by Bruce Wells | Aug 21, 2015 | Petroleum Companies

The Texas oil patch was making headlines as World War I raged in Europe. An earlier major discovery at Electra had launched a drilling boom that brought new exploration and production companies to nearby Wichita Falls. (more…)

by Bruce Wells | Jul 22, 2015 | Petroleum Companies

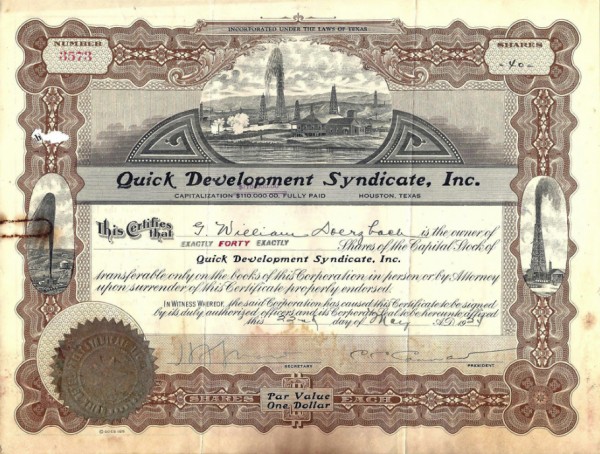

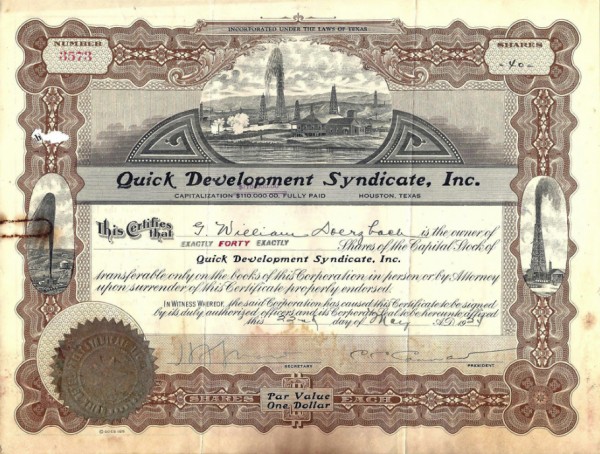

Quick Development Syndicate was incorporated in 1923 in Houston by C.C. Cannon, J.C. Gibson, and others. Initially capitalized at $110,000, by March the company had issued more stock to increase funds to $170,000 for exploring for oil.

Quick Development Syndicate gambled on drilling a wildcat well in Brazoria County, just south of Houston.

Although there was a brief show of oil from its exploration attempt, commercial production was uneconomical and the well abandoned.

Although there was a brief show of oil from its exploration attempt, commercial production was uneconomical and the well abandoned.

In December 1924, the Texas district court in Seguin ruled on a Texas Railroad Commission suit against Quick Development Syndicate for violation of Rule 37.

The rule “requires oil well drillers to secure permission from the commission before sinking a well within the prescribed 150 feet.”

The court issued a permanent injunction against Quick Development Syndicate and imposed a fine. The company disappears from financial records after the ruling.

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2020 Bruce A. Wells.

by Bruce Wells | Jun 15, 2015 | Petroleum Companies

With World War I raging in Europe (America still on the sidelines), a series of discoveries in North Texas and Oklahoma brought oil fever to the East Coast. Despite allegations of fraud and ongoing litigation, an insurance company president took advantage of excited (if unwary) oil patch investors.

