by Bruce Wells | Mar 14, 2023 | Petroleum Companies

Updated research and articles about the histories of old oil company stock and petroleum company histories.

Found an old oil company stock certificate and hoping for a petroleum financial gusher?

The American Oil & Gas Historical Society’s research and accompanying forum depend upon your individual financial support. The historical society is an independent, energy education organization — unaffiliated with upstream or downstream petroleum companies, state or federal government, or industry advocacy groups.

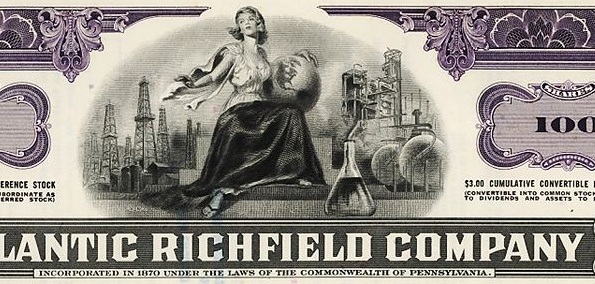

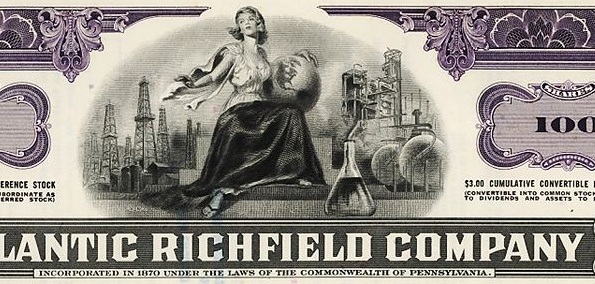

A petroleum company’s old oil stock certificate vignette sometimes has value for collectors of scripophily – the buying and selling of certificates after they have no redeemable value as a security.

Although use of fossil fuels today is highly controversial, the history of U.S. petroleum exploration, production, and transportation provides context for modern energy debates.

From 19th-century kerosene for lamps, 20th-century gasoline for cars, and modern plastic polymers for everyday products, the petroleum industry’s huge social, economic and technological heritage should be preserved.

A Popular Vignette

Collectors have found a surprising number of examples where quickly formed exploration companies picked the exact same oilfield scene for stock certificates.

In the rush to print stock certificates during oil booms, new companies often chose to print certificates using a vignette of derricks!

It might have saved time and money by choosing a common vignette today found on shares of Centralized Oil & Gas Company; Double Standard Oil & Gas Company; Evangeline Oil Company; Texas Production Company; Tulsa Producing and Refining Company; Hecla-Wyoming Oil Company; Oil Prospectors Inc.; Craven Oil & Refining; Buck Run Oil and Refining; Home Oil & Gas; Hog Creek Carruth Company; Buffalo-Texas Oil Company; and the Champion Oil Company (see links to them below).

Can you tell me anything about this old petroleum company (for free)? I found its stock certificate in an attic. Am I rich? Probably not. Since first commercial U.S. oil well in 1859, the petroleum industry’s boom and bust cycles have left many casualties.

The vast majority of old oil stock certificates (especially prior to U.S. Securities and Exchange Commission (SEC), simply become family mementos — and not connected to any modern company. For one that led to extended court battles, see Not a Millionaire from Old Oil Stock.

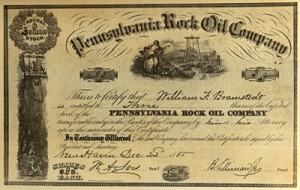

America’s first oil company – the Pennsylvania Rock Oil Company of New York – organized it 1855.

Unfortunately, this small historical society cannot grant requests for free research regarding individual company histories and the potential value of stock certificates. As you may have discovered, financial research is difficult and time consuming. If you are fortunate, a visitor to this website or a society volunteer may have posted helpful information.

If your certificate is not listed here, and to share further research experiences, you are invited to submit your query in the current Stock Certificate Q&A Forum.

(more…)

by Bruce Wells | Jul 1, 2015 | Petroleum Companies

Old Colony Oil Company began about the time the “Roaring Ranger” in Texas made national headlines in 1917 (see Oil Boom Brings First Hilton Hotel). The new company explored near Duncan, Oklahoma.

Despite production from its first two wells – a 20,000,000-cubic-foot-a-day “gasser” and a well producing 2,000 barrels oil oil a day from the Duncan field – Old Colony Oil Company failed to survive.

The company’s success in the Mid-Continent oilfield helped attract investors for funding additional lease purchases and exploratory drilling. The Mid-Continent’s potential had been revealed as early as 1892 (see First Kansas Oil Discovery). Old Colony Oil soon had operations in Texas, Oklahoma, Utah and Montana – but leasing and drilling costs coupled with a lack of consistent producers brought debt.

However, by 1922 the company’s fortunes had diminished to such a point it could only extract about 125 barrels a day from its nine remaining shallow wells in the diminishing Duncan oilfield.

With oil prices down, by May 1922 Old Colony Oil assets amounted to just $75,000 and the company was defaulting on $10,000 monthly payments due to the Wilkin-Hale Bank. Then the bank begin to fail (Wilkin and Hale of the Wilkin-Hale Bank were directors of the Old Colony Oil).

In the summer of 1922, Okahoma bank examiners investigated the interlocking directorates’ books. Hoping for the big oil strike to balance the ledgers, Wilkin-Hale Bank had used $200,000 worth of essentially worthless Old Colony Oil bonds in a transaction with the Consumers Bank of El Reno – and thereby sunk Wilkin-Hale, El Reno, and Old Colony Oil.

Obsolete Old Colony Oil stock certificates from the 1920s may have collectible value on eBay and “scripophily” websites. Such certificates sometimes are valued as artifacts from investors’ gambles on business ventures that failed.

Dry holes, market behavior, drilling costs, and a host of unpredictable hazards remain part of the high-risk, high-reward U.S. oil patch.

In 1947 experts from Halliburton and Stanolind companies applied a technology on a Duncan oilfield well – the the first commercial application of hydraulic fracturing. Learn more in Shooters – A “Fracking” History.

___________________________________________________________________________________

The stories of other exploration attempts to join petroleum exploration booms (and avoid busts) can be found in an updated series of research at Is my Old Oil Stock worth Anything?

Please support the American Oil & Gas Historical Society and this website with a donation. © AOGHS.

by Bruce Wells | Aug 2, 2013 | Petroleum Companies

Sharing history about the U.S. petroleum exploration and production industry.

You found an old petroleum stock certificate in your attic and hope you might be a millionaire. Unlikely, but here is a free discussion forum about old oil companies. Be sure to check the more than 100 old oil companies already researched in Is my Old Oil Stock worth Anything?

Welcome to the American Oil & Gas Historical Society’s discussion page for often obscure petroleum stock certificates. Although the U.S. oil and natural gas industry, launched by an 1859 oil discovery in Titusville, Pennsylvania, has drilled millions of wells, chances are the certificate you found will not make you rich.

Unless it is valued by collectors, outdated financial certificates today have little value — except as family keepsakes. (more…)