by Bruce Wells | Jan 28, 2019 | Petroleum Companies

Alas, there is very little chance your newly found old oil stock certificate will lead to petroleum riches here at Old Oil Stocks in progress G. Few come close to Not a Millionaire from Old Oil Stock about a certificate that spawned lengthy litigation with the Coca-Cola Company.

The American Oil & Gas Historical Society, which depends on your support, does not have resources for extensive research. As AOGHS looks into forum queries as part of its energy education mission, investigations have revealed interesting stories like Mrs. Dysart’s Uraniu Well and Buffalo Bill’s Shoshone Oil Company; others have found questionable dealings during booms and “black gold” fever epidemics like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum for updates frequently added to the A-to-Z listing in Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Garfield Oil & Refining Company

The Oklahoma business records department can provide incorporation information on the Garfield Oil & Refining Company, which had properties near Nowata but does not appear to have prospered.

Gate City-Wyoming Oil & Gas Company

The Gate City-Wyoming Oil and Gas Company incorporated in Idaho July 10, 1917, with Pocatello, Idaho, physician Dr. O.B. Steeley as president. The company acquired leases in Wyoming’s Lost Soldier Dome (640 acres); Rattlesnake Dome (640 acres); Laramie Dome (160 acres); and Rock Springs Dome (640 acres). Curiously, the company’s officers and property were also recorded as the Gate City Oil & Gas Company. Dr. Steeley died suddenly in June 1920. The Idaho secretary of state may have further information, but the company’s last filing was in September 1923. Its charter was forfeited on December 1, 1924. Read about other Wyoming wildcatters in First Wyoming Oil Wells and Buffalo Bill’s Shone Oil Company.

Gatex Oil Company

Gatex Oil Company incorporated in Delaware March 1, 1920. The company undertook exploratory “wildcat” drilling in northeast Texas’ Hopkins and Bowie counties with plans to drill in Hunt County. But in Hopkins County, its Davis No. 1 well was abandoned after reaching 2,020 feet deep without finding oil. Similarly in Bowie County, its Perkins No. 1 well was shut down at 1,570 feet deep with no success. Wildcat drilling on unproven land has always been risky; early failures have often exhausted under-capitalized ventures. This seems to have been the case with Gatex Oil Company, which was dissolved on June 4, 1936. (more…)

by Bruce Wells | Jan 24, 2019 | Petroleum Companies

People seeking obscure financial information probably will not find riches here – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends on your donations, doesn’t have resources for extensive research.

But as AOGHS looks into forum queries as part of its energy education mission, investigations have revealed interesting stories like Mrs. Dysart’s Uranium Well and Buffalo Bill’s Shoshone Oil Company; others have found questionable dealings during booms and “black gold” fever epidemics like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Fairchild Petroleum

One company named Fairchild Petroleum was incorporated in 1921 capitalized at $120,000 in Paintsville, Kentucky, a few miles from the town of Oil Springs (also known as Medina) and home to the Big Sandy Oil & Refining Company. Although there was substantial interest in Johnson County’s petroleum prospects, there is little trace of Fairchild Petroleum activity in Kentucky.

More information may be available from the Kentucky secretary of state business services. This notwithstanding, in 1922 a Fairchild Petroleum Company drilled the No. 1 Boggs well in Brazoria County, Texas, and also drilled in Liberty County, near Nome. The No. 1 Boggs reportedly produced oil from a depth of 4,550 feet. The Texas Railroad Commission maintains records that may provide further insights. (more…)

by Bruce Wells | Jan 4, 2019 | Petroleum Companies

Old Oil Stocks in progress H will not lead to lost riches – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends on your support, simply does not have resources to provide free research of corporate histories.

However, AOGHS continues to look into forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company; many others have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