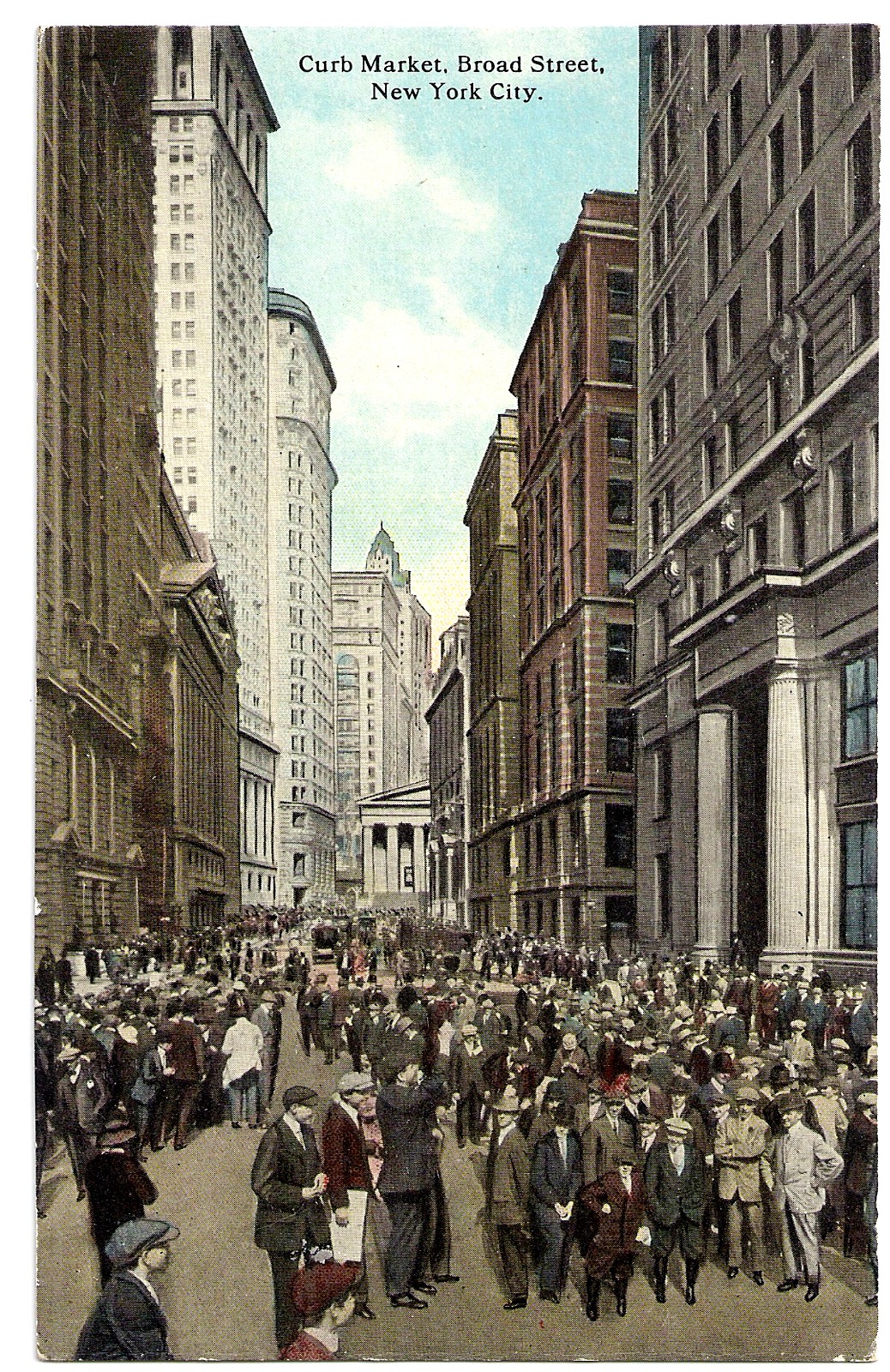

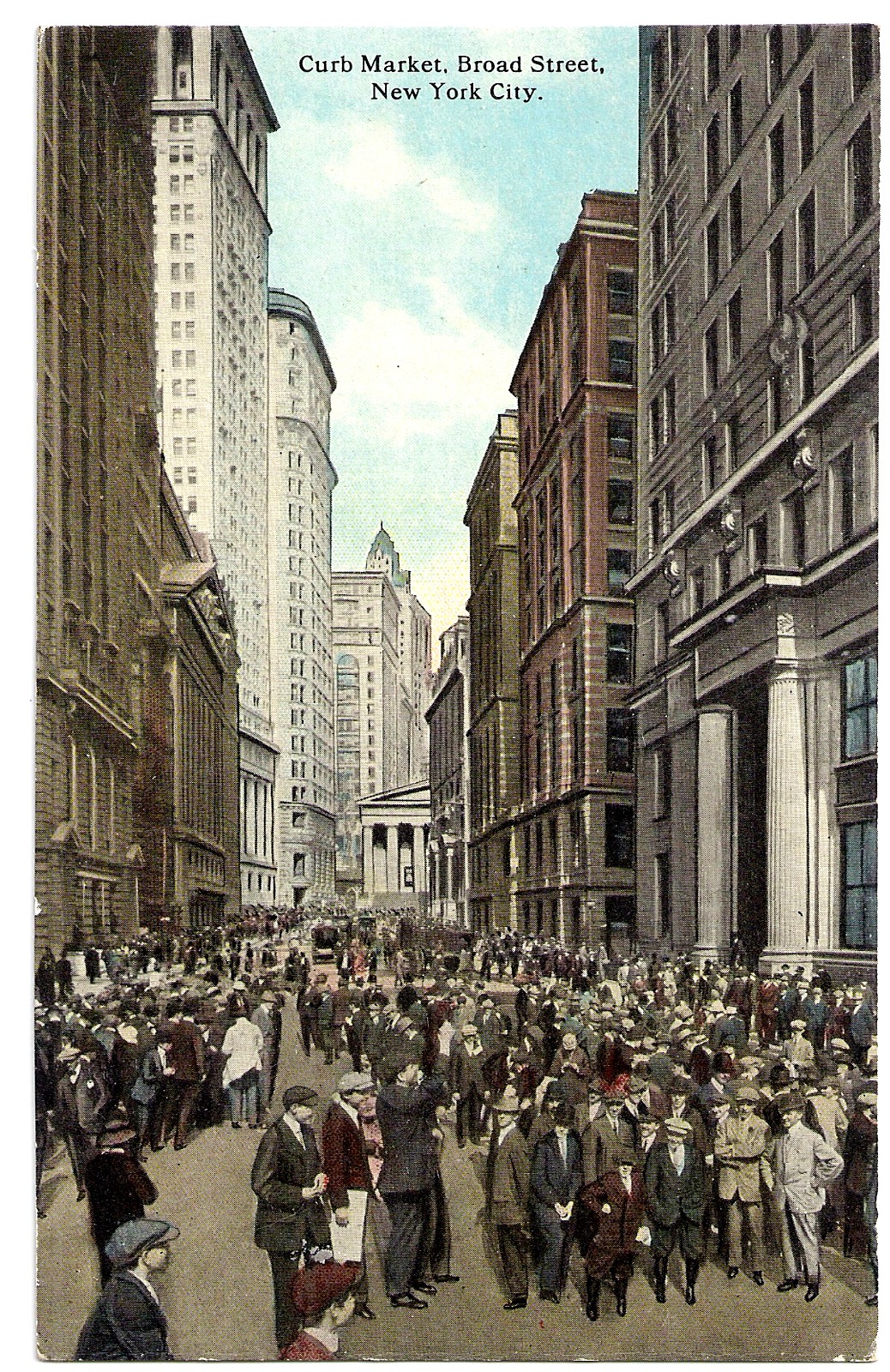

Organized in 1911, “to eliminate the irresponsible brokers and valueless stocks from the outside market,” the New York Curb did not move indoors until 1921 – and later became the American Stock Exchange.

In New York City, “curbstone brokers” at Broad Street and Exchange Place attracted investors to newly formed petroleum exploration and production companies.

This was the New York Curb market, outdoor home to young and aggressive traders offering speculative investments, unlisted stocks, and securities just down the street from the prestigious New York Stock Exchange.

The New York Evening Post described the traders as “a motley, agitated mass of struggling, yelling, finger-wriggling humanity.” (more…)

by Bruce Wells | Apr 3, 2015 | Petroleum Companies

The future looked bright for three Chicago businessmen who formed an oil company that discovered a Kansas oilfield in 1922. But greed and litigation would ultimately cast a shadow across their venture into the petroleum industry.

Barrington Oil Company was incorporated July 15, 1921, by R.O. Farrell, H.M. Cassidy and B.F. Brubaker. Offices were initially located at 1404 Harris Trust building in Chicago, and the business was capitalized at $100,000. The company reportedly acquired mineral leases on more than 10,000 acres near producing wells the Sallyards, Virgil, and Rosalia oilfields in Kansas. (more…)

by Bruce Wells | Aug 2, 2013 | Petroleum Companies

Sharing history about the U.S. petroleum exploration and production industry.

You found an old petroleum stock certificate in your attic and hope you might be a millionaire. Unlikely, but here is a free discussion forum about old oil companies. Be sure to check the more than 100 old oil companies already researched in Is my Old Oil Stock worth Anything?

Welcome to the American Oil & Gas Historical Society’s discussion page for often obscure petroleum stock certificates. Although the U.S. oil and natural gas industry, launched by an 1859 oil discovery in Titusville, Pennsylvania, has drilled millions of wells, chances are the certificate you found will not make you rich.

Unless it is valued by collectors, outdated financial certificates today have little value — except as family keepsakes. (more…)

Although there was a brief show of oil from its exploration attempt, commercial production was uneconomical and the well abandoned.

Although there was a brief show of oil from its exploration attempt, commercial production was uneconomical and the well abandoned.