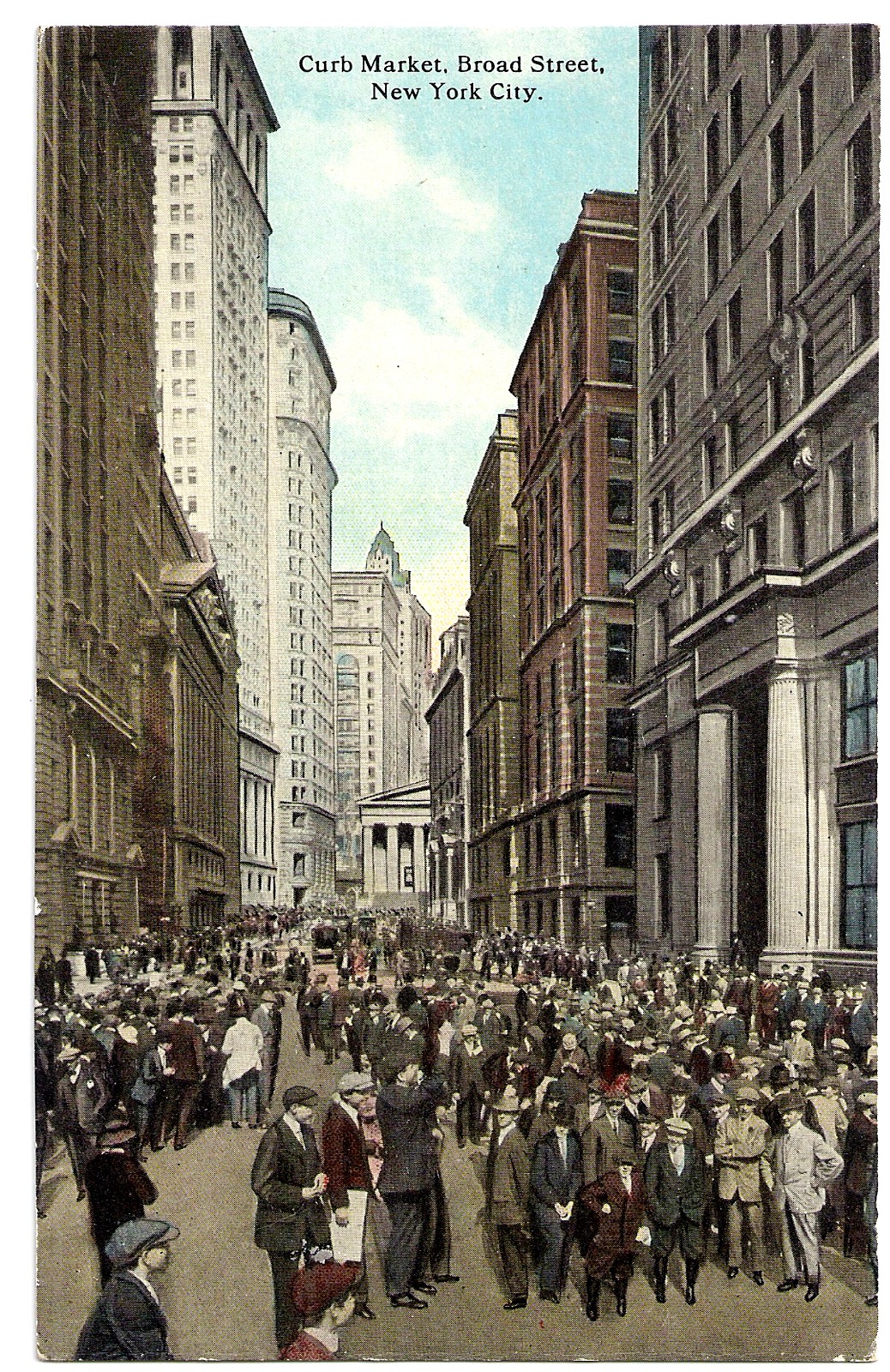

In New York City, “curbstone brokers” at Broad Street and Exchange Place attracted investors to newly formed petroleum exploration and production companies.

This was the New York Curb market, outdoor home to young and aggressive traders offering speculative investments, unlisted stocks, and securities just down the street from the prestigious New York Stock Exchange.

The New York Evening Post described the traders as “a motley, agitated mass of struggling, yelling, finger-wriggling humanity.”

