by Bruce Wells | Jul 22, 2015 | Petroleum Companies

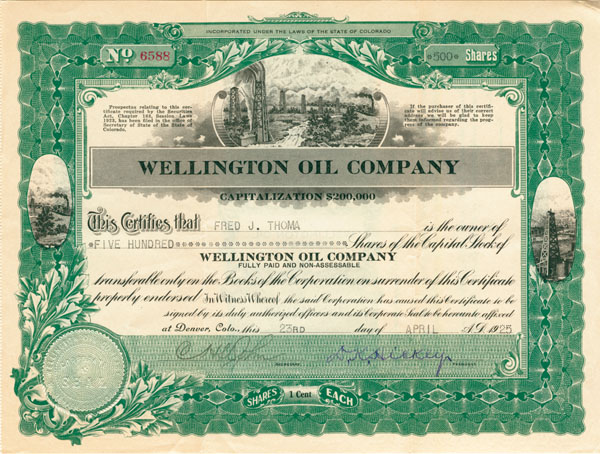

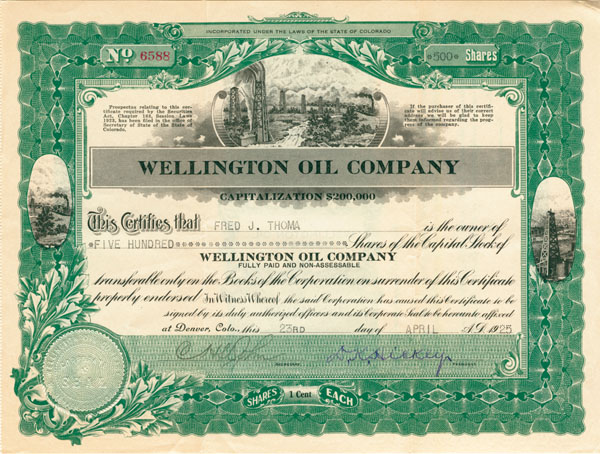

Wellington Oil Company incorporated in Delaware on September 1, 1936, in order to merge the Wellington Oil Company (California) and Santa Clara Oil and Development Company (Texas).

The new company issued 850,000 shares of stock in exchange for the physical assets of the two previous petroleum exploration companies.

John T. O’Neil and C.W. Atkins were named president and vice president respectively; both were experienced and successful independent oil producers. The company’s main office was in San Antonio, Texas.

In 1942 Wellington Oil Company was sold to Seaboard Oil Company with one share of Seaboard exchanged for every four shares of Wellington. Seaboard Oil Company was in turn absorbed by the Texas Company (later Texaco) in 1958.

The Texas Company was most significant company started during the Spindletop oil boom according to one historian.

The company formed soon after the 1901 “Lucas Gusher” when Joseph “Buckskin Joe” Cullinan formed the Petroleum Iron Works, building oil storage tanks in the Beaumont area – where he was introduced to Arnold Schlaet.

Both men would later travel rom their offices in Beaumont to another major oilfield at Sour Lake. Cullinan and Schlaet formed the Texas Company on April 7, 1902, by absorbing the Texas Fuel Company and inheriting its office in Beaumont.

Texas Fuel had organized just one year earlier to purchase Spindletop oil, develop storage and transportation networks, and sell the oil to northern refineries.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.

___________________________________________________________________________________

by Bruce Wells | Jul 22, 2015 | Petroleum Companies

There’s not much of a chance of discovering financial information here in Old Oil Stocks – in progress “R” that will lead to lost riches – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society needs support, and does not have resources to provide free research.

However, AOGHS continues to look into forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company; many others have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

Visit the Stock Certificate Q & A Forum and view company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? AOGHS will continue to look into forum queries, including these “in progress.”

Railroad Employees Oil Company

In August 1951 the Stephens County district court clerk announced that among other absentee enterprises, Railroad Employees Oil Company was being sued (Case Number 14,886) and ordered to appear in court. “Defendants have been absent from Stephens County and the state of Texas for more than five years,” the suit alleged. “Defendants have not paid any taxes on the mineral interest.”

