by Bruce Wells | Sep 10, 2013 | Petroleum Companies

In 1921, Union Oil Company brought in the Bell No. 1 well in the city of Santa Fe Springs, California.

In 1921, Union Oil Company brought in the Bell No. 1 well in the city of Santa Fe Springs, California.

The Union Oil gusher, which produced more than 2,000 barrels of oil a day, prompted a rush of new exploration as entrepreneurs hoped to exploit yet another California oil bonanza.

A year later, the extent of the Santa Fe Springs oilfield was still undefined as dozens of new wells were being drilled.

Amid this drilling fever, the Santa Fe Dome Oil Company was formed and funded by investors whose purchase of stock provided the cash to acquire a lease and drill as close as possible to known producing wells.

Santa Fe Springs became a promoters’ paradise, notes one historian. Prospective investors were bussed to the field, served free lunches in circus tents, and regaled with stories about fortunes to be made in oil.Meanwhile the region’s oil production grew, reaching 80,000 barrels a day. By the end of the 1920s, the oilfield’s production, which exceeded production at the more famous Signal Hill field. Also see Signal Hill brings California Oil Boom.

Santa Fe Dome Oil joined the oil rush and bought a lease on the Myer property in Los Angels – today found at Shoemaker Avenue, between Beaty and Sunshine streets.

The company drilled its first well about a mile south of the proven producing area but came up dry. With falling cash reserves, a second attempt was made within a hundred feet of the company’s first attempt – not an uncommon practice, given the technology of the day – but this well also was a dry hole.

Santa Fe Dome Oil Company disappeared from financial records.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

by Bruce Wells | Sep 10, 2013 | Petroleum Companies

Beginning as early as the late 1880s, speculators and drillers fruitlessly tried their luck – sometimes in areas even known to have burning oil and coal-gas seeps.Although the state of Washington has never been close to becoming a major producer of oil, that has never stopped exploration companies from trying.

Hundreds of companies tried and failed, some never raising enough cash to drill a single well in the rugged country. Independent oilman Aron Hover’s petroleum company apparently was among them. (more…)

