The future looked bright for three Chicago businessmen who formed an oil company that discovered a Kansas oilfield in 1922. But greed and litigation would ultimately cast a shadow across their venture into the petroleum industry.

Barrington Oil Company was incorporated July 15, 1921, by R.O. Farrell, H.M. Cassidy and B.F. Brubaker. Offices were initially located at 1404 Harris Trust building in Chicago, and the business was capitalized at $100,000. The company reportedly acquired mineral leases on more than 10,000 acres near producing wells the Sallyards, Virgil, and Rosalia oilfields in Kansas.

A 1915 discovery east of Wichita had revealed the El Dorado oilfield – the first found using the new science of petroleum geology. The well launched a Kansas oil boom. More Mid-Continent discoveries encouraged many companies to search east toward Eueka, about 30 miles away.

When the Burkett-Seely oilfield was revealed in 1922 about 15 miles north of Eureka, the Barrington Oil Company soon arrived and completed its first well on the Burkett farm. All of the company’s drilling would be in Section 24, Township T23 South, Range R10 East, in Greenwood County. The first well’s initial production was about 250 barrels of oil a day (at the time, oil sold for $1.60 a barrel).

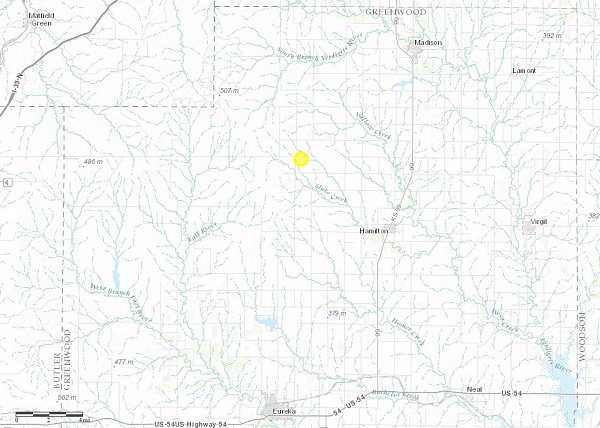

Based in Chicago, Barrington Oil Company drilled wells near proven Mid-Continent oilfields in Greenwood County, Kansas, in the 1920s. Map detail of northern Greenwood County courtesy Kansas Geological Survey.

Trade publications reported the company’s progress as it drilled two more wells near the same Greenwood County site, sometimes wrongly identifying the wells as Birkitt rather than Burkett. The company’s second well produced 150 barrels of oil a day from 2,120 feet after being “shot” with nitroglycerin. These successful wells enabled further drilling (unlike many under-capitalized ventures that failed after a single dry hole).

The company’s third well ran into trouble and reportedly was “fishing” downhole at 2,030 feet deep. Nonetheless, Poor’s Cumulative Service noted the company declared regular monthly dividend of one percent and an extra dividend of five percent, both payable March 15, 1922. Shares traded at $3 on the Over the Counter Market.

As Barrington Oil continued to pay its shareholders a monthly one percent dividend, in December 1922 its Burkett No. 4 was completed at 2,201 feet producing 300 barrels of oil a day. The company’s fifth well also was a producer. Three more good wells followed. By June 1924 company stock sold for $7.75 per share. The future looked bright.

According to the Oil Trade Journal, in 1926 Barrington Oil announced it would build large distributing plants at Oklahoma City and Kansas City after adding new directors Morris Jepson, J.O. Brown, and C.J. Farwell. Then a dispute arose over the company’s Burkett lease, bringing litigation that would last until 1930. It ultimately would have to be decided by the U.S. Board of Tax Appeals. But things got far worse before the lawyers were finished.

As reported by the DeKalb Daily Chronicle on June 20, 1927, the president and vice president of Barrington Oil were arrested for their 1922 embezzlement of $100,000 of (DeKalb) county funds which were used “for investment in oil stock scheme in Eureka, Kansas.”

The theft reportedly “was covered up so that auditors since have failed to detect the discrepancy.” But when the company’s bank failed in 1927, bank examiners were called in and the crime discovered. Thereafter, Barrington Oil Company disappears from readily available financial records.

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2019 Bruce A. Wells.

____________________________________________________________________