The many plaintiffs in the case, sought to have a receiver appointed, “for the purpose of selling, executing and delivering an oil and gas lease covering the undivided mineral interest of said Defendants.” The Texas Railroad Commission should have more information on the Railroad Employees Oil Company.

Railroaders’ Oil Company

Railroaders’ Oil Company, Railroaders’ Gas Company, and Railroaders’ Oil & Gas Company all appear to be variants of the same company. In 1920 Railroaders’ Oil was organized in Louisville, Kentucky, capitalized at $2 million. Officers were: T.J. Heaton, president and J.J. O’Malley, both of Milwaukee, Wisconsin. Oil exploration operations were soon underway in along the Ohio River in Harrison County, Indiana, with more than 30,000 acres under lease.

By June 1921 Railroaders’ Oil had drilled five successful gas wells and was negotiating to provide natural gas from the Laconia field to New Albany, about 25 miles distant. National Petroleum News reported in 1926 the company – now called Railroaders’ Oil & Gas Company – “has about 50 gas wells in the southern part of the county and are drilling more.”

By 1928 Railroaders’ Oil & Gas had 40 wells in the Laconia field (Tobacco Landing and Dogwood areas) and the New Middleton field. But when Kentucky Pipe Line Company (an auxiliary of Louisville Gas & Electric) declined to buy its daily quota of natural gas for the city of Louisville, litigation ensued. Dry holes, pipeline costs and onset of the Great Depression then forced the company, by now known as Railroaders’ Gas Company, into bankruptcy and receivership. It was absorbed by the Indiana Utility Corporation in 1929.

Ramsey Oil Company

Both Ramsey Oil Company and Pecos Natural Oil Company pursued oil in West Texas, circa 1917 to 1925. Wells were drilled in the vast Permian Basin, in sparsely populated Loving County, 120 miles west of Midland (and about 40 miles from today’s Million Barrel Museum in Monahans). Loving County remains the least populous county in the United States.

Wildcatters James Jackson “J.J.” Wheat Sr. and Bladen F. Ramsey had earlier formed Toyah Bell Oil Company (1920), which became Ramsey Oil. The El Paso Herald reported Pecos Natural Oil’s interest in a Toyah Bell exploratory well in Pecos County. In 1921 Toyah Bell Oil spudded two wells in Loving County. With a showing of oil at their first well, the No. 1 L.B. Russell, and a second well (No. 2 Russell) underway, Toyah Bell Oil changed its name to Ramsey Oil.

Ramsey Oil contracted to sell oil to El Paso’s Rio Grande Oil & Refining Company for three dollars per barrel. The Oil Trade Journal called the Ramsey well, “one of the most promising wildcats anywhere in Texas” and noted that it had “stimulated wildcatting activities throughout the Pecos region.”

Despite its promising beginnings, the No. 1 L.B. Russell well’s casing collapsed in 1922 and the well could not be saved. It was shut down at 4,485 feet and never completed as a producing well. “Because of bad casing and improper drilling, it was abandoned in 1925,” noted the Bureau of Economic Geology.

Bad luck continued in 1923 when the Russell No. 2 well was capped at 705 feet deep without finding oil. Wheat and Ramsey sold out to Pecos Valley Oil Company and Ramsey Oil Company disappeared. In 1925, Pecos Valley Oil drilled a mile south of Ramsey Oil’s abandoned No. 1 L.B. Russell well – and completed Loving County’s first commercial producer, the No. 1 Wheat, opening the Wheat oilfield.

Pecos Valley Oil became part of Sinclair Prairie Oil Company. Production from the Permian Basin’s Wheat oilfield peaked in 1931 at more than 1.2 million barrels of oil. Although Ramsey Oil Company did not survive, the town it helped to create the town of Ramsey, named after oilman Bladen F. Ramsey. Now renamed Mentone, it remains the county seat of Loving County.

