A 1957 oilfield discovery in Alaska Territory will helped establish 49th state.

Two years before Alaska statehood, Richfield Oil Corporation made an oil discovery that greatly benefited the exploration company (today’s ARCO) and the “north to the future” state.

Richfield Oil began in the petroleum business in 1915 as the Rio Grande Oil Company of El Paso, Texas. At the time, its main business was supplying U.S. military forces with gasoline in support of operations against Pancho Villa.

By 1936, Rio Grande had reorganized and merged with other companies to become Richfield Oil Corporation. Twenty years later, Richfield discovered an oilfield, that today is considered the state’s first commercial well (a 1902 well actually had revealed the Alaska Territory’s first commercial oilfield).

In July 1957, Richfield Oil’s Swanson River Unit No. 1 well, which produced 900 barrels of oil per day from a depth of 11,150 feet to 11,215 feet. The company had leased 71,680 acres of the Kenai National Moose Range, now the 1.92 million acre Kenai National Wildlife Refuge. More discoveries followed and by June 1962 about 50 wells are producing more than 20,000 barrels of oil per day.

Alaska’s oil production soon accounted for more than 90 percent of Alaska’s general fund revenues.

“The U.S. Congress viewed that discovery as the foundation for a secure economic base in Alaska, and statehood was granted two years later,” noted the Alaska Resources Council. A decade later, the discovery of the giant Prudhoe Bay oilfield on Alaska’s North Slope will make Alaska a world-class oil and natural gas producer – a status reaffirmed in 1969 with the discovery of the nearby Kuparuk field, the second largest in North America after Prudhoe Bay.

Four of the ten largest U.S. oilfields have been discovered on Alaska’s North Slope. In 1973, the Trans-Alaska Pipeline Authorization Act authorized construction of the 800-mile Trans-Alaska pipeline system from Prudhoe Bay to the port of Valdez.

Richfield Oil Corporation merged with the Atlantic Refining Company to form Atlantic Richfield Company in 1966. In 1999 BP Amoco purchased ARCO for $26.8 billion in stock, making BP Amoco the world’s second-largest petroleum company.

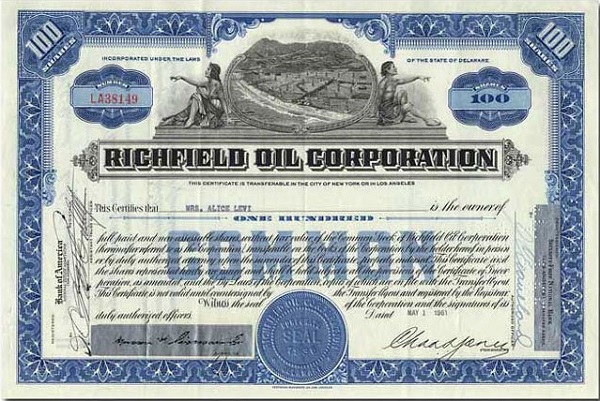

Regarding potential value of old Atlantic Richfield Corporation certificates, if the shareholder named on the certificate failed to surrender it during a change of ownership (merger, sale, etc.), the stock shares would have been cancelled on the books and any remaining value turned over to the Unclaimed Property Division of the owner’s state.

For more detailed company history, see From the Rio Grande to the Arctic: The Story of the Richfield Oil Corporation, authored in 1972 by former CEO Charles S. Jones. Obsolete Richfield Oil stock certificates are offered by collectors online for about $10.

The stories of exploration and production companies joining petroleum booms (and avoiding busts) can be found updated in Is my Old Oil Stock worth Anything? The American Oil & Gas Historical Society preserves U.S. petroleum history. Support this energy education website. For membership information, contact bawells@aoghs.org. © 2021 AOGHS. All rights reserved.