by Bruce Wells | Sep 8, 2015 | Petroleum Companies

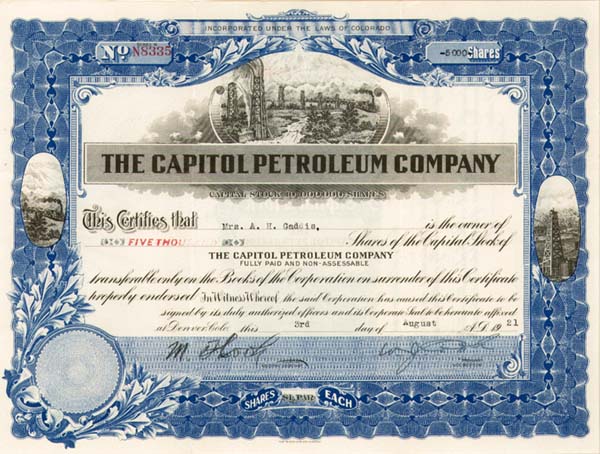

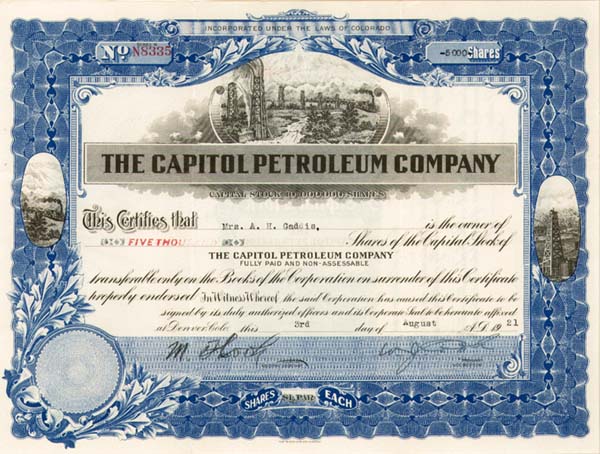

The modern American petroleum industry truly began at the beginning of the 20th century. The Capitol Petroleum Company wanted to be part of it, but failed.

Although the first commercial U.S. oil discovery had taken place in 1859 in Pennsylvania (for making kerosene), demand for another refined product would create thousands of new companies. They searched for “black gold.”

In Texas, an 1894 discovery of the Corsicana oilfield launched the Lone Star State’s petroleum industry, including its first refinery. The town’s leaders had hired a contractor to drill a water well and found oil instead.

When the internal combustion engine arrived on the scene (the first U.S. auto show was in 1900) and electricity was replacing kerosene for illumination, new oilfield discoveries were providing oil for refining into gasoline. (more…)

by Bruce Wells | Aug 9, 2015 | Petroleum Companies

Information here at Old Oil Stocks – in progress “V” will not find lost riches – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends on donations, simply does not have resources to research of corporate histories.

However, AOGHS continues to look into forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company,

Many have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Ventura Oil Development Company

The Clampitt brothers’ Ventura Oil Development Company in 1910 offered to sell blocks of 1,000 shares of stock at between 10 cents and 15 cents per share. The brothers published a variety of “quick sales” opportunities in newspapers and periodicals. An oil discovery a decade earlier had led to a flurry of drilling near Piru, California, had led to wild predictions of the largest oilfield in the state. (more…)

by Bruce Wells | Aug 4, 2015 | Petroleum Companies

Welcome to Old Oil Stocks – in progress “U” – but it is unlikely research here will lead to finding lost riches – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends donations, does not have resources to provide free research of corporate histories.

However, AOGHS continues to look into forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company; many others have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Uncle Sam Oil Company

Henry Harrison Tucker Jr. (1878-1959) is a colorful and litigious character whose petroleum ventures included both the Texas American Syndicate and Uncle Sam Oil Company. He left reams of court transcripts and contemporary media reports either supporting or condemning his operations.

In 1905 Tucker was celebrated by some as an oil patch David taking on the Goliath of John D. Rockefeller’s Standard Oil Company. (more…)

by Bruce Wells | May 18, 2015 | Petroleum Companies

For those seeking financial information here at Old Oil Stocks – in progress J, chances are you will not find lost riches – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends on donations,does not have resources to research all oil corporate histories of an industry that began in 1859.

AOGHS continues to look into a limited number of forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company; many others have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

View company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

View company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Johnson Oil Company

Johnson Oil Company was one of many fraudulent ventures for which Gilbert S. Johnson was ultimately convicted and imprisoned (see Admiral Oil Company for one example).

Court documents regarding Johnson Oil noted, “all money received from the persons intended to be defrauded for stock of the Johnson Oil Company was not used for drilling operations, but large sums were appropriated by the said defendant to his own use and benefit.”

Accusing Johnson of fraud throughout the years following World War I, the court documents condemned his latest oil venture, noting that “no honest or economical effort had been made by the defendant to develop new production; that the company did not continue to make progress, but at that time was on the verge of bankruptcy and did make a financial failure; that these statements were made by the defendant for the purpose of deception and of inducing the persons to be defrauded to part with their money and property without receiving anything of value therefore.”

Justheim Petroleum Company

According to the Securities and Exchange Commission, Justheim Petroleum Company incorporated in Nevada in 1952 to acquire, hold and sell oil and natural gas leases while retaining overriding royalty rights.