Ranger and Burkburnett Oil Company

Henry H. Hoffman was president of the Ranger and Burkburnett Oil Company, capitalized at $500,000. In 1921 he was sued by company stockholders. They soon objected to “the much discussed question of a promoter accepting blocks of stock in exchange for leases” in order to manipulate stock prices.

Shareowners alleged that leases, “costing Hoffman but little, were sold in the company for considerable blocks of stock.” Stockholders sought appointment of a receiver, a verdict of $250,000 in damages against Hoffman, and cancellation of documents that gave him 275,000 shares of Ranger & Burkburnett Oil.

Ranger-Vindicator Oil & Development Company

As North Texas continued to experience a drilling boom, in 1922 the Ranger-Vindicator Oil and Development Company drilled its Thornton No. 1 well to a depth of 3,300 feet in Navarro County. Water intrusion ruined the well, about two miles west of Wortham. It apparently was not followed by any successful attempts. Two years later another company struck a gusher (the Roy Simmons No. 1) revealing an oilfield that produced three million barrels of oil by 1925.

Red Rock Oil & Gas Company

In 1917 Investment Weekly reported Red Rock Oil and Gas Company to be “an excellent purchase for early speculative profits.” The company had incorporated in Oklahoma and issued 150,000 shares of stock (par value $1) in order to develop leases acquired in Neosho County, Kansas (160 acres); the Bixby oilfield, Oklahoma (80 acres); and Tulsa County, Oklahoma (80 acres).

These Mid-Continent field leases were near areas of proven production. Many nearby wells yielded both oil and natural gas. With producing zones ranging from 800 feet deep to 900 feet deep, drilling costs were about $1.25 per foot, according to Investment Weekly. The trade publication predicted the value of Red Rock Oil & Gas stock would sharply advance when the company brought in its first well, noting, “The unusual features of low capitalization, and evident early production are undoubtedly attracting attention to this (stock) issue.”

The Investment Weekly prediction did not pan out. Red Rock Oil and Gas drilled in Colorado and Louisiana as well as Kansas and Oklahoma. It was still a viable company in 1921 – but by then its stock sold on the New York curb market for about 75 cents a share. Investment Weekly’s enthusiasm waned.

“We do not believe that the prospects of Red Rock Oil & Gas Company, even as a speculation are particularly bright at this time,” the editors concluded. In 1922 the company had some modest success in Louisiana’s Webster Parish, but seems to disappear from financial records soon thereafter. A March 1905 oil discovery at Caddo-Pines near Shreveport had brought wildcatters to northern Louisiana. A museum in Oil City today tells the story.

Richey Oil Company

Richey Oil Company, a Montana corporation, formed in January 1952. Its founders may have been inspired by a Shell Oil Company oil discovery six months earlier near Richey, in Dawson County. Shell Oil’s wildcat well produced 1,400 barrels of oil a day from about 7,250 feet deep.

The 1951 Shell Oil discovery well was the first commercial oil found in the Montana portion of the humongous Williston Basin (a portion that produced 868,595 barrels of oil per day in 2015). The petroleum-rich basin had been revealed earlier that year by North Dakota’s first oil well.

The Shell Oil discovery prompted a rush of exploration companies to the county, including Richey Oil, which secured a lease in adjacent Richland County. On May 5, 1952, Richey Oil spudded its Otis Waters No. 1 well. Mr. Waters was the mayor of Richey. On June 25 the Helena, Montana, Independent Record reported bad news.

“The Richey Oil company’s drill stem test at its wildcat well seven miles east of Shell’s original discovery in the Montana part of the Williston basin was ‘a fizzle,’ Secretary-Treasurer John Whiteman of Richey reports,” the newspaper noted. The well had reached a total depth of 7,565 feet before being given up as a dry hole. Plugged and abandoned in accordance with state regulations, the documents close with, “Welded Steel Plate Over Surface Pipe.”

Montana secretary of state records show that Richey Oil Company was “Involuntarily Dissolved,” which usually means a dissolution carried out through a court ruling. Creditors often seek a judicial resolution because of non-payments…or fraudulent activities by the directors.

