Although William S. Pratt entered the oil exploration business in Wyoming in 1915, he soon moved to Kansas and organized the Wichita Eagle Oil Company. It and many newly formed “wildcatting” companies would not succeed in risky Mid-Continent drilling and production (see Otter Creek Oil & Gas, formed by Wichita businessmen and the Cahege Oil & Gas Company, at Caney, where a Kansas gas well fire had made headlines.

A major oilfield discovery in North Texas — “Roaring Ranger” — in 1917 also attracted national attention. Pratt launched his Texas United Oil Company there in July 1919. By the last quarter of 1919, the Texas comptroller’s office reported Pratt’s company had produced more than 31,000 barrels of oil.

Promoting Texas United Oil

Texas United Oil Company solicited investment capital with a series of ads placed in newspapers nationwide, including in Spokane, Washington; El Paso, Texas; Troy, Syracuse, and Plattsburgh, New York; and Washington D.C.

From December 1919 through 1920, company marketing efforts promised: For Quick Returns and Unlimited Profits Invest With the Texas United Oil Company…27 Wells Showing Initial Production of 8,700 Bbls. Daily.

But at least one investment magazine described the company as unlikely to prosper, and the assessment proved to be accurate.

By December 1920, Texas United Oil Company entered into receivership and did not emerge until April 27, 1921, reorganized and with a new president, Aldred S. Wright of Philadelphia.

Despite the reorganization, the company did not survive long. United States Investor reported in 1922 that Texas United Oil Company had very little value.

“It is of course not listed on any of the principal exchanges,” the magazine noted, adding that no dividends had been issued since 1920. “The company had about $1,300,000 stock outstanding and there was one public offering by people in Hartford, Connecticut, at $2 per share. Two cents per share is approximately the price now.”

“A Sure and Safe Investment ”

October 1, 1919 – The Texas United Oil Company of Dallas produces 31,541 barrels of oil valued at $10,789 between October 1 and December 31, 1919, according to the Texas comptroller.

December 21, 1919 – In one of its first newspaper appearances, President W. S. Pratt describes the company’s leases and production success in the Northwest Extension of the Burkburnett oilfield.

Pratt announces that the company’s trustees have resolved to increase capital to $5 million and he encourages potential investors to purchase stock at $2 per share to enable “development of our many properties and the purchase of additional production.” — ad in Spokesman-Review, Spokane, Washington

January 3, 1920 – The company is promoted in an open letter advertisement sent from Electra, Texas, “to our stockholders and others” from J. R. Lucore, shareowner, of Olean, New York. Lucore reports very positive on-scene observations of drilling and production in progress. His endorsement follows:

“The Texas United is a sure and safe investment for anyone to buy stock in. No one need be in the least afraid to invest as large as one see fit and his investment will be the safest and surest of any company operating in the State…I expect to arrive home in a few days and will enlarge my stock order to you in the Texas United Oil Company on my arrival.” — ad in Gloversville, N.Y., Morning Herald

January 31, 1920 – The company is reported as formed by a Declaration of Trust filed on July 2, 1919, with trustees L. W. Harrington, Herbert Bingham, H. C. Ralph and J. M. Davis. It receives a poor recommendation:

January 31, 1920 – The company is reported as formed by a Declaration of Trust filed on July 2, 1919, with trustees L. W. Harrington, Herbert Bingham, H. C. Ralph and J. M. Davis. It receives a poor recommendation:

“Our information as to the management is that it is not as economical as it might be, and that operating costs are likely to be altogether too high because of rather poor judgment in planning the work.” — article in United States Investor

“The King of the Oil Companies”

February 21, 1920 – The Texas United Oil Company of 1209 Half Main Street, Dallas, Texas, asserts that the United States Investor’s bad recommendation refers to another company of the same name whose headquarters is in Wichita and not Dallas. The company protests that “conclusions relative to the Wichita enterprise cannot fairly be applied.” Investigation planned. — article in United States Investor

February 25, 1920 – The company proclaims itself as “The King of the Oil Companies” and promises 30 percent dividends and $5 million in capital stock with 12 producing wells. — ad in Spokesman Review, Spokane, Washington

March 13, 1920 – Company promotion continues, citing “12 producing oil wells – over 3,000 barrels daily” and “30 percent dividends have been paid in 7 months” Shares are offered at $2. Agent is J. S. Miramon, Rensselaer Hotel, Troy “Salesmen wanted: Liberal commission. Phone for appointment.” — ad in Troy (N. Y.) Times