by Bruce Wells | Sep 9, 2013 | Petroleum Companies

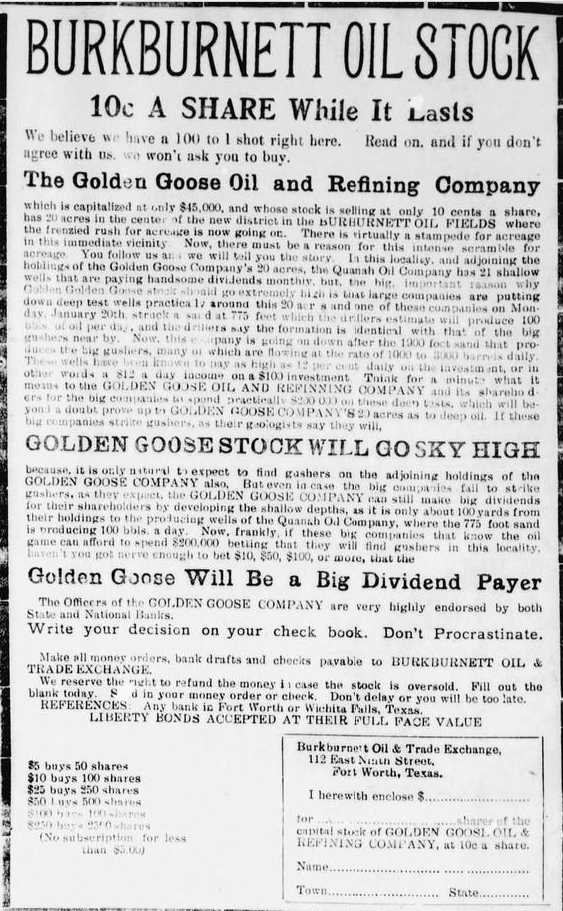

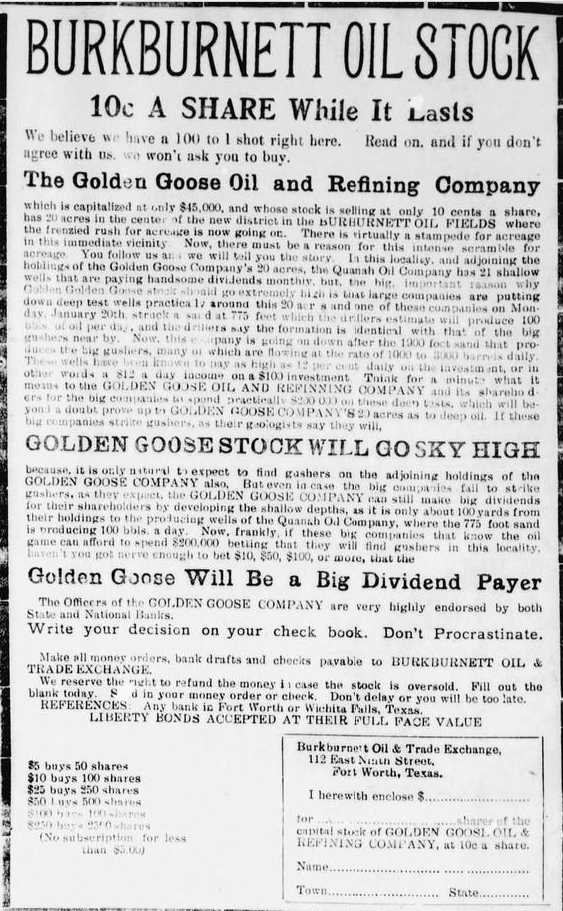

Newspaper advertisements made many incredible claims, including: “Think for a minute what it means to the olden Goose Oil and Refining Company and its shareholders for the big companies to spend practically $200,000 on these deep tests, as it is only 100 yards from from the producing wells…”Golden Goose Oil and Refining Company promoted sales of its stock in Texas newspapers during February of 1919, urging investors to buy at “10 cents A Share While It Lasts.”

The company purported to own a 20-acre lease in the prolific Burkburnett oilfield – where there was a “frenzied rush” and “virtual stampede for acreage in this immediate vicinity.”

The company’s stock was available at the Burkburnett Oil & Trade Exchange in Fort Worth. Advertisements proclaimed that “Golden Goose Stock Will Go Sky High.” It didn’t.

Golden Goose Oil and Refining Company certificates may have value to scripophily collectors. Learn more about the North Texas petroleum history in “Boom Town” of Burkburnett.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

by Bruce Wells | Sep 1, 2013 | Petroleum Companies

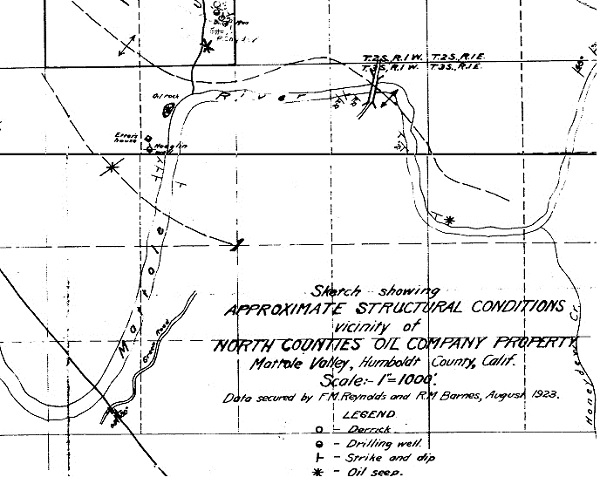

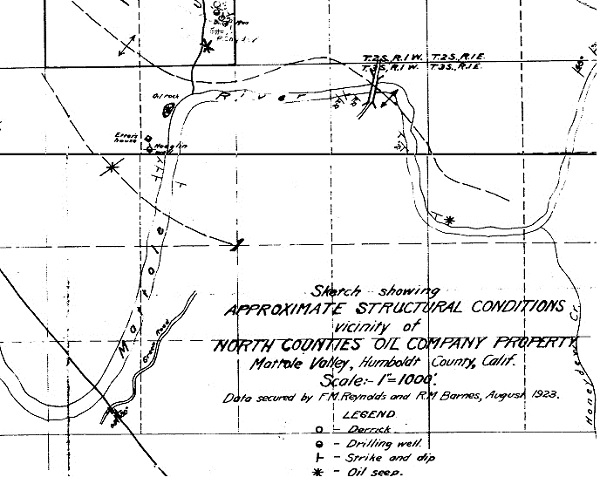

Ernest C. Matthews, proprietor of a music and stationery store in Eureka, California, incorporated North Counties Oil Company on May 14, 1920. On and off over the next 16 years, he drilled wells in Humboldt County. None of the wells proved successful.