Rockefeller Oil Company

On January 10, 1901, an oil gusher at Spindletop launched the modern petroleum industry and led to the founding of many new petroleum companies. Most did not survive long.

As newspapers everywhere published stories about the “black gold” found near Beaumont, Texas, Rockefeller Oil Company was chartered on April 23, 1901, capitalized with $200,000.

As newspapers everywhere published stories about the “black gold” found near Beaumont, Texas, Rockefeller Oil Company was chartered on April 23, 1901, capitalized with $200,000.

The Spindletop oilfield soon produced more oil in one day than all the rest of the world’s oilfields combined. In its first year alone, Spindletop produced 3.59 million barrels of oil – climbing to 17.4 million by its second year. Unfortunately for many companies and their investors, the unregulated oil production caused prices to drop from $2 per barrel to less than 25 cents per barrel.

Although Texaco, Gulf, Mobil and Sun oil companies can trace their roots to Spindletop and its nearby oilfields, hundreds lesser funded speculative ventures failed to survive. Oilfield service companies like Beaumont Confederated Oil & Pipeline Company also suffered. On November 30, 1901, United States Investor reported, “The Rockefeller Oil Co. is little known and as it owns no Spindle Top property, we do not think much of it.” On May 6, 1903, Rockefeller Oil Company’s charter do business was revoked by Texas “for nonpayment of franchise taxes.”

Rosson Oil Company

Along the Red River in North Texas, Wichita Falls grew explosively after the opening of the vast Burkburnett oilfield in June 1918. Within three weeks, 56 drilling rigs were at work as close as they could get to the discovery well. Entrepreneurs scrambled to get in on the opportunity.

The “World’s Wonder Oilfield” spawned many new oil companies as Wichita Falls bank deposits grew by 400 percent in 1919. There were nine refineries and 47 factories within the city limits by 1920. Oil companies cultivated investors to get money to drill a producing well before the inevitable exhaustion of the field.

Rosson Oil formed in early 1919 largely funded with investors’ money. By May 1919 its first well in the Burkburnett field (Van Cleave lease) reached 1,800 feet deep without striking oil – a dry hole, which often proved lethal to any under capitalized business. Rosson Oil sold stock to fund drilling and went broke after failing to find oil.

Rosson Oil formed in early 1919 largely funded with investors’ money. By May 1919 its first well in the Burkburnett field (Van Cleave lease) reached 1,800 feet deep without striking oil – a dry hole, which often proved lethal to any under capitalized business. Rosson Oil sold stock to fund drilling and went broke after failing to find oil.

