Prior to becoming an aspiring Kansas oilman, William Seyler wrote a book admonishing others about speculating in the petroleum industry. Then he started his own oil company.

Seyler was a self-proclaimed capitalist and investment expert who in 1919 published Danger Signals – A Key to Investing Money to Make Money.

His book (today available free online) offered several chapters about America’s rapidly expanding petroleum industry, including chapter 12, “Oil Land Get-Rich-Quick Schemes.”

Seyler advised potential investors to be wary. “The alluring possibilities of the oil business is, at this very writing, causing so many inexperienced men to engage in the promotion of wild-cat oil companies that haven’t the remotest chance to succeed,” he proclaimed. “Experience and constant practice alone make experts in judging the soundness of stocks and securities; of this there is no doubt.”

Within a year of publishing his book of investment advice, Seyler incorporated Elbukan Oil Company in Delaware (June 5, 1920). He began operations in El Dorado, Kansas, where the Stapleton No. 1 well of 1915 had launched a major Kansas Oil Boom.

His company was initially capitalized at $750,000 with par value assigned at $1 per share. But by March 1921 Elbukan Oil had increased its capital stock to $1.5 million to fund acquisition of more properties in the prolific Mid-Continent field.

The company successfully completed its Millheisler No. 5 well, which produced 100 barrels of oil northeast of El Dorado. Although production declined to 50 barrels a day, the success enabled the company to drill another well, the Millheisler No. 6, on the same 40-acre lease.

By December 31, 1921, Elbukan Oil Company had sold approximately $1.6 million of stock to investors nationwide, apparently including a large number from Wisconsin.

Seemingly prospering, the company owned a number of leases and pipelines in Kansas and Oklahoma. By 1923 it was producing and selling oil and natural gas. Then questions were raised about its accounting practices.

Elbukan Oil was prohibited from selling its stock in Wisconsin and Indiana, “as a result of continued delays by the Seyler company in presenting the semiannual audit of the financial conditions require by the state commission of all companies selling stock.”

The company’s difficulties compounded when it was alleged in court that Seyler had set up his company’s $120,000 purchase of a well valued at only $6,000. The deal included Elbukan Oil paying him personally $42,500 in cash and stock.

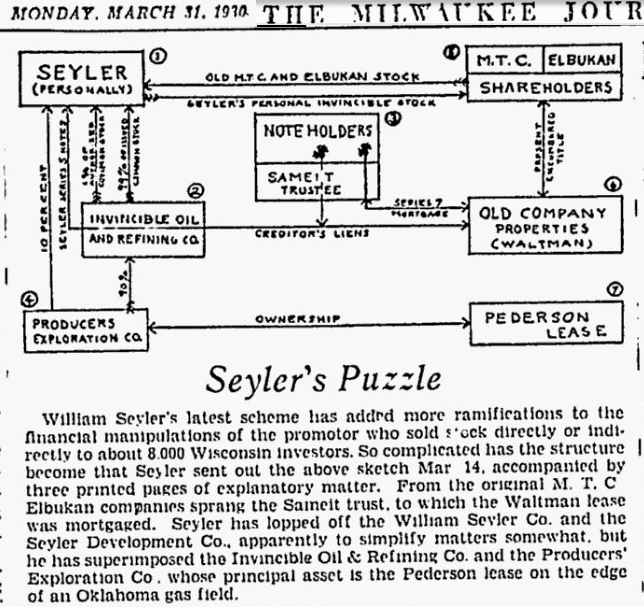

The U.S. District Court ultimately appointed receivers to manage Elbukan Oil assets as extended litigation followed. Undeterred, Seyler returned in 1930 – only to have the Milwaukee Journal report expose “William Seyler’s latest scheme.”

The Wisconsin newspaper illustrated Seyler’s intricate structure of company ownership, liens, properties, mortgages and stockholders. “Seyler’s Puzzle” appeared in a March 31, 1930, article.

Although Elbukan Oil Company stock was worthless by 1932, Seyler was not finished. He returned to Wisconsin investors one last time five years later, according to the Milwaukee Journal.

“Seyler, Oil Promoter, Again is Active Here,” the newspaper noted on April 15, 1937, adding that the investment adviser turned oilman was back “with a brand new scheme.” Editors again cautioned readers: “State authorities say Seyler and his many associates at one time took in $3,200,000 from about 9,000 Wisconsin residents.”

___________________________________________________________________________________

The stories of other companies and attempts to join highly speculative petroleum exploration booms (and avoid busts) can be found in an updated series of research at Is my Old Oil Stock worth Anything?

___________________________________________________________________________________

Please support the American Oil & Gas Historical Society and this website with a donation.