Capitalization was 500,000 shares at a nominal par value of $1 each. More than 170,000 shares were issued. The company’s future depended upon finding oil with their first well, spudded in March 1921 on the Mattole River near Honeydew.

Searching for oil in Humboldt County, California, North Counties Oil had trouble with its drilling crews. The company secretary’s wife cooked for the outfit, which attempted three wells.

The area had seen brief oil excitement circa 1865 and again in 1898, but none of the exploratory wells proved commercial.

North Counties Oil drilled on the Etter Ranch in Section 36, Township 2 South, Range 1 West. The well showed promising signs of oil and natural gas before being beset by mechanical difficulties. By 1922, the California State Mining Bureau noted of the well, “Finances low – trouble with crews – Reynolds now drilling. Secretary’s wife cooking for outfit.” The well failed.

Still confident there was oil on their lease, North Counties Oil returned five years later to drill a second well within a few hundred feet of their first. It was not a commercial producer.

Another 10 years passed before North Counties made its third and final attempt, spudding a well within sight of its two others in September of 1936. This well was a dry hole. North Counties Oil Company seems to have run out of both money and luck.

W. O. Kinsman was company secretary, so Mathews – the music store proprietor – and Kinsman’s signatures may be on the company’s collectible stock certificate. But officers changed over time. F. M. Reynolds and Stanley Barry later served as president of the failed oil exploration venture.

———–

The stories of exploration companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this energy education website. For membership information, contact bawells@aoghs.org. © 2021 AOGHS.

by Bruce Wells | Sep 1, 2013 | Petroleum Companies

Henry H. Hoffman formed several petroleum companies and split his time between New York City and Houston.

Henry H. Hoffman formed several petroleum companies and split his time between New York City and Houston.

With interests in both oil exploration and refining, he had early hopes of finding his fortune at the Goose Creek oilfield 21 miles southeast of Houston.

Goose Creek had produced only dry holes and marginal oil wells prior to a gusher in August 1916 (it also was where Howard Hughes Sr. secretly tested a prototype two-coned bit in 1909). The discovery well initially produced 8,000 barrels daily, indicating Goose Creek was a large oilfield. Houston drilling companies rushed to the area to bid for leases, build derricks and drill wells.

However, in October 1916, Hoffman withdrew from his interests in the Goose Creek and nearby Humble oilfields and organized two new companies.

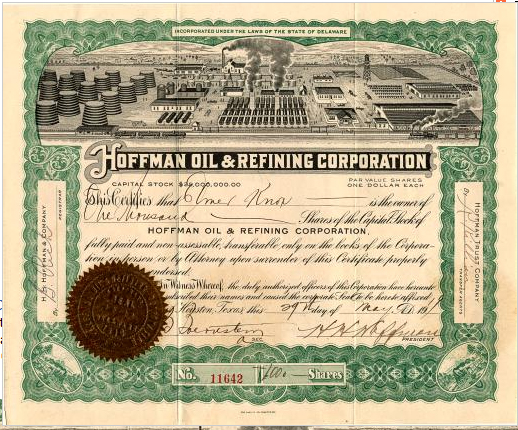

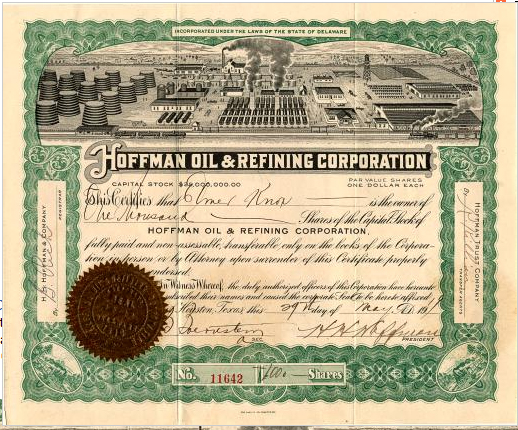

Hoffman Oil & Refining Corporation was formed to acquire and operate refineries. This company incorporated in November 1916 with Hoffman as president and was offered at $10 per share.