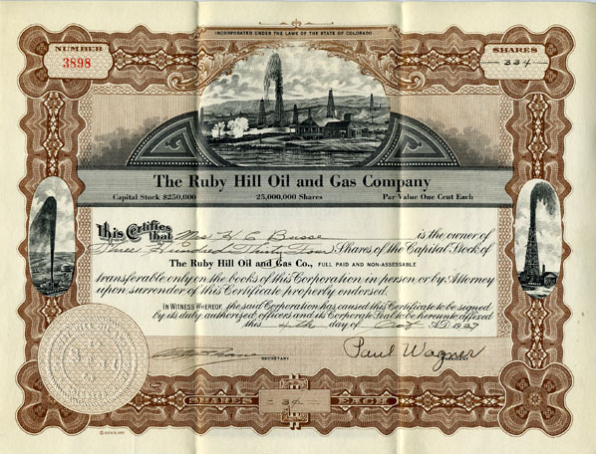

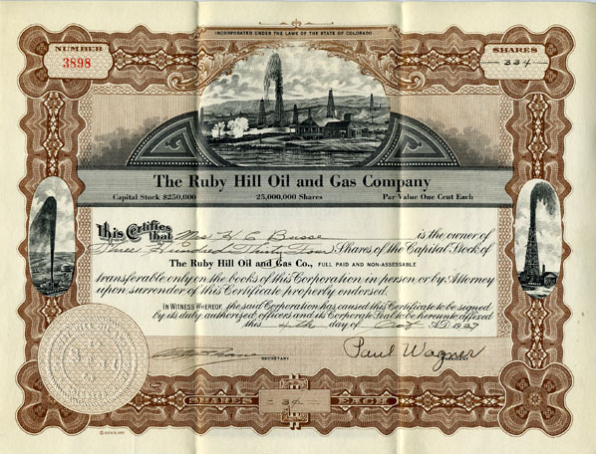

Ruby Hill Oil & Gas Company

Ruby Hill Oil & Gas Company stock was promoted at five cents per share in 1930 and the company drilled near Denver, in 1934. Its No. 1 Braden well in Jefferson County, stalled for a year – then resumed “making hole” in 1935.

The company apparently failed, as its stock certificates are valued only by collectors for their artistic and historic value.

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2020Bruce A. Wells.

by Bruce Wells | Apr 11, 2015 | Petroleum Companies

Chances are people seeking financial information here at Old Oil Stocks in progress A will not find lost riches – see Not a Millionaire from Old Oil Stock. The American Oil & Gas Historical Society, which depends on member donations, does not have resources to provide free research of corporate histories.

However, AOGHS continues to look into forum queries as part of its energy education mission. Some investigations have revealed little-known stories like Buffalo Bill’s Shoshone Oil Company; many others have found questionable dealings during booms and epidemics of “black gold” fever like Arctic Explorer turns Oil Promoter.

Visitors’ forum questions are posted on the Stock Certificate Q & A Forum and company updates regularly added to the A-to-Z listing at Is my Old Oil Stock worth Anything? Visit again, because AOGHS continues to look into forum queries, including these “in progress.”

Acme Oil & Gas Company

One of many ventures to unsuccessfully search for oil in the state of Washington, Acme Oil & Gas Company in 1930 used a cable-tool rig to drill its Acme No. 1 well to a depth of 310 feet with no showing of oil. The company shut down the exploratory well, moved the rig 20 feet, and began drilling again. The reason is unclear, but percussion cable tools frequently got stuck, requiring down-hole “fishing.”

The new drilling effort, Acme No. 2, found showings of natural gas and oil en route to a total depth of 1,241 feet, but nothing more. Both failed wells were northwest of Ferndale, Washington. Using the Public Land Survey System (PLSS), the location of these wells was in the South half of the Southeast Quarter of Section 13, Township 39 North, Range 1 East (the drilling site is visible on Google Earth with the PLSS overlay).

It was not until August 19, 1957, that Washington state’s first and only commercial oil well. The Sunshine Mining Company Medina No. 1 initially produced 223 barrels a day of 38.9 gravity oil from a depth of 4,135 feet. The well, near Ocean City in Gray Harbor County, produced a total of only 12,500 barrels of oil before being shut down in 1961. “About 600 gas and oil wells have been drilled in Washington, but large-scale commercial production has never occurred,” Washington’s Commissioner of Public Lands reported in 2010. “The most recent production, which was from the Ocean City Gas and Oil Field west of Hoquiam, ceased in 1962, and no oil or gas have been produced since that time.”

Alabama Central Oil & Gas

Alabama Central Oil & Gas Company was one of many that formed in the wake of the December 20, 1909, discovery of commercial quantities of natural gas near Fayette, Alabama. The discovery by Eureka Oil & Gas Company opened of what is now known as the Black Warrior Basin.

With the backing of Birmingham and New York City investors, Alabama Central Oil & Gas incorporated in 1910 in Delaware with capitalization of $1 million. The company offered its stock for sale to the public at $1 per share. “In this way money is to be raised for the building of plants, for refining in case of oil being brought up, and for pipe lines for the gas,” reported the publication Industrial World.

With leases on about 800 acres, Alabama Central Oil & Gas drilled its first well (the Freeman No. 1) near the Southern Railway’s Bankston Station, about 12 miles west of Fayette. Despite encouraging shows of oil and natural gas, trouble soon appeared. “One misfortune followed another, however, and finally the tools were lost…and the well abandoned,” noted Industrial World. Salt water intrusion ruined the well at a depth of about 1,900 feet. The well was later deepened to more than 2,900 feet, but with no success.

