Investors were in for anxious times only a few years after Allied Oil Corporation incorporated in 1917.

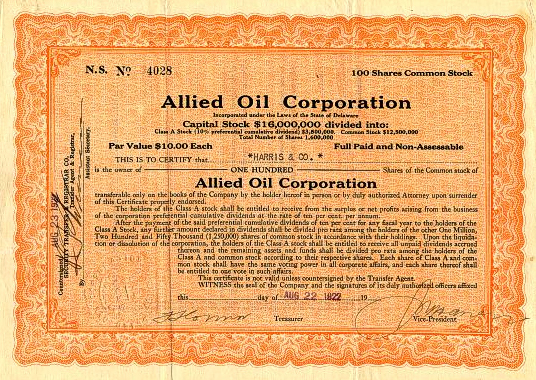

With $12.5 million capitalization and an authorized 1.6 million shares of common and 350,000 shares of preferred stock, the company added companies.

Allied Oil took possession of the stock of Consumers Gas & Fuel Company of Texas, Dalsa Oil Company of Texas, San Jacinto Petroleum Corporation and Alamo Petroleum Corporation. It also owned most of the stock of Western Globe Oil Association of Texas.

However, Allied Oil’s brief lifespan played out on the pages of United States Investor – and the publication’s responses to increasingly nervous investors.

June 1919 – “So far as we have been able to learn it seems to be more or less of a speculation, with the value as yet undetermined,” noted the investment magazine after assessing the company’s potential.

January 1920 – Allied Oil acquired all outstanding capital stock of Central Power and Light Company of Texas and half of Okla-Paragon Pipe-Line Corporation.

Company advertisements proclaimed in The Magazine of Wall Street that “substantial dividends have been paid on the stock since January 1, 1919, and it is the opinion of directors that at the next dividend period the Company will be in a position to declare a dividend which will maintain the rate of 12 percent per annum.”

November 1920 – With dividends suspended, Allied Oil stock fell to about 50 cents per share.

“Although little encouragement can be given to one who is looking for improvement in the standing of his shares, there is, nevertheless, some chance of this, and it would be unwise for one to sell the shares at this time at the low prices which prevail,” United States Investor proclaimed.

June 1921 – With Allied Oil stock down to six cents a share, United States Investor noted failed attempts to refinance. The company’s president “is reported to have made efforts to obtain $300,000 without success. The prospect does not appear very bright.”

August 1922 – There may be sporadic operations of some of the subsidiaries of Allied Oil, but these are neither profitable nor important from a stockholder’s point of view,” United States Investor reported.

December 30, 1922 – With Allied Oil stock down to only a penny a share and the company ripe for plunder, the controversial arctic explorer Frederick Cook targeted the company. Cook, who will later go to jail for fraud, used his notorious Petroleum Producers Association to entice Allied’s vulnerable investors with a “fold in” merger scam. Read Arctic Explorer Turns Oil Promoter.

In Allied Oil’s epitaph, United States Investor explained to a disconsolate Allied Oil Corporation investor:

“We do not think that your holdings are worth much of anything and do not think you should spend more money to protect something that is next to worthless. Allied Oil has been a great disappointment to a large number of people and there is no reason why they should be imposed on further.”

___________________________________________________________________________________

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Please support this AOGHS.ORG energy education website. For membership information, contact bawells@aoghs.org. © 2018 Bruce A. Wells.