Delhi Oil Company

Oil from the giant El Dorado oilfield was often featured in petroleum industry news as America prepared to enter World War I in April 1917. The mid-continent field, discovered two years earlier east of Wichita, had made headlines and launched a Kansas oil boom.

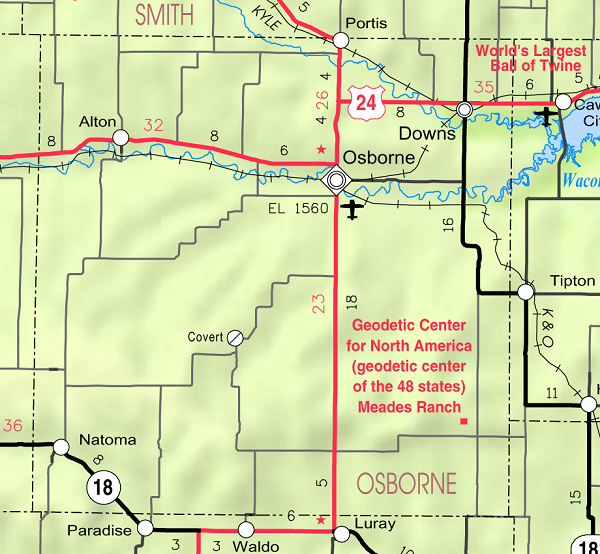

More than 200 miles to the northwest, the Delhi Oil Company would soon bet its fortunes on a wildcat oil well in Osborne County – and lose. In a chronology not unlike many small, community-based oil speculations, Delhi Oil began by seeking investors to fund its exploratory drilling.

The venture was started by Isaac M. Mahin, a state senator, and F.W. Mahin, both lawyers who owned the North Kansas Land & Loan Company in Smith Center. In November 1917, the Topeka Daily Capital reported the two men and other businessmen had “proposed to enter the oil hunting industry” by incorporating the Delhi Oil Company “with a capital stock of $60,000, all of which will be expended in drilling.”

Delhi Oil secured leases in Smith and Osborne counties and by March 1918 had contracted for an 84-foot drilling rig. The company advertised in earnest for potential investors. “This is good news for the people of this county as it marks the beginning of actual oil development in Osborne County,” proclaimed one editorial ad in the Salina Evening Journal.

The newspaper also noted, “the Delhi Oil company which is composed of local men with headquarters in Osborne seeking to develop the resources of Osborne County, should have the support of every businessman and land owner in this community.”

The newspaper also noted, “the Delhi Oil company which is composed of local men with headquarters in Osborne seeking to develop the resources of Osborne County, should have the support of every businessman and land owner in this community.”

Although the first Delhi Oil well had yet to be spudded by early 1919, efforts to secure funds and investors continued. “Salina stands to benefit greatly by the development of the field,” stated one promotion. “Should gas be found, Salina’s fuel bill would be cut in half. Should a good oil field develop, Salina will become a refining and distributing center. And further, you have the assurance that every dollar you invest in this venture will be used in development, and also that your interest applies to the entire 5,320 acres.”

The newspaper’s praise continued: “This is to certify that we have thoroughly investigated the organization and plans of the Delhi Oil Company, are interested in their success and believe their stock to be a good, clean investment, one well worth your careful consideration.”

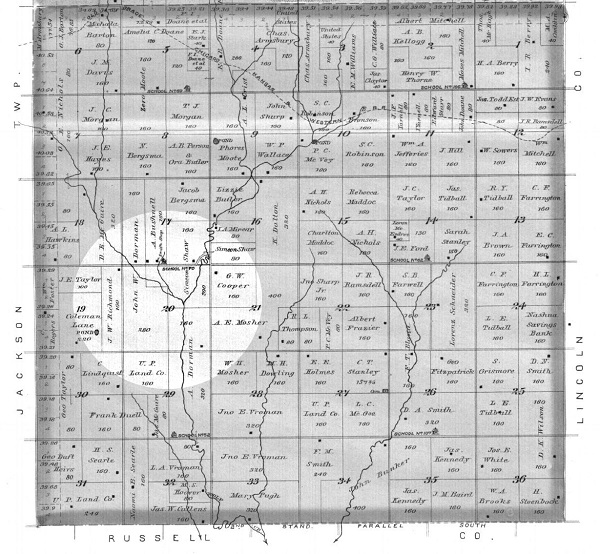

Sufficient working capital was finally secured and by May 1919, Delhi Oil’s wildcat rig was erected in Osborne County on the Dorman lease (Section 20 of Township 10 South, Range 11 West). It took eight months of drilling for the Dorman No. 1 well to reach 1,510 feet, ostensibly having seen a “show of oil” at just 500. Enthusiastic testimonials appeared in January 1921 newspapers:

“This news, together with the rumors that the company nine miles east of the Delhi lease is building oil tanks, has caused no little excitement among the people who are interested in the projects. There are real indications that a big field is about to be opened and the men who have their money invested are beginning to take heart over the outlook.”

“At this time they are drilling at a little more than 2,000 feet, in limestone,” reported the Western Kansas World in WaKeeney. “Delhi oil prospects are getting brighter and brighter each day. Sunday a large number of stock holders and others interested in the well were out watching the drill go down.”

Echoing a popular theme, the newspaper said the well “may mean untold wealth to Osborne County,” and on June 30, 1921, noted “the Delhi Oil Co. well near Luray is down 2,800 feet and it is said you can smell gas when you get near it.” But within four months, drilling at the Dorman No. 1 well was shut down at 2,930 feet. Securing working capital from investors remained a problem.

On April 13, 1922, the Salina Evening Journal reported Delhi Oil was “organizing in every town and township in Osborne county in an attempt to raise the necessary funds to complete the well on their leases. It is estimated that $20,000 will be needed to complete the project and one-half of that amount has already been raised, so that the big drive will have for its object the raising of the final $10,000.”

The newspaper added that “the money must be raised in the next two weeks, and if it is not forthcoming the well will be abandoned, as the company can no longer finance the drilling, although within 300 feet of what is believed to be a paying pool of oil.” Four days later the paper announced, “The Delhi Oil Company is making a county-wide drive in an endeavor to raise funds to complete their project within the next ten days.”

Somehow, Delhi Oil was able to drill its Dorman No. 1 well deeper, adding another 320 feet to a total depth (TD) of 3,250 feet, according to World Oil, Volume 33, 1924, or another 548 feet to a TD of 3,478 feet, according to the Kansas Geological Survey. At either depth, the hole was dry and shareholders lost their investment. Kansas Corporate Commission records show that Delhi Oil forfeited its charter to do business for failure to file required annual reports.

Somehow, Delhi Oil was able to drill its Dorman No. 1 well deeper, adding another 320 feet to a total depth (TD) of 3,250 feet, according to World Oil, Volume 33, 1924, or another 548 feet to a TD of 3,478 feet, according to the Kansas Geological Survey. At either depth, the hole was dry and shareholders lost their investment. Kansas Corporate Commission records show that Delhi Oil forfeited its charter to do business for failure to file required annual reports.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoid busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

___________________________________________________________________________________