With the company’s first well abandoned, Alabama Central Oil & Gas tried again with their Woods No. 1 well, which like the first attempt, had slight shows of oil and natural gas between depths of 1,350 feet and 1,440 feet. After encountering flowing salt water in sand, this well had to be abandoned too, apparently exhausting the company’s capital. With Alabama Central Oil & Gas Company’s failure to pay its taxes for two consecutive years, its charter to do business was revoked on January 22, 1914.

The Fayette boom soon died out. By 1917, more than 40 wells had been drilled in the area but no significant new natural gas deposits were found in Alabama for several decades. Today, coal bed methane has become the focus of energy exploration in the Black Warrior Basin.

Alto Gasoline & Oil Company

Alto Gasoline & Oil Company incorporated in June 1919 with offices in Fort Worth, Texas, and promptly offered 300,000 shares of common stock to the public on the New York Curb Market. Alto Gasoline & Oil held leases in the prolific Burkburnett oilfield as well as owning a casing-head gas plant in Skiatook, Oklahoma.

By 1921 the company’s petroleum production was about 2,600 barrels of oil a day from 18 wells, with drilling underway at another 11, according to Moody’s Analyses of Investments, Industrials. One year later, 91 percent of the company’s stock was purchased by the Middle States Oil Company for a reported $954,000. Middle States Oil had a convoluted litigation history; its chairman was Charles Haskell, the first Governor of Oklahoma after statehood in 1907.

Amalgamated Oil Company

Scripophily collectors value old Amalgamated Oil Company stock certificates, which sell on Ebay and other venues. Amalgamated was incorporated in California, October 27, 1904, and by June 1910, it had total production of 4,948 barrels a day from its 138 wells. The company acquired properties from Arcturus Oil Co. and Salt Lake Oil Co. and owned a pipeline from its producing properties to Los Angeles. There, on six acres between the tracks of the Southern Pacific Railroad and the Atchison, Topeka and Santa Fe Railroad, the Amalgamated Oil Company’s 3,000-barrel-a-day refinery shipped its products.

The company paid investors dividends of as much as 10%. By 1922, the Associated Oil Company of California had gained control of Amalgamated Oil Company through purchase of 50.01% of Amalgamated’s stock. Amalgamated continued to drill extensively in several California oil fields, e.g.; Coyote Hills, Santa Fe Springs, Huntington Beach, Salt Lake, and Richfield. Amalgamated brought in a 1,000 barrel a day producer (the Butterworth No. 3) in the Santa Fe Spring field. The California Division of Oil, Gas, and Geothermal Resources has data online that will enable you to drill deeper for more information.

Despite some success, Amalgamated’s 1922 balance sheet showed a decrease of over one-half million dollars from its 1920 earnings, primarily because of increased drilling expenses. To find more about the Amalgamated Oil Company, try searching the California Digital Newspaper Collection online. For example, the company is uniquely related to the creation of the Los Angeles community of Beverly Hills. Amalgamated bought the land for oil exploration in 1905, but finding no oil, spawned the Rodeo Land & Water Company as a subdivision to develop the property as real estate.

American Oil & Refining Company

The trade publication Petroleum Age in June 1918 reported the American Oil & Refining Company, including its refinery at Cedar Grove, Louisiana, had been taken over by the newly formed Pine Island Refining Company (formerly, the American Refinery Company). Officers of the new company included R.L. Cook, president; D.H. Christman, vice president; and C.M. Cook, secretary. The next year, Oil Distribution News reported that Pine Island Refining’s plant (with a capacity to process 200 barrels of oil a day) had been purchased by International Oil & Gas Corporation. To follow this research trail further, learn about efforts to exploit the Caddo and Pine Island oilfields at the Louisiana Oil Museum in Oil City.