On December 31, 1986, a company by the name of C.E.C. Management Corporation merged into Justheim Petroleum. C.E.C. Management was in the minerals processing business, including engineering consulting as well as designing and marketing custom systems and equipment. The newly merged companies were renamed as C.E.C. Industries Corporation with an OTC (over the counter) symbol of CECC.

In 2001, the SEC charged C.E.C. Industries Corporation with fraud, falsifying books and records and accounting violations in 1996 and 1997.

In 2004, C.E.C. Industries Corporation dismissed all its officers and the entire board of directors to reform itself as a business development company, changing its name to Advantage Capital Development. At that time there were more than 58.7 million shares outstanding and 1,500 shareholders.

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2020 Bruce A. Wells.

by Bruce Wells | Apr 14, 2015 | Petroleum Companies

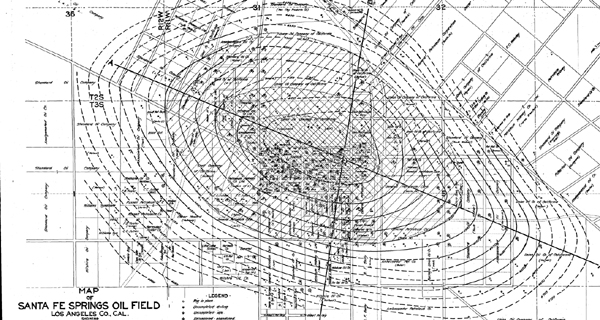

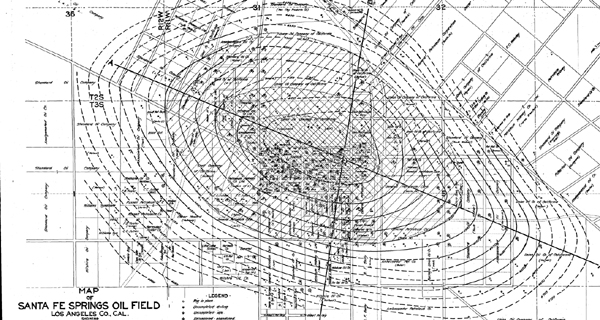

California became a major oil producing state in the 1920s thanks to oilfield discoveries including Signal Hill, Santa Fe Springs and Huntington Beach.

In November 1921, Union Oil Company completed a well producing 2,500 barrel of oil a day near Santa Fe Springs, California. The discovery at a depth of 3,763 feet prompted a flurry of speculation and leasing – especially because of a major discovery earlier that year a few miles to the south at Signal Hill.

By the start of 1922, 24 exploration companies were drilling at Santa Fe Springs – after scrambling to secure leases close to the Union Oil gusher (Section 5, Township 3 South, Range 11 West), today near the intersection of Telegraph Road and Bloomfield Avenue. By acting quickly to get close to proven production, these companies found it easier to interest investors.

Discovered by Union Oil Company in November 1921 near Los Angeles, the Santa Fe Springs oilfield attracted competing exploration companies.

That summer, Joe B. Turman had leased property in the adjacent Section 6 and launched his organization. To get in on the anticipated bonanza,Turman investors purchased “units,” each of which represented one five-thousandths (0.0002 percent) interest in the net proceeds of all oil and gas produced.

By August 1922 his company (also known as “Joseph/Jos. B Turman No. 2”) had secured sufficient funding and begun drilling in the new Santa Fe Springs oilfield. With one well underway and two more planned, sales of units remained critical. The California State Mining Bureau recorded monthly progress as Joe B. Turman’s rotary rig drilled deeper.

The Santa Ana Register of April 12, 1923, included a help wanted ad for sales agents: “Lady Solicitors Wanted To Represent Joe B. Turman Oil Syndicate in Orange and Santa Ana. Hustlers make big money, why not you?”

In March, the California Mining Bureau’s report declared, “The Santa Fe Springs field has a daily production equal to nearly one-half the entire production of the State of Oklahoma, California’s closest competitor for first honors in the production of petroleum.”

The Santa Fe Springs oilfield alone produced more than 81 million barrels in 1923. The production joined that from Signal Hill’s Long Beach field and the Huntington Beach oilfield.

The Eureka state’s natural oil seeps had attracted petroleum exploration companies since the first California oil well in 1876 and the discovery of the Los Angeles oilfields in 1893.

But despite Turman’s abundant unit sales, his drilling operation soon ran into technical difficulties. The Joe B. Turman No. 1 well got stuck at a depth of 3,660 feet – “frozen” in driller parlance of the time.

“When mudding through drill pipe, by circulation, the lower portion of the drill pipe is apt to be broken off, thereby causing a bad fishing job and endangering the hole…restricted mud circulation tends to freeze the drill pipe,” noted one expert about the process of fishing in petroleum wells.

It was the end of that well and plans for others as legal troubles began for the Joe B. Turman Oil Syndicate.

As court documents would later disclose, the syndicate had oversold its units in an “amount far in excess of the requirements of the drilling contract, and even far in excess of the total issue authorized.”

Officers reportedly “converted large sums to their own use,” the court documents noted, agreeing with a jury’s finding “that the whole scheme was conceived in fraud and was consummated through the misuse of the mail.”

On April 14, 1924, Turman was fined $50,000 and sentenced to three years in the federal penitentiary in Leavenworth, Kansas.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

___________________________________________________________________________________