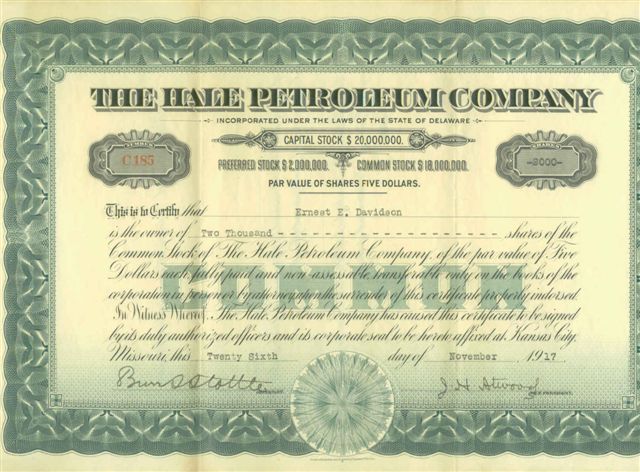

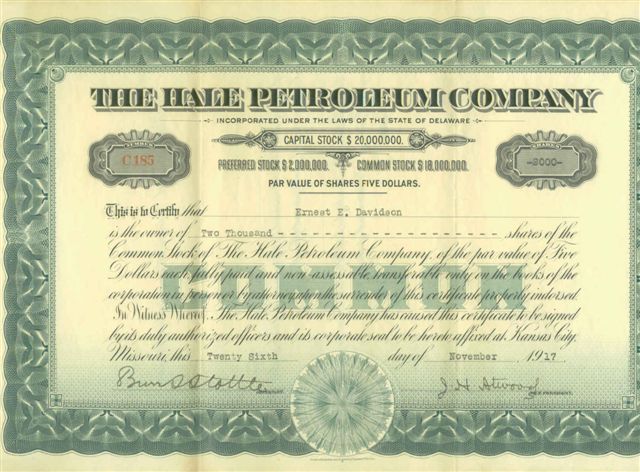

Hale Petroleum Company

The Hale Petroleum Company from 1917 is not related to today’s Hale Petroleum Company of Columbus, Kansas. It also has no relation to the Standard Oil-affiliated Frank Hale Oil Company in Louisiana. In a 1918 text published by the Kansas City Testing Laboratory, Hale Petroleum is identified as having a refinery in Wichita, Kansas, and pipelines to Wichita from nearby El Dorado – site of Butler Country’s Kansas Oil Museum.

The Hale Petroleum Company from 1917 is not related to today’s Hale Petroleum Company of Columbus, Kansas. It also has no relation to the Standard Oil-affiliated Frank Hale Oil Company in Louisiana. In a 1918 text published by the Kansas City Testing Laboratory, Hale Petroleum is identified as having a refinery in Wichita, Kansas, and pipelines to Wichita from nearby El Dorado – site of Butler Country’s Kansas Oil Museum.

A Hale Petroleum is identified as part of Sterling Oil & Refining Company. Sterling Oil was created by Ross Shaw Sterling, the founder and president of the Humble Oil and Refining Company, which eventually became the Exxon, now ExxonMobil. In the 1920s, he sold his interests in Humble, although he served as president of Sterling Oil & Refining Company until 1946. (more…)

by Bruce Wells | Dec 6, 2018 | Petroleum Companies

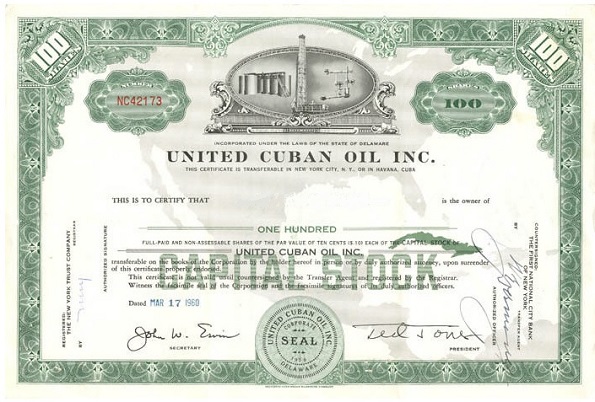

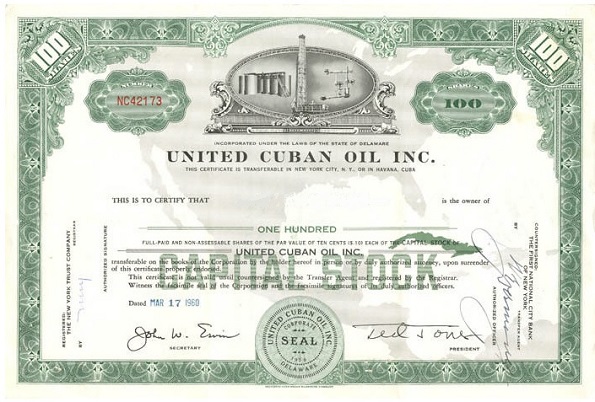

In July 1953, Fidel Castro’s revolutionaries first challenged the government of Fulgencio Batista with organized guerrilla resistance and revolution. Three years later, United Cuban Oil incorporated with Ted Jones as president and offices in Los Angeles. The investment banking firm of S.D. Fuller & Company underwrote the venture, investing $534,694 to control 66 percent of United Cuban Oil stock.

In July 1953, Fidel Castro’s revolutionaries first challenged the government of Fulgencio Batista with organized guerrilla resistance and revolution. Three years later, United Cuban Oil incorporated with Ted Jones as president and offices in Los Angeles. The investment banking firm of S.D. Fuller & Company underwrote the venture, investing $534,694 to control 66 percent of United Cuban Oil stock.

The new petroleum company’s objective was “to consolidate production, development and exploration of oil and gas on concession rights (38 leases) in Cuba.” Jones had existing but independent ventures working on the north coast of the island, including Companie de Fomento Petrolero.

United Cuban Oil filed with the U.S. Securities and Exchange Commission to register 2,573,625 common stocks and an initial public offering of 2,000,000 shares at $1.25 a share. The company exchanged 573,625 shares of stock one-for-one to absorb Jones’ Companie de Fomento Petrolero and make it a subsidiary.