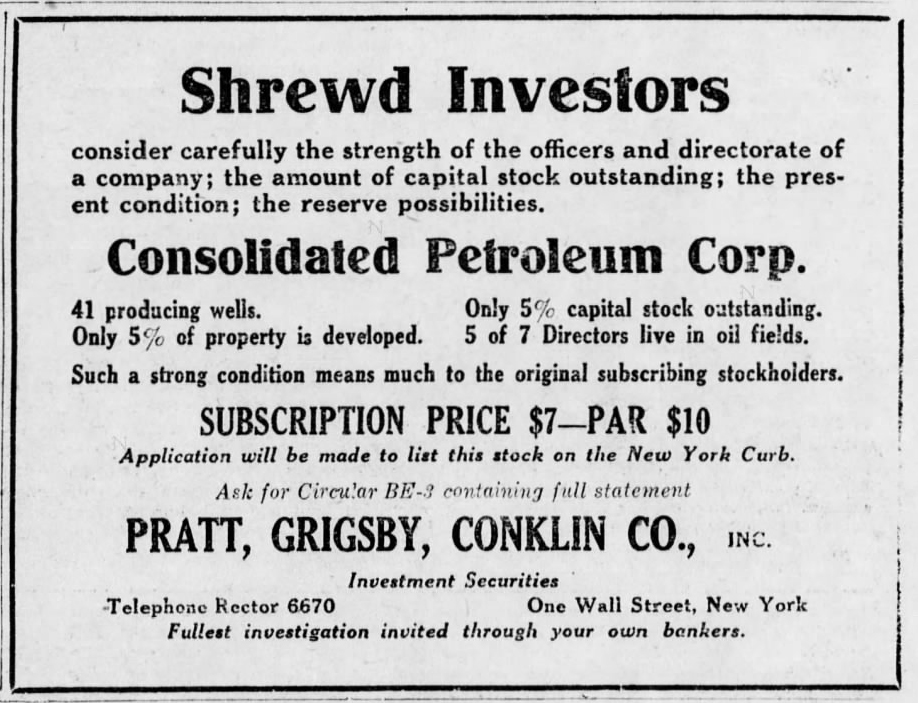

The New York Curb was organized in 1911, “to eliminate the irresponsible brokers and valueless stocks from the outside market.” Consolidated Petroleum Company incorporated in Delaware on April 5, 1916, capitalized at $7 million and began pursuing investors’ money with vigor.

World War I had been underway in Europe for two years and oil prices had risen from 64 cents per barrel in 1915 to $1.10 per barrel in 1916. Consolidated Petroleum was organized to exploit this growing demand for oil.

Shady Insurance Company President

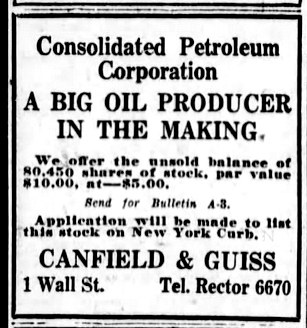

The company’s reported goal was to profit by consolidating, developing and operating proven oil properties in Louisiana, Oklahoma, Texas, and Mexico. This was not risky wildcat exploration for new oilfields, according to its president.

The company president, Charles R. Porter, was the former president of State Mutual Life Insurance Company of Rome, Georgia. Before that he had been president of Rome Industrial Insurance Company. Before that he had been president of Rome Insurance Company.

Charles Porter, once president of three separate insurance companies, founded Consolidated Petroleum Company in 1916 while fighting fraud allegations in court.

Newspaper advertisements promoted the oil company’s potential to potential investors in Atlanta, Georgia, and Concord, North Carolina.

All of Porter’s insurance companies were beset by fraud allegations followed by bankruptcy, receivership and lawsuits. Porter was still in court when he founded his petroleum company, which he soon described as “a big oil producer in the making.”

However, within a year of its formation, Consolidated Petroleum was hauled into a San Antonio, Texas, court. Despite the litigation, the July 1916 Fuel Oil Journal included an announcement by Consolidated Petroleum averring that stock “will be listed and actively traded in on the New York Curb.”

Although Consolidated never appeared within the Fuel Oil Journal ‘s pages again, promotions appeared in newspapers from Atlanta to Concord, North Carolina. The former insurance company executive painted a bright future for his new company.

In August 1916, a Concord Times newspaper article enthused:

Southern Capitalists Interested in Consolidated Petroleum Corporation – With a calculation based on the fact that forty wells now producing occupy a space of 400 acres (and) the corporation has reserve acreage of 5,659 acres upon which it will have room for five hundred wells. This reserve acreage is located in the most productive sections of the Louisiana oil-fields. Drilling is now being carried on, and the announcement of new production is expected in the near future.

Consolidated Petroleum, like many companies of the time, was less than candid about its financial potential. In 1916, extravagant and unsubstantiated stock promotions were as common as patent medicine advertisements.

It would be five years before New York passed its first “Blue Sky” law, the Martin Act, targeting those “engaging in any practice or transaction or course of business relating to the purchase, exchange, investment advice, or sale of securities or commodities which is fraudulent, or in violation of law, or would operate as a fraud on the purchaser.”

Consolidated Petroleum Company was last seen in a January 29, 1917, article in the Washington Herald where shares were offered for $7 dollars each. The article noted that “application has been made to list on the New York Curb.”

Neither Charles Porter’s oil company nor the New York Curb market survived. The “curbstone brokers” became the American Stock Exchange in 1953. Consolidated Petroleum became part of oil patch history.

The “curbstone brokers” and the New York Curb in 1953 became the American Stock Exchange, which was acquired by the New York Stock Exchange in 2008.

Please support the American Oil & Gas Historical Society and this website with a donation.