American Workers Oil Field Company

The American Workers Oil Field Company was underwritten by about 6,000 shipyard workers on the coast of Washington (Bremerton, circa 1919) and acquired 2,000 acres in Wyoming, encompassing areas of the Lost Soldier Field extending to Casper. The Wyoming Oil and Gas Conservation Commission may offer more information. Read more about Wyoming’s petroleum history in First Wyoming Oil Wells.

Anglo-Philippine Oil & Mineral Corporation

From its inception in 1971, Anglo-Philippine Oil & Mineral Corporation was in the business of mining iron ore. The company mined magnetite sand deposits along the beach of Santo Tomas, La Union, Philippines. It does not appear Anglo-Philippine Oil & Mineral was directly in the oil business – exploration, production, refining, transportation, or distribution. The company shipped more than 83,000 metric tons of iron ore to Japan in 1972. In 1996, it became an investment firm, Anglo-Philippine Holdings Corporation, traded on the Philippine Stock Exchange.

Anna May Oil Company

In November 1921 the Anna May Oil Company was reported to be drilling south of Miles City in Montana’s famed Powder River Basin but its first well (No. 1 in Section 20) had to be abandoned when the drill bit stuck at about 100 foot depth and could not be retrieved. Efforts to retrieve – often called “fishing” – the stuck tool failed and the well was abandoned. The second well in section 21 was drilled all the way to 802 feet in the shallow field without finding oil and was also abandoned. With that kind of investment unrewarded, the company soon disappeared from financial records.

Arizona Development Company

Arizona Development Company incorporated with a Delaware charter on March 8, 1900 but the charter was repealed in 1903 and the company listed in “Obsolete American Securities and Corporations, Volume I” by R. M. Smythe. In 1921, Union Oil Company brought in the Bell No. 1 well in the city of Santa Fe Springs, California, producing over 2,000 barrels of oil a day and prompting a rush of new exploration as entrepreneurs hoped to exploit yet another oil bonanza. A year later, the extent of the Santa Fe Springs oilfield was still undefined as dozens of new wells were being drilled and production reached 80,000 barrels of oil a day.

Arkadelphia Oil Company

Nine months after Spindletop launched the modern American petroleum industry in January 1901 with unprecedented oil production, the Arkadelphia Oil Company was formed with S.R McNutt as president and L.C. Newberry as secretary. The company’s stated purpose was “to sink oil wells at Beaumont, Texas.”

The United States Geological Survey Bulletin 212 identifies Arkadelphia Oil Company as having drilled to a depth of 1,025 feet to complete a producing well amidst the frenzy of drilling and investment in Spindletop Hill oilfield and a discovery at nearby Sour Lake Springs. Spindletop would soon produce more oil in one day than all the rest of the world’s oilfields combined. In its first year alone the field produced 3.59 million barrels of oil — climbing to 17.4 million barrels of oil by its second year.

Although Texaco, Gulf, Mobile, Humble and Sun oil companies can trace their roots to southeastern Texas, many ventures were not successful. Over supply drove crude oil prices down to as low as three cents per barrel! Production slowed down. “After yielding 17,500,000 barrels of oil in 1902, the Spindletop wells were down to 10,000 barrels a day in February 1904,” notes the Texas State Historical Association.

Market pressures proved too much for many under-capitalized ventures, Arkadelphia Oil Company among them. The Arkansas secretary of state includes Arkadelphia Oil in its “List of Domestic Corporations Whose Rights to do Business were Forfeited July 2, 1906.”

Associated Oil & Gas Company

Associated Oil and Gas Company president Harry J. Mosser was a well established oilman and entrepreneur from Alice, Texas who prospered in the exploration and production of natural gas in the 1940s and 1950s.

In addition to serving as president of Associated Oil & Gas, Mosser was also president of Orange Grove Oil & Gas Corporation, Prince Marine Drilling & Exploration Company, H.J. Mosser Oil & Gas Company, and South-Tex Corporation. Associated Oil & Gas undertook several acquisitions, including Gulf States Development Corporation, and created subsidiaries such as George Rental Service and the Texas Gas Utilities Company. Associated Oil & Gas Company reincorporated in Delaware on October 10, 1964, but P.O. Box 66465 remained its Houston office.