Jones’ holdings in Cuba also became subsidiaries: Empresas Petroleras Jones de Cuba and Compania Perforadora Jones de Cuba. A group headed by James J. McBride bought 1,200,000 shares to be held in escrow for three years.

On June 13, 1957, United Cuban Oil announced plans to drill in California. The selected site was on the 111 acre Muller ranch, about three miles west of La Honda. Drilling of the Muller No. 1 well began on June 29. Interviewed by the Santa Cruz Sentinel, company president Jones took the opportunity to promote United Cuban Oil’s prospects with its six producing wells in Cuba.

Six weeks later, Jones, “reportedly stated that oil was struck at 2,610 feet in 45 feet of oil sand. Officials would only say that it was producing a ‘couple of hundred barrels.’” Regardless of production, by the end of August 1957, United Cuban Oil had plugged and abandoned the Muller well after water intrusion and a failed re-drilling effort.

In Texas, United Cuban Oil completed its No. 1A Coker well in Coleman County, five miles northeast of Novice. But the wildcat well turned out to be just a brief producer. It too was abandoned. At the time, United Cuban Oil was selling for about 56 cents a share on the American Stock Exchange, but for any business operating in Cuba, everything changed on January 1, 1959. Fidel Castro seized power, dictator Fulgencio Batista fled the island, and the Cold War became more dangerous.

Back in the United States, United Cuban Oil was reorganized by three wealthy entrepreneurs from El Paso, Texas. In May 1959, they merged Balcones Corporation, Dell City Gas Company, and United Cuban Oil to form a new company while retaining the United Cuban Oil name and Ted Jones as president. The company planned to move its headquarters to El Paso.

Although United Cuban Oil’s underwriters, S.D. Fuller & Company, offered analysis of prospects to potential investors in the Commercial and Financial Chronicle, few were willing to gamble on Cuba’s uncertain future. By November 1959, the Law 635 of the Batista government effectively stripped United Cuban Oil of its Cuban operations.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

by Bruce Wells | May 18, 2018 | Petroleum Companies

Chances are people seeking financial information here at Old Oil Stocks in progress I will not find lost riches (see Not a Millionaire from Old Oil Stock). The American Oil & Gas Historical Society, which depends on donations, does not have resources to provide free research of corporate histories.

However, AOGHS continues to look into forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company; many others have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Imperial Drilling Company

More than 70 years ago a query about Imperial Drilling Company stock resulted in the Robert D. Fisher Manual of Valuable and Worthless Securities noting that the Texas secretary of state and the county clerk in Cisco, Texas, “informed us: ‘Unable to give you any information regarding above company, but don’t think it is active, as I have not heard of it.’ (October 10, 1939).”

Imperial Drilling Company was likely one of many ventures born of the “Roaring Ranger” a 1917 oilfield discovery well near Cisco that launched drilling booms at many Eastland County towns. A host of such companies and stock speculations had brief lifespans and left behind now obsolete stock certificates. Cisco was a tough town, its citizens hung Santa Clause…twice. See Oil Boom Brings First Hilton Hotel.

Indian Oil & Gas Company

Indian Oil and Gas Company was incorporated on January 29, 1913, by J.D. Boxley, H.E. Brinson, and O.D. Smith. The Tradesman, a contemporary periodical also reported J.J. Jackson to have been an incorporator.

With only 400 shares of common stock were issued, this under-capitalized venture ($10,000) would have been known as a “poor boy” operation, likely using cable-tool equipment that limited drilling depths. Read more in “Making Hole” – Drilling Technology.

Within two months of incorporating, Indian Oil & Gas acquired an 80 acre lease in Hughes County and 40 acres in Creek County, Oklahoma. The Hughes County lease was about 12 miles southwest of Holdenville; the Creek County site about 60 miles away, near Bristow. Because these drilling sites were far from proven territory and producing wells, it would have been a very speculative gamble – wildcat drilling. (more…)

The Hale Petroleum Company from 1917 is not related to today’s Hale Petroleum Company of Columbus, Kansas. It also has no relation to the Standard Oil-affiliated Frank Hale Oil Company in Louisiana. In a 1918 text published by the Kansas City Testing Laboratory, Hale Petroleum is identified as having a refinery in Wichita, Kansas, and pipelines to Wichita from nearby El Dorado – site of Butler Country’s Kansas Oil Museum.

The Hale Petroleum Company from 1917 is not related to today’s Hale Petroleum Company of Columbus, Kansas. It also has no relation to the Standard Oil-affiliated Frank Hale Oil Company in Louisiana. In a 1918 text published by the Kansas City Testing Laboratory, Hale Petroleum is identified as having a refinery in Wichita, Kansas, and pipelines to Wichita from nearby El Dorado – site of Butler Country’s Kansas Oil Museum.