Hoffman Oil & Refining Corporation was formed to acquire and operate refineries. This company incorporated in November 1916 with Hoffman as president and was offered at $10 per share.

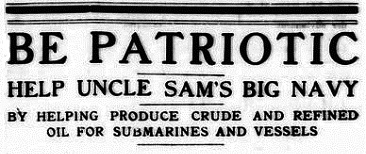

Hoffman began running newspaper advertisements that capitalized on Americans’ growing patriotism as World War I raged in Europe.

Noting the importance of investing in U.S. refineries to “Help Uncle Sam’s Big Navy,” one ad claimed there were profits to be made from Hoffman Oil & Refining: “Yes, wealthy Chicago people and elsewhere are buying this Refinery stock up fast. Don’t delay. Get in while you can.”

Hoffman also formed the Hoffman Oil Company, capitalized a $4 million and focused on exploration and production. The two companies shared the same officers. He then purchased “moving picture machines” for a traveling promotion concept.

After acquiring 12 projectors, Hoffman ordered 24 reels of original oilfield scenes to market a stock selling campaign in a number of the larger cities. His plan included renting a room at each location and giving a free show. His oil company stock was then offered for sale.

Hoffman’s motion picture sales presentations apparently were more successful than his attempts to find, recover, and refine oil. In Ohio, he was indicted by a grand jury “for advertising securities for sale in that state without obtaining a license.”

In August of 1918, Hoffman Oil & Refining acquired Buffalo Oil & Refining with the understanding that Buffalo shareholders were to receive 10 shares of Hoffman stock for one of their shares. There were few benefits.

Although Hoffman’s company once again held properties in the Goose Creek oilfield – as well as leases in the “Roaring Ranger” oilfield and the Burkburnett oilfield – the company’s fortunes continued to fade. Read more about these internationally famous North Texas discoveries in Pump Jack Capital of Texas.

By July 1919, Hoffman Oil & Refining had lost its charter to do business in Texas.

“We do not assume to pass upon the merits of the particular stock offered by Henry H. Hoffman as an individual or through the Hoffman Oil Company,” declared a January 1920 article in Trust Companies magazine about his exploration company.

“But it is a horse of another color when Hoffman uses letter heads bearing the imprint ‘Union Trust Company,’ and in small type underneath the word ‘incorporated’ as bait to secure investors throughout the county,” the magazine concluded.

In March of 1920, the Oil Trade Journal announced that Turnbow Oil Corporation was being organized to take control of the failed Hoffman Oil & Refining. Hoffman was listed as Turnbow Oil vice president.

The takeover, which also absorbed the Interstate Oil & Refining Company of Texas, included Hoffman’s eight-story office building in Houston and a 1,000-barrel-a-day refinery on the Houston Ship Channel.

Desperation behind the Turnbow Oil deal was revealed in a November 1920 United States Investor report that noted the value of Hoffman Oil & Refining stock:

The fact that recent quotations on Hoffman Oil & Refining are from one and one-half to three cents per share gives rather conclusive evidence as the sharp decline in value of the stock. This would be placing a value of $15,000 to $30,000 on the assets of this corporation which originally attempted to float $10,000,000 of stock. Of course, nothing like the entire capital was ever issued and consequently the market value is even smaller than the above figures indicate.

Turnbow Oil – and all of the Henry H. Hoffman’s petroleum corporations – failed to survive. Ross S. Sterling, founder and president of Humble Oil Company (now ExxonMobil) constructed a highly successful major refinery at Goose Creek oilfield in 1921.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

In 1921, Union Oil Company brought in the Bell No. 1 well in the city of Santa Fe Springs, California.

In 1921, Union Oil Company brought in the Bell No. 1 well in the city of Santa Fe Springs, California.

Henry H. Hoffman formed several petroleum companies and split his time between New York City and Houston.

Henry H. Hoffman formed several petroleum companies and split his time between New York City and Houston. Hoffman Oil & Refining Corporation was formed to acquire and operate refineries. This company incorporated in November 1916 with Hoffman as president and was offered at $10 per share.

Hoffman Oil & Refining Corporation was formed to acquire and operate refineries. This company incorporated in November 1916 with Hoffman as president and was offered at $10 per share.