April 17, 1920 – J. S. Miramon, now of Barows Company, 141 Broadway, New York City, advertises “Wise Investors, Increase your income” with company’s “2 percent monthly dividends, with record of 39 percent in dividends past nine months.” — ad in El Paso (Texas) Herald

April 10, 1920 – Analysts confirm poor recommendation after consulting with the company, the New York City based owners of the company. “We cannot do otherwise than classify this as the ordinary type of oil gamble, a quite unproven enterprise, depending for its future upon the skill with which it is managed. — article in United States Investor

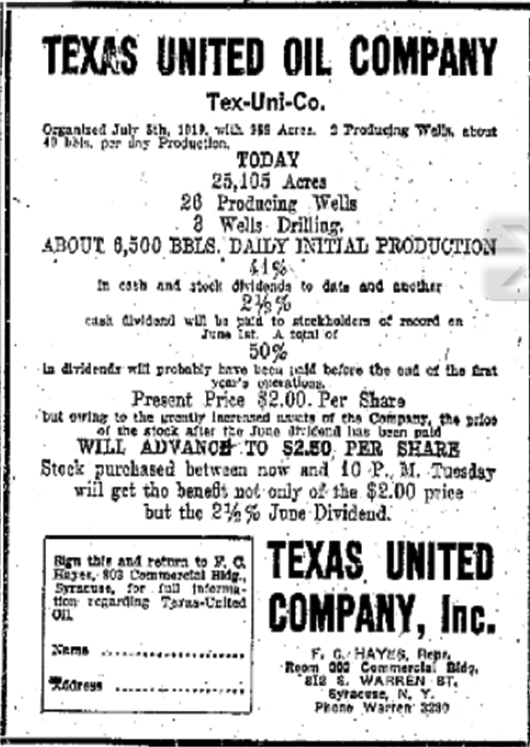

May 15, 1920 – Tex-Uni-Co. (trademark for Texas United Oil Company) advertises 18 producing wells, two ready to come in per April 30 telegram testimonial by Ralph P Reed, president National Investors Protective Corporation.

“These dividends will make a total of 43 ½ percent in cash and stock dividends paid in less than one year.” A. E. Roberts and Co., Washington, D.C. — ad in The Federal Employee, Washington D.C.

May 30, 1920 – The company promotes its self (Tex-Uni-Co.) as having rapidly grown from its origins in July, 1919 with 389 acres and two 2 producing wells, yielding about 42 barrels a day of production grown until. — ad in Syracuse Herald, Syracuse, New York.-

“Quick Returns and Unlimited Profits”

Jun 2, 1920 – “For Quick Returns and Unlimited Profits Invest With The Texas United Oil Company” upstate New York advertisement proclaims “27 Wells Showing Initial Production of 8,700 BBls. Daily.” — ad in Daily Republican, Plattsburgh, New York

December 1920 – Company enters into receivership.

February 25, 1921 – Advertising continues for twelve producing wells 30 percent dividends.” — ad in Spokesman-Review, Spokane, Washington

April 16, 1921 – Value of the company plummets as it is reported to have “been the subject of much litigation of late…Texas United shares have declined to around five cents since their first appearance upon the market at $2 per share.” — article in United States Investor

April 27, 1921 – The company emerges from receivership reorganized and with a new president, Aldred S. Wright of Philadelphia.

November 11, 1922 – The company “is of little value …two cents per share is approximately the price now.” — article in United States Investor

More history ablur U.S. petroleum exploration and production companies joining petroleum booms (and avoiding busts) can be found in Is my Old Oil Stock worth Anything?

Among trusted financial publications — and available at many libraries — is the Directory of Active Stocks and Obsolete Securities published by Financial Information, Inc., Jersey City, New Jersey.

_______________________

The American Oil & Gas Historical Society (AOGHS) preserves U.S. petroleum history. Become an AOGHS annual supporting member and help maintain this energy education website and expand historical research. For more information, contact bawells@aoghs.org. Copyright © 2023 Bruce A. Wells. All rights reserved.

Citation Information – Article Title: “Texas United Oil Company.” Authors: B.A. Wells and K.L. Wells. Website Name: American Oil & Gas Historical Society. URL: https://aoghs.org/old-oil-stocks/texas-united-oil-company. Last Updated: October 1, 2023. Original Published Date: January 5, 2013.