In 1969, according to Financial Information’s “Directory of Obsolete Securities,” the name of Associated Oil & Gas Company was changed to A.O. Industries and its location to Coral Gables, Florida. That company acquired Auto-Swage Products, Inc., and sought the Securities and Exchange Commission’s authority for the issue of A.O. Industries stock, “…in exchange for all the assets or shares of other corporations in connection with its acquisition program.” The newly constituted A.O. Industries was a very diverse holding company rather than the energy and natural gas producer that was its predecessor.

By 1971 A.O. Industries’ trading volume on the American Stock Exchange was about 15,000 shares daily. In 1974 A.O. Industries was renamed Aegis Corporation but its principal place of business remained Coral Gables, Florida. The corporation by now had interests in tread rubber, metallurgy, ship repair and pleasure boats. As of March 18, 1981, there were almost 11 million shares of Aegis common stock outstanding – and selling for about $2.50 per share.

By 1984, when Aegis Corporation was acquired by Minstar Incorporated, the $60-million deal was struck at a price of about $6 per share. In 1988, Minstar Incorporated “went private” as famed corporate raider Irwin Jacobs (known as “Irv the Liquidator”) paid Minstar shareholders about $400,000,000 for the company, which had evolved into a major builder of sport and pleasure boats. In 1994 Jacobs’ new private company, Genmar Holdings absorbed Minstar Inc. In 2009, Genmar Holdings entered bankruptcy.

Atlantic Petroleum Company

Atlantic Petroleum sold on the New York Curb market for about $3 a share during 1921 until the company recapitalized and exchanged all of its Atlantic Petroleum (old) for new Atlantic Petroleum shares. The basis was five of the old shares for one of the new. When moved from the curb market to the New York Stock Exchange (NYSE), the new stock sold for about $18 per share by the end of October 1921, up to $25 per share by February 1922.

Early in 1922 Poor’s Government and Municipal Supplement reported that 90 percent of the newly recapitalized Atlantic Petroleum had been acquired by Cosden Oil & Gas Company. Three shares of Atlantic Petroleum were exchanged for two shares of Cosden. Atlantic holdings added about 2,740 acres of producing leases in Oklahoma and Kansas with 32,318 acres undeveloped leases in Oklahoma, Kansas and Texas. Atlantic properties reportedly produced 164,503 barrels of oil in the first quarter 1922 with successful new wells being drilled in Texas’ Bristow district.

Atlantic Petroleum stock certificates would have been perforated or otherwise canceled in the exchange with Cosden. These shares have no value as a marketable securities because the original owner named on the certificate turned it in to a transfer agent during acquisition to receive Cosden shares. Like other obsolete stock certificates, they no longer reflect partial ownership in a company. In 1925 the Mid-Continent Petroleum Company acquired Cosden Oil & Gas Company.

The American Oil & Gas Historical Society preserves U.S. petroleum history. Support this AOGHS.ORG energy education website with a contribution today. For membership information, contact bawells@aoghs.org. © 2020 Bruce A. Wells.

As newspapers everywhere published stories about the “black gold” found near Beaumont, Texas, Rockefeller Oil Company was chartered on April 23, 1901, capitalized with $200,000.

As newspapers everywhere published stories about the “black gold” found near Beaumont, Texas, Rockefeller Oil Company was chartered on April 23, 1901, capitalized with $200,000. Rosson Oil formed in early 1919 largely funded with investors’ money. By May 1919 its first well in the Burkburnett field (Van Cleave lease) reached 1,800 feet deep without striking oil – a dry hole, which often proved lethal to any under capitalized business. Rosson Oil sold stock to fund drilling and went broke after failing to find oil.

Rosson Oil formed in early 1919 largely funded with investors’ money. By May 1919 its first well in the Burkburnett field (Van Cleave lease) reached 1,800 feet deep without striking oil – a dry hole, which often proved lethal to any under capitalized business. Rosson Oil sold stock to fund drilling and went broke after failing to find oil.