Middle States Oil Corporation

Charles Nathaniel Haskell, Oklahoma’s first governor, struggled in the oil and gas business.

Already a successful lawyer, railroad promoter, and politician, Charles Haskell ventured into the Indian Territory in 1901 looking for business opportunities. He advocated statehood and when it came in 1907, Haskell became Oklahoma’s first governor. He is remembered by some as a progressive Democrat who introduced child labor statutes and graduated income tax; by others as a supporter of Jim Crow laws who took bribes from Standard Oil Company.

Already a successful lawyer, railroad promoter, and politician, Charles Haskell ventured into the Indian Territory in 1901 looking for business opportunities. He advocated statehood and when it came in 1907, Haskell became Oklahoma’s first governor. He is remembered by some as a progressive Democrat who introduced child labor statutes and graduated income tax; by others as a supporter of Jim Crow laws who took bribes from Standard Oil Company.

In 1911, after leaving the governor’s office in Oklahoma City – had moved the capitol from Guthrie one night in 1910 – Haskell went to work for Harry F. Sinclair “investigating and negotiating for properties in the oil fields of the state.” Five years later, Sinclair incorporated Sinclair Oil & Refining Company (also see Dinosaur Fever – Sinclair’s Icon).

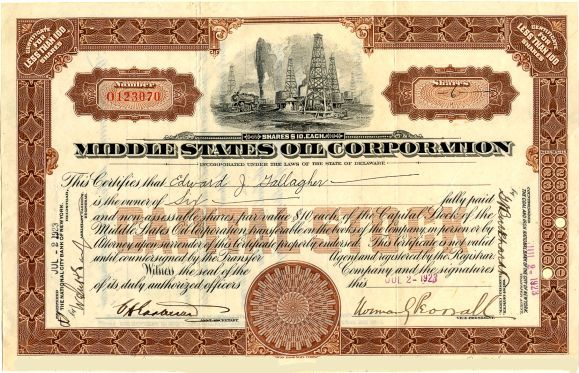

A year later in 1917, Haskell incorporated Middle States Oil Corporation as a Delaware holding company. Meanwhile, the growing number of giant discoveries in Osage oilfields attracted Sinclair and other future oil barons to lease auctions beneath what became known as the Million Dollar Elm.

With Haskell chairman of the board, Middle States Oil initially authorized 1.6 million shares (par $10) to capitalize at $16 million. In November of 1919, he assumed the same role for the Dominion Oil Company, “already operating in Oklahoma, Kansas, Indiana and Texas fields, in all of which it has producing properties.”

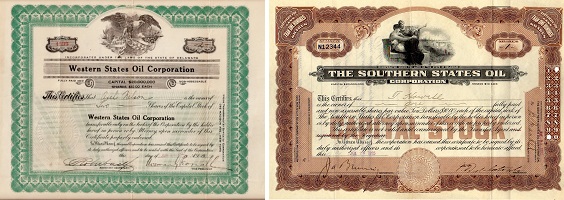

By April 1922, Middles States Oil had raised capitalization to three million shares and reported assets of $2,362,220 with liabilities of $185,000. Haskell incorporated Southern States Oil Company in Delaware as another holding company operating through subsidiaries such as Sure Oil Company and Southern States Drilling Company.

Southern States Oil reportedly was operated by “the same interests which control and operate the Middle States Oil Corp.” It traded on the New York Curb Market with capitalization of $20 million.

Southern States Oil reportedly was operated by “the same interests which control and operate the Middle States Oil Corp.” It traded on the New York Curb Market with capitalization of $20 million.

Four months later, Moody’s Manual wrote that as of July 1922, Southern States Oil had 116 producing oil wells, two producing natural gas wells, “and 19 new wells drilling.” Daily production was 3,326 barrels at $1.85 to $2.45 per barrel with 3,100 acres leased nearby.

The Oil Trade Journal added, “The Southern States Oil Co., completed on July 12 two wells in the Hewitt field, Carter County, Okla., one doing 2,032 bbls. And the other 150 bbls., these wells more than doubling the production of this property. The company has six more wells nearing the top of the sand in this locality.”

In January 1923, Western States Oil Company joined Middle States and Southern States as part of a complex and growing network of holding companies and subsidiaries. “This corporation has been formed by the Haskell interests to bring under one management oil producing properties in Wyoming, California and Montana, with occasional interests in other Western States.”

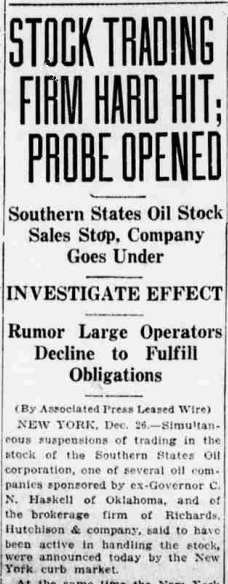

However, by the end of 1923, Haskell’s business was in trouble with investors. Newspapers reported “Stock Trading Firm Hard Hit: Probe Opened; Southern States Oil Stock Sales Stop, Company Goes Under.”

Another article added that trading in C N. Haskell’s Southern States Oil company stock was suspended on the New York Curb market, explaining, “Suspension of Southern States transactions is due to the sensational fluctuations on this stock during the past two weeks. Financial circles, according to reports received in Muskogee have been informed that during the period of the wild scramble approximately seven million dollars profit was made in the trading.”

Another article added that trading in C N. Haskell’s Southern States Oil company stock was suspended on the New York Curb market, explaining, “Suspension of Southern States transactions is due to the sensational fluctuations on this stock during the past two weeks. Financial circles, according to reports received in Muskogee have been informed that during the period of the wild scramble approximately seven million dollars profit was made in the trading.”

A cascade of lawsuits ensued. Haskell, who conducted the market operations of the stock, resigned as chairman of Middle States Oil after the company had acquired control of Southern States Oil.

“In less than one year the assets of the company have dwindled to the extent of over $77,000,000,” declared the presiding judge of U.S. District Court, Southern District of New York. “Middle States Oil Corp. has already defaulted in the payment of principal and interest due on these notes on August 1, 1924.”

More litigation followed as shareholders alleged fraud and mishandling, demanding receivers be appointed to manage the failing companies.

“The receivership grew out of the collapse of the system of oil, railroad, and land companies, security and holding companies, controlled by C. N. Haskell, formerly governor of Oklahoma,” court documents reported. “The system had comprised some fifty-five corporations, of which Middle States Oil Corporation and thirty-eight others which were, in August 1924, wholly or partly owned by Middle States Oil directly or through sub-holding companies, eventually were placed in receivership in this District.”

The receivers were faced with about 90 lawsuits against the former governor’s corporations and $15 million in federal tax claims, “based upon the false-and-inflated earnings statements which Haskell had caused to be issued to aid in sales of securities of the companies.” Stockholders lost their investment and their stock certificates became worthless. It would be 1952 before a final U.S. District Court decision resolved the matter, but Charles Nathaniel Haskell had died in 1933 at the age of 73, still in the oil business, leaving the complications behind.

___________________________________________________________________________________

The stories of exploration and production companies trying to join petroleum booms (and avoid busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

___________________